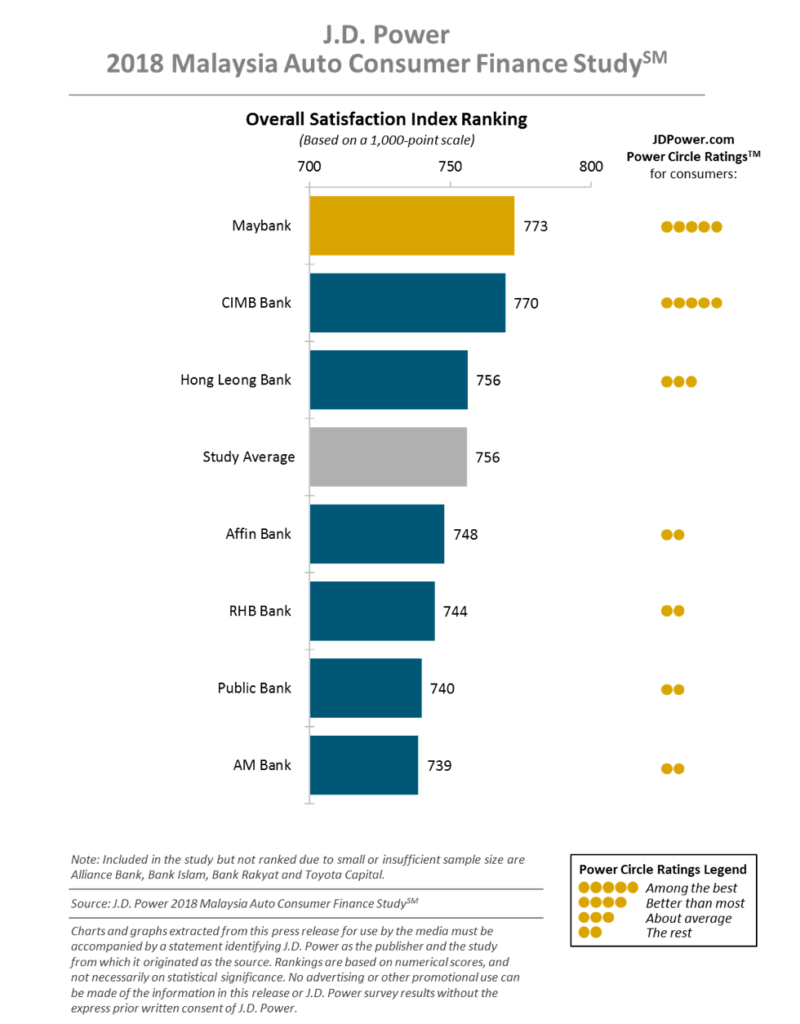

A recent study conducted by research firm J.D Power shows that Maybank ranks highest with an overall satisfaction score of 77.3%. CIMB Bank is a close second with a score of 77% followed by Hong Leong Bank 75.6% who ranks third in the study.

Since the study was fielded in March and April 2018, it might not reflect potential improved customer satisfaction from the recent launch of CIMB’s InstaApproval, which approves auto loans almost instantaneously.

The 2018 Malaysia Auto Consumer Finance Study is based on responses from 2,504 new-car buyers who financed a vehicle in the past 12 months.

The study measures customer satisfaction with the products and services provided by their auto finance provider. The study measures overall satisfaction in six key factors: interaction (33%); onboarding (22%); billing & payment (17%); finance deal (10%); origination (10%); and finance advisor (8%).

Customers Prefer Digital Channels

Although most customers still apply for their auto finance by filling out paperwork, these customers are less satisfied than those applying onlin , according to the J.D Power

Two-thirds of customers who apply online have their applications approved within two business days compared with 42% of customers applying with traditional paperwork. The approval time for applications is one of the main drivers of satisfaction. Overall satisfaction is higher among customers who receive an auto finance approval within two business days than those waiting for three or more business days

Anthony Chiam

“..It is interesting that there are currently only a few providers offering online auto finance applications. Moving the process onto a digital platform can go a long way in meeting the needs of customers and improving their overall experience, particularly as 82% say they prefer a paperless application process for their next auto finance product.” said Anthony Chiam, Service Industry Practice Leader at J.D. Power.

The study also finds that satisfaction is higher among customers purchasing Islamic auto finance products (25%) than among those purchasing conventional auto finance products. Satisfaction among customers purchasing Islamic auto finance has increased since last year.

Following are additional key findings of the 2018 study:

- Interest rates are key when selecting auto finance provider: More than one-fourth of customers say the main reason for selecting their finance provider’s auto finance deal is because of the interest/ profit rate. This has increased by 5 percentage points from last year (21% vs. 26%, respectively).

- Financing directly vs. dealer financing: Of the 32% of new-vehicle buyers who finance their purchase directly through a finance company, satisfaction is higher than among those going through a dealer to arrange financing

- Opportunity to deepen relationship with the customer: Among customers opting for an auto finance provider that is different than their primary bank, 17% of those who are delighted with their auto finance experience say they “definitely would” switch their primary banking relationship to their finance provider.