Fi Life Partners AXA Affin to Offer Online Medical Insurance

by Fintech News Malaysia February 10, 2021AXA Affin General Insurance Berhad (AXA) has partnered with Fi Life, a Malaysian insurtech startup, to offer online medical insurance complete with an e-medical card.

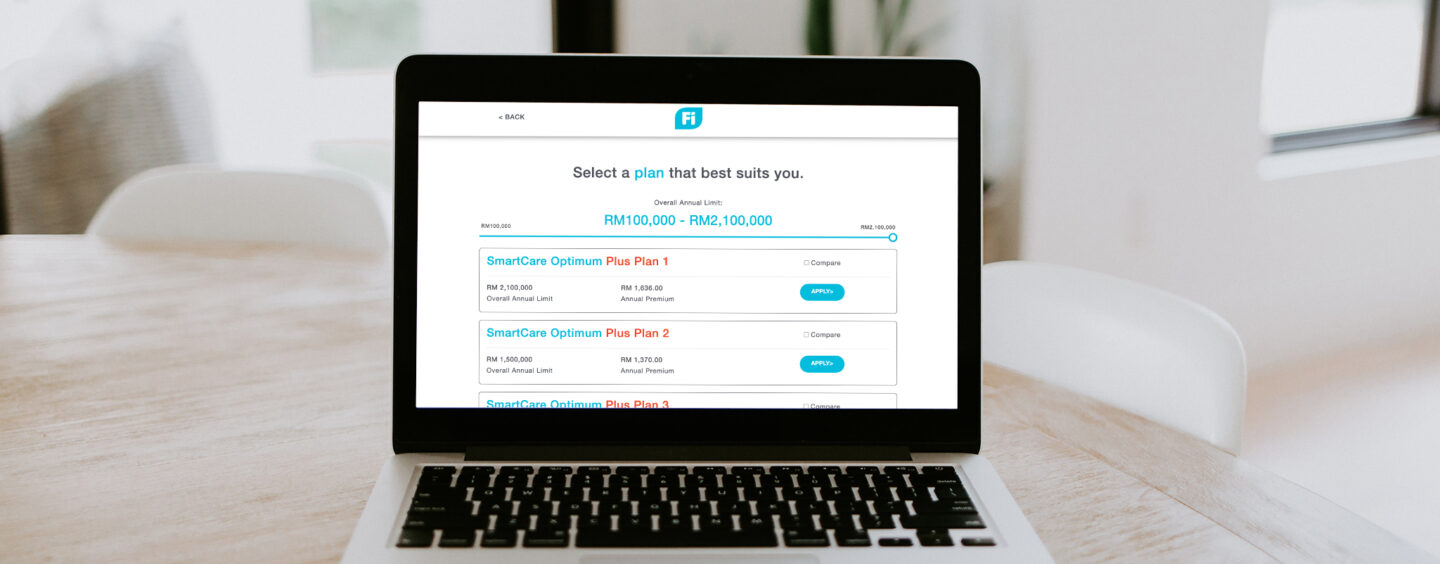

The products offered by them are SmartCare Optimum and SmartCare Optimum Plus.

AXA said that this is the first online medical insurance in Malaysia that allows for substantial annual limits for medical claims of RM100,000 all the way up to RM2.1 million. Prior to this launch, the highest annual limit for medical insurance that can be bought online is RM250,000.

This was made possible because Fi Life incorporates AXA’s full medical underwriting process within its online application system.

With these products, customers will have to answer online questions on their medical history to get medical insurance and an e-medical card immediately.

Unlike other online medical insurance, customers with certain prior medical issues are not automatically rejected. Customers will be asked for details of their medical issue and given the opportunity to upload their doctor’s or other medical report to see if they can still obtain medical insurance. In these situations, their cases will be considered by AXA underwriters on an individual basis. If all uploaded documents are complete, AXA said that its underwriters will be able to make a decision within 5 days.

In addition to a straightforward acceptance or decline, Fi Life claims that its online underwriting system is flexible enough to give an acceptance with exclusions, or an acceptance with a premium loading.

Further, in relation specifically to the online SmartCare Optimum plans, customers are able to opt to pay for the first RM 7,500, RM 10,000, RM 15,000 or RM 20,000 of medical expenses in return for a 25% to 50% discount on premiums. These plans are suitable for customers who already have a basic medical plan through their employers but would like a higher claim limit by supplementing their employer plan with their own individual plan.

With a 41% penetration rate of medical insurance plans in Malaysia in 2019, Fi Life believes that medical insurance is essential to safeguard Malaysians against unexpected hospitalisation and surgery expenses. Such expenses from private hospitals have been increasing at a runaway rate of 17% per year.

Emmanuel Nivet, Chief Executive Officer of AXA said,

Emmanuel Nivet

“At AXA, we are committed to be a trusted partner to our customers. As one of the largest global insurers, we are constantly innovating our products and services to deliver fast, secure and simple online insurance solutions that cater to customers’ needs.

We are delighted to have Fi Life with us in building an efficient online ecosystem, and we truly believe our synergy in launching Malaysia’s 1st online medical insurance is an innovative step forward to ensure customers’ experience is made more convenient and accessible.”

Featured image credit: Edited from Unsplash