The Islamic Fintech Landscape in Malaysia, Where Do We Stand?

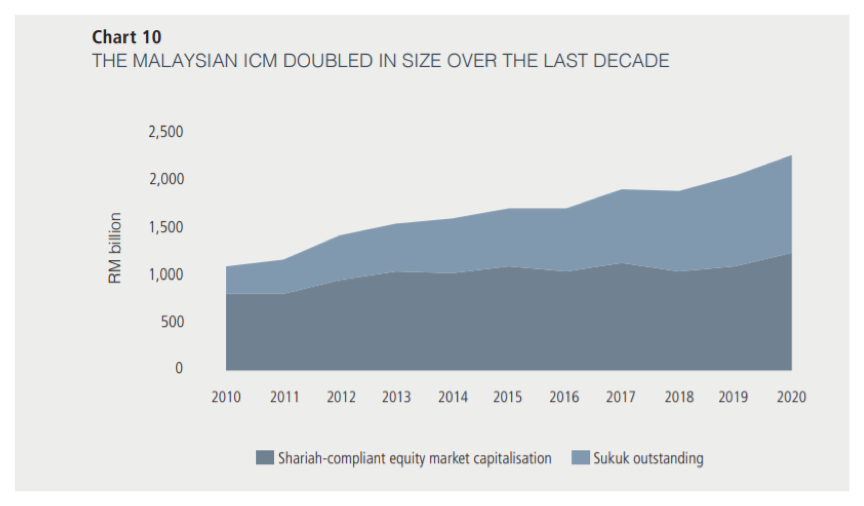

by Fintech News Malaysia October 25, 2021In the recent release of the Capital Market Masterplan 3 by Securities Commission Malaysia (SC), it was highlighted that Malaysia continues to be a prominent global Islamic Capital Market (ICM) hub, with Islamic assets under management (AUM) growing 2.7 times. Additionally, shariah-compliant assets amounted to RM 2.3 trillion as of the end of 2020, having grown from RM 1.1 trillion in 2010.

Malaysia also recorded the largest market share of global sukuk issuance in 2020 at 39.2%, according to RAM. Overall, the global sukuk issuance increased by 16.8% to USD 152.6 billion in that year, compared to USD 130.6 billion in 2019. Malaysia was followed by Saudi Arabia at 20.4% and Indonesia at 17.5%, and these three markets alone contributed to more than 75% of the total global sukuk issuance in 2020.

Presently, Islamic Capital Markets accounts for more than 60% of the Malaysian capital market. Since the early 1990s, it has evolved from mainly focusing on basic Shariah-compliant products and services as alternatives to conventional versions to offering more comprehensive financial solutions for various market segment needs.

Out of this robust development in Islamic finance, Islamic fintech is also becoming an emerging industry to look out for. Based on Shariah principles, Islamic fintech emphasizes the use of technology to deliver Shariah-compliant financial solutions, products, services, and investments. So, where does Malaysia stand when it comes to Islamic Fintech?

The Malaysian ICM doubled in size over the last decade, Source: SC Capital Market Masterplan 3

