Just a couple of weeks ago I had the opportunity to attend the Money 20/20 conference at Singapore, seeing as I was attending a fintech conference and in need some Singaporean Dollars I figured it was the perfect time to test and review the currency exchange service by MoneyMatch, who incidentally was the winner of the Fintech Startup of The Year at the inaugural Malaysia Fintech Awards, just a week prior.

It may seems strange for a fintech advocate to be talking about cold hard cash instead of the myriad of digital wallets available at our disposal, the unfortunate reality is that, in Southeast Asia for the most part much of the societies are still quite dependant on cash.

This still rings true in even in countries like Singapore which is touted as one leading fintech countries in Asia, with 90% of their consumers still preferring cash over digital payments according to a survey done by PayPal late last year.

Until the time comes where cash is completely obsolete, I believe that there will still be much relevance to a service like one offered by the folks at MoneyMatch.

The Service Offered

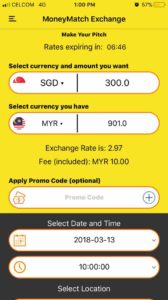

MoneyMatch offers on-demand currency exchange from MYR to SGD at mid-market rates, which means the same rates that you see when you search in Google.

The Process

The process to exchange my MYR to SGD was fairly straightforward and user friendly, we’ve outlined below the steps that was taken.

Step 1

Select the “Exchange Foreign Currency Option”

Step 2 – e-KYC

Before being able to exchange your currency you’re required to go through a simple eKYC process which is mandated by Bank Negara Malaysia. This is a one-time process and for subsequent exchanges you do not need to go through this again

The eKYC process is pretty straightforward, you’ll be put through to a compliance officer who will then ask you to snap a picture of the front and back of your NRIC along with a few questions and then you’re pretty much good to go.

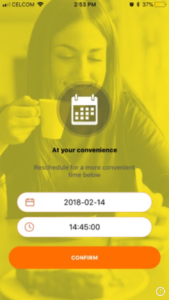

Full disclosure, for the purposes of this review they have moved me up the queue, as you can see my original queue number is 26 which may take 1-2 working days to process. It is advisable for you to get this done a couple of days earlier. They have also made the option of selecting the most convenient time and date for the compliance officer to contact you back.

Step 3 – Confirming your Exchange and Collecting Your Money

Next you’ll need to select the amount of currency you’d like to exchange and the date in which you’d be flying. When selecting dates you’re able to choose 2 days prior up to 3 hours before the collection time which can prove to be useful if you’re making last minute arrangements.

Do note that the operating hours are from 10.00am – 10.00pm.

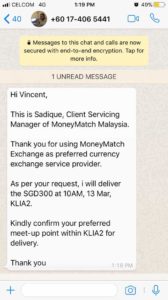

Upon selecting your your time and date, you will be contacted by MoneyMatch’s client service officer/ client service manager who will arrange for a meet up with you at the airport to conduct the exchange. Sadique was the representative assigned to me during this exchange, and he was professional and courteous through the entire process.

Finally, all you need to do is bring the amount of MYR you’d like to exchange to SGD and meet the MoneyMatch representative at the airport and collect your currency.

Verdict

Pros

- Convenience -The entire service is extremely convenient, user friendly and completely done through the app without the hassle of going to a physical money exchanger, which is very useful for someone like me who travels frequently to Singapore.

- Mid-Market Rates – I’ve easily saved about RM50 from that small transaction even with MYR 10 fee charged and only exchanging a small amount of 300 SGD. The savings would be even more substantial for those exchanging larger amounts.

- Safe – Compared to some peer to peer currency exchange operating models where I have to meet a stranger to perform the transaction (and possibly get stabbed in some alley), it feels a lot more reassuring to deal with a representative of a company who is approved under the Bank Negara Malaysia fintech sandbox.

Cons

- eKYC queue is a little long

- Operating hours window may not fit those who are travelling outside that time frame

- Only limited to MYR to SGD exchanges at the moment

Conclusion

MoneyMatch’s currency exchange solution is still a very useful solution if you’re travelling from Malaysia to Singapore and you’re in need of cheap and convenient currency exchange, provided you’re travelling within that window of their operating hours.

However seeing as how this is still in its beta stages, I’m sure once the service gains more traction MoneyMatch will be looking at getting more compliance officers to reduce the wait time, expanding the currency options, and widening the operating hours.

Go ahead and show MoneyMatch some love the next time you’re travelling down to Singapore and in turn we hope MoneyMatch will also show some love by taking on some of the above mentioned suggestions.