Insurtech

PolicyStreet Introduces Professional Liability Coverage for Kiddocare Babysitters

Malaysian insurtech company PolicyStreet, in partnership with Kiddocare, a Khazanah-backed on-demand care services platform, has announced a new insurance initiative named Kiddocarer Protect+. This programme aims to provide comprehensive insurance coverage for Kiddocare’s babysitters, known as Kiddocarers, while they are

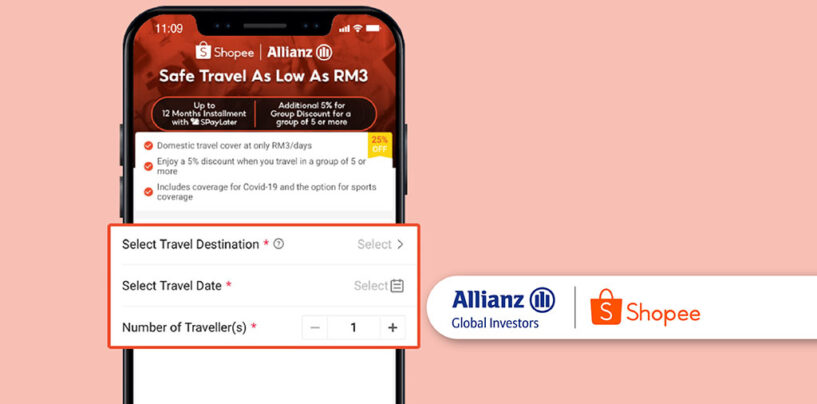

Read MoreTravel Insurance Starting at RM3/Day Now Available on Shopee

SeaMoney, the financial arm of Sea Limited, has expanded its insurance offerings in Malaysia by launching a new travel insurance product available through the Shopee platform, in partnership with Allianz General Insurance Malaysia. This new offering, accessible via Shopee, starts

Read MoreFWD Group Deepens Malaysian Roots with 70% FWD Takaful Ownership

Multinational insurance company FWD Group has expanded its investment in Malaysia by acquiring an additional 21 percent stake in FWD Takaful, securing a 70 percent majority share. With this latest investment, the remaining 30 percent is held by Employees Provident

Read MorePolicyStreet Offers Accident Coverage, Loan Protection for Auto Repairs

Regional insurtech company PolicyStreet has joined forces with Direct Lending to launch DirectCare+, an embedded microtakaful plan providing personal accident coverage and loan protection. This marks PolicyStreet’s first-ever microtakaful product. The launch of DirectCare+ comes at a critical time, given

Read MoreVircle Taps PolicyStreet to Offer Child Insurance Plan Tied to Its Visa Card

Malaysian insurtech company PolicyStreet and Vircle, a Malaysian neobanking service provider for kids, have joined forces to launch “Vircle Club Protect,” a new insurance service designed to offer financial security for children of Malaysian families who subscribe to the latter’s

Read MoreTune Protect Life Launches AI-Powered Insurance Tailored for Millennials and Gen Z

Digital-first life insurer, Tune Protect Life has launched FLEXIOne, an offering which they say integrates artificial intelligence to offer bespoke life, medical, and critical illness coverage. This new offering is tailored to meet customers’ individual budgets and coverage needs, focusing

Read MoreBigPay Users Can Now Buy In-App International Travel Insurance From RM35

BigPay users will be able to apply for their travel insurance, BigPay TravelEasy, within the app starting today with the application process taking just minutes. The new comprehensive travel insurance product is underwritten by Tune Protect Malaysia and made possible

Read MoreBank Islam to Offer Digital Takaful Solutions on Be U App with Zurich and Senang

Zurich Malaysia, local insurtech firm Senang.io, and Bank Islam have joined forces to introduce digital takaful solutions via the Be U by Bank Islam app. Be U by Bank Islam is a fully cloud-native digital banking proposition and the app

Read MorePolicyStreet Gets Approval From Labuan Regulator for Takaful Operations

Malaysian insurtech company PolicyStreet has received the regulatory nod from the Labuan Financial Services Authority (LFSA) to begin its Takaful and Retakaful operations in the region. By securing the necessary approvals, PolicyStreet is now equipped to reinsure and underwrite Takaful

Read MoreFinology Taps IFCA Software to Streamline Property Sales Process

Finology Group, a Malaysian fintech that enables embedded finance, has joined forces with IFCA Software in a bid to improve the property sales experience for both developers and home buyers. The collaboration introduces the integration of Finology‘s digital lending solution, Loanplus

Read More