Malaysia Takes Top Spot on Islamic Fintech Global Arena

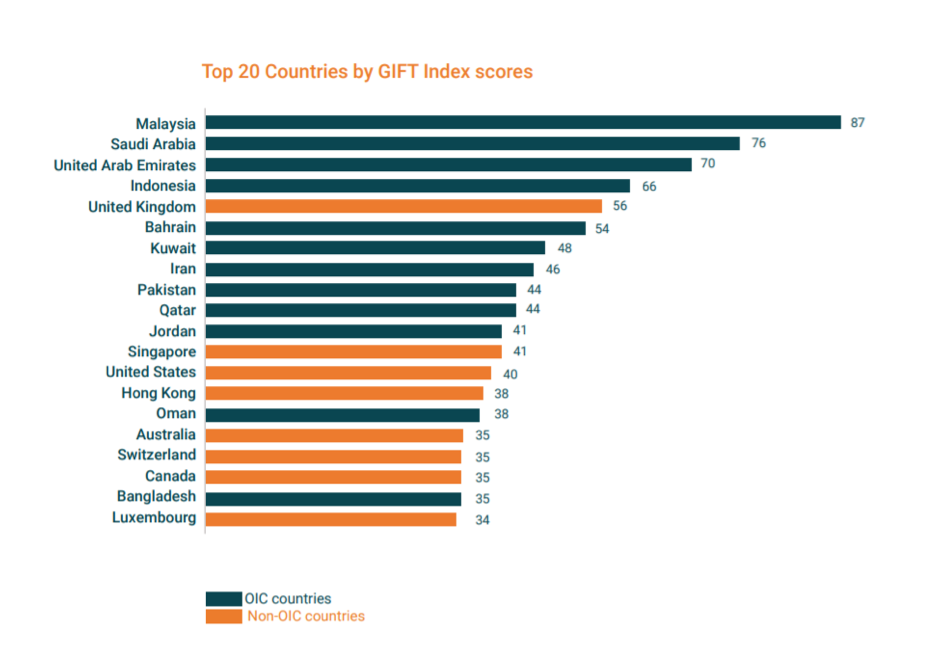

According to the Global Islamic Fintech Report 2021, Malaysia led the ranking on the Global Islamic Fintech (GIFT) Index, which is used to represent the countries with the most conducive environment to promote the growth of Islamic fintech. The composite index applied 32 indicators across five categories such as Islamic fintech market and ecosystem, talent, regulation, infrastructure, and capital.

On the index, Malaysia is followed by Saudi Arabia, United Arab Emirates, Indonesia, and the United Kingdom (UK). The UK is the only non-Organisation of Islamic Cooperation (OIC) member country to have made it to the top five spots. The report was produced by DinarStandard, a growth strategy research and advisory firm together with Elipses, a digital finance advisory firm.

Top 20 Countries by GIFT Index Scores, Source: Global Islamic Fintech Report 2021

Malaysia’s Initiatives Fuel Growth in Islamic Fintech

The Malaysian government, regulators, recognising the potential that lies within the Islamic fintech market, has been taking initiatives to spur the growth of this industry.

Through its Shared Prosperity Vision 2030 (SPV 2030), the Malaysian government has identified Islamic finance and Islamic digital economy as Key Economic Growth Activities (KEGA) and aims to position the country as an Islamic Finance Hub 2.0. This will also then be beneficial to champion the growth of Islamic fintech in the nation.

Apart from this, the Malaysia Digital Economy Corporation (MDEC) has also introduced a dedicated unit that has been tasked to support the Islamic digital economy and fintech space. Additionally, the Ministry of Science, Technology, and Innovation (MOSTI) have also established a fund to support Islamic fintech.

Both the International Centre for Education in Islamic Finance (INCEIF) and the International Shariah Research Academy for Islamic Finance (ISRA), which was established by Bank Negara Malaysia, have also introduced initiatives to support capacity building as well as research and development in the Islamic fintech field.

Additionally, the SC, together with the United Nations Capital Development Fund (UNCDF), has also launched FIKRA. This is an Islamic fintech accelerator programme aimed at identifying and scaling relevant fintech solutions in Malaysia. FIKRA also aims to create a fintech talent pipeline in Malaysia by increasing awareness about Islamic fintech.

