Posts From Vincent Fong

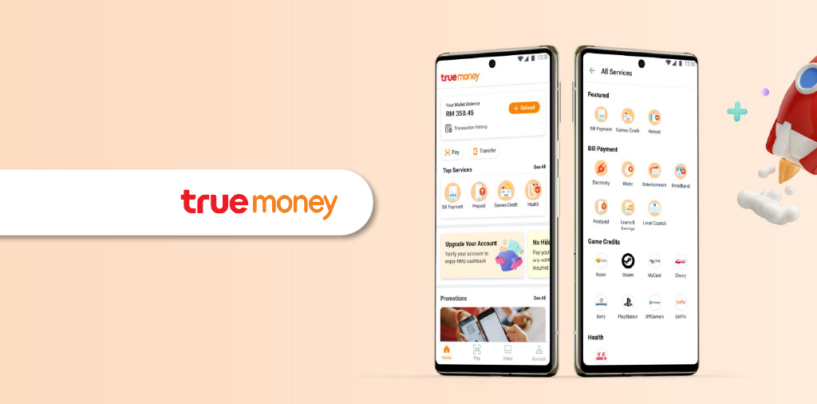

Thai Unicorn Launches its TrueMoney E-Wallet in Malaysia’s Crowded Market

TrueMoney, a payments player and a subsidiary of Ascend Money announced today their launch in Malaysia. During their press event, they also announced that they are now the “official payment” provider for all of Lotus’s hypermarket locations across the country.

Read More5 Interesting New Details in BNM’s New Digital Insurance & Takaful Draft Framework

On Friday, Bank Negara Malaysia (BNM) issued its exposure draft for digital insurance and takaful operators (DITO) for written feedback following the issuance of the Discussion Paper in January this year. As part of the licensing application process, BNM will

Read MoreKenanga Bets Big on Its Super App and Embedded Wealth for Their Next Phase of Growth

These days everyone wants to be a super app from bigtechs to banks and even an airline company like Air Asia. It’s easy to see why, the allure of being able to deliver a plethora of services through a single

Read MoreMOF, BNM, SC Task Force Seeks Feedback for BNPL Regulation

The Consumer Credit Oversight Board Task Force today issued the Consumer Credit Act consultation paper, the new act seeks to regulate and consolidate all consumer credit activities under its umbrella, and to promote fair lending and responsible conduct by credit

Read MoreHow Malaysia’s Oldest Islamic Bank Is Reinventing Itself Against the Wave of Digibanks

The Malaysian financial services space is undergoing an interesting phase in its evolution, shifting consumer behaviors and entrants of new players are giving incumbent banks reasons to rethink their digital strategy. Many of Malaysia’s incumbent banks are actively looking at

Read MoreBank Negara Malaysia Announces Much Anticipated Digital Banking Licenses

After a month of delay, Bank Negara Malaysia (BNM) finally announced the list of successful applicants. The framework which was first issued on 30th December 2020, was hotly contested and attracted 29 parties to bid for the licenses. The central

Read MoreDigitisation a Key Agenda in Bank Negara’s Malaysia New Financial Sector Blueprint

Bank Negara Malaysia (BNM) today announced the launch of Malaysia’s five-year financial sector blueprint during the opening of MyFintechWeek 2022. The central bank has identified five strategic thrust that will anchor its efforts in the blueprint which includes; funding Malaysia’s

Read MoreNavigating the Evolution of Malaysia’s Financial Services in 2022

As we close the curtains on a turbulent year, it seemed fitting to reconnect with old friends, reflect on learnings for the year, and contemplate how to navigate a hopefully post-pandemic 2022. Which is why it was timely when the

Read MoreInsiders Reveal the Key Reasons Behind Razer Pay’s Demise

When there are too many holes on a ship, plugging one does little – water continues flowing in from the rest. Over time, these holes collectively bring down the ship. When Razer announced last week it was suspending its e-wallet

Read MoreBinance and CZ Faces Enforcement Action from SC For Illegal Crypto Activities in Malaysia

The Securities Commission Malaysia (SC) today announced enforcement actions against Binance for illegally operating a crypto exchange in Malaysia. The regulator ordered Binance to immediately disable access to its website and app within 14 days from 26th July 2021, immediately

Read More