The Home Buying Process is Broken, Here’s How a Malaysian Fintech is Trying to Solve it

by Fintech News Malaysia November 26, 2018The current property buying process in Malaysia is broken. Let’s say you want to purchase a property, you usually begin the process by looking at areas that you like or developers that you trust.

After what is likely several months of finding that one home that is perfect for you, you go through the process of applying for a mortgage loan. Chances are many first-home buyers will either have their loans rejected or offered loan rates that are not favourable to them.

This is problematic because, you’ll have restart the entire process again. Beyond just being a huge disappointment for the prospective buyer this also poses a huge challenge for the industry especially for new projects.

Jared Lim, Managing Director, Finology told Fintech News Malaysia that booking cancellations can go as high as 60%. As recent as August, Guocoland incurred a net loss of RM 20.49 Million that is attributed to cancellations of sales purchase agreements.

Reversing the Broken Process

Finology a locally based fintech company intends to solve this issue by reversing the process and they are starting by partnering IQI Group, a real estate agency with over 1,000 agents.

Through this partnership they aim to provide visibility to both the buyer and the seller visibility of their prospective buyer’s loan eligibility at the early stages for the buying process.

According to Jared, the loan eligibility accuracy is roughly 95%, which equips the potential home buyer with the knowledge of whether he or she qualifies for the loans and the loan rates they will likely receive.

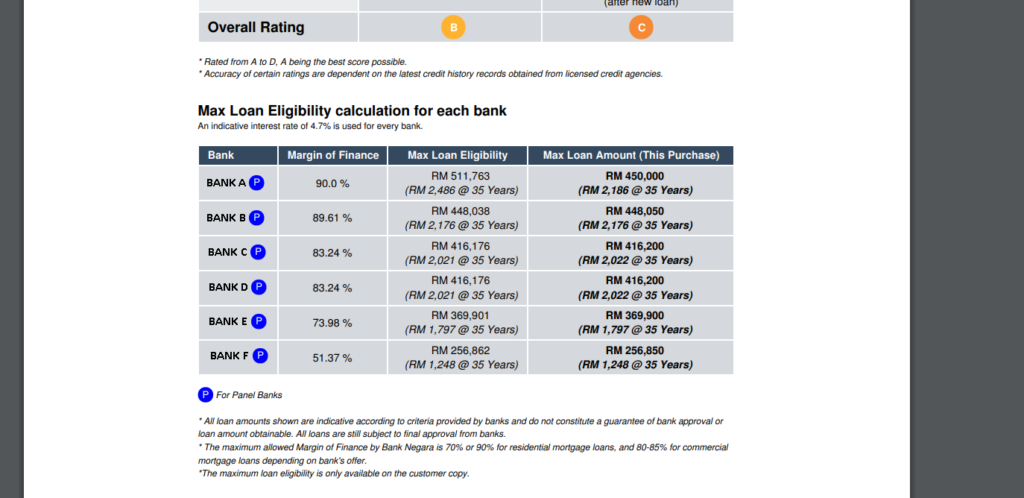

To receive the loan eligibility report users will will key in the same information as they would when applying for a mortgage loan with a bank. Using the data received and data extracted from local credit bureaus the system will generate report and send it to the user within 10 minutes.

Should the rates be unfavourable, the report will also provide remedial steps for the user to improve their credit score.

To kickstart, they begin with Millerz Square project located at Old Klang Road. Interested buyers will be able to check on-the-spot across 17 different banks for their loan eligibility.

On the sidelines of their press conference, Jared also shared with Fintech News Malaysia that they will also be seeking partnership with online property marketplace to provide this service to potential home buyers.