Islamic Fintech Companies in Malaysia

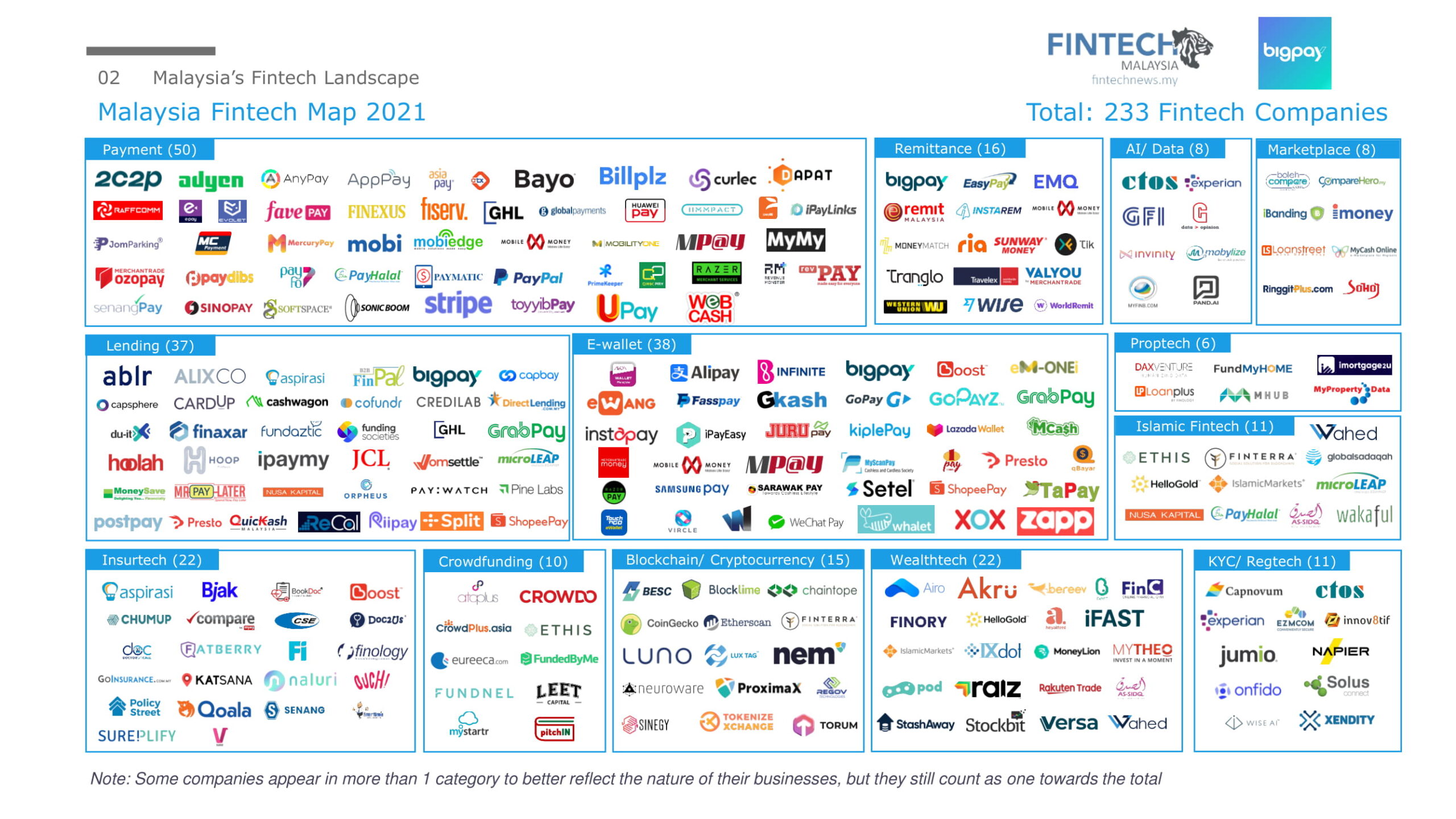

While we’ve been making good progress within the Islamic finance space, there’s still plenty of room to grow in Malaysia. Our annual fintech report tracked out of the 233 fintechs operating in Malaysia, only 4% are Islamic fintechs.

Though things are improving, increasingly we are seeing conventional operators recognising the potential in Islamic fintech and introducing shariah compliant options in their offering. Companies like CapBay who operates in the P2P financing space have started offering shariah-compliant investments and even went into a joint-venture with Kenanga Capital to set up a new entity offering Islamic Supply Chain financing services.

Malaysia Fintech Map 2021, Source: Fintech News Malaysia

More Opportunities Ahead

As per the State of the Global Islamic Economy Report (GIER) 2020/21, it is estimated that Muslims are expected to spend US$2.4 trillion by 2024 at a 5-year Cumulative Annual Growth Rate (CAGR) of 3.1%. Furthermore, the report also included a finding from a Nielsen study that indicated 66% of consumers are willing to pay more for ethical/sustainable products.

Interestingly, younger consumers demonstrate more commitment to fork out the extra money. Should these estimations prove to be correct, especially concerning the younger demographic who are generally more tech-savvy, Islamic fintech seems poised to be a burgeoning area to keep an eye out for.

Featured image credit: Unsplash