Insurtech Startup Fi Life Introduces New 20 Year Level Term Life Insurance Policy

by Fintech News Malaysia November 21, 2019Fi Life announced today that it has added a new 20-year level term life insurance policy to its current suite of life insurance policies. This level term policy is underwritten by Tokio Marine Life Insurance Malaysia Bhd.

The company said that the level term policy complements Fi Life’s existing yearly renewable term life policy, which has been offered to Malaysians since 2015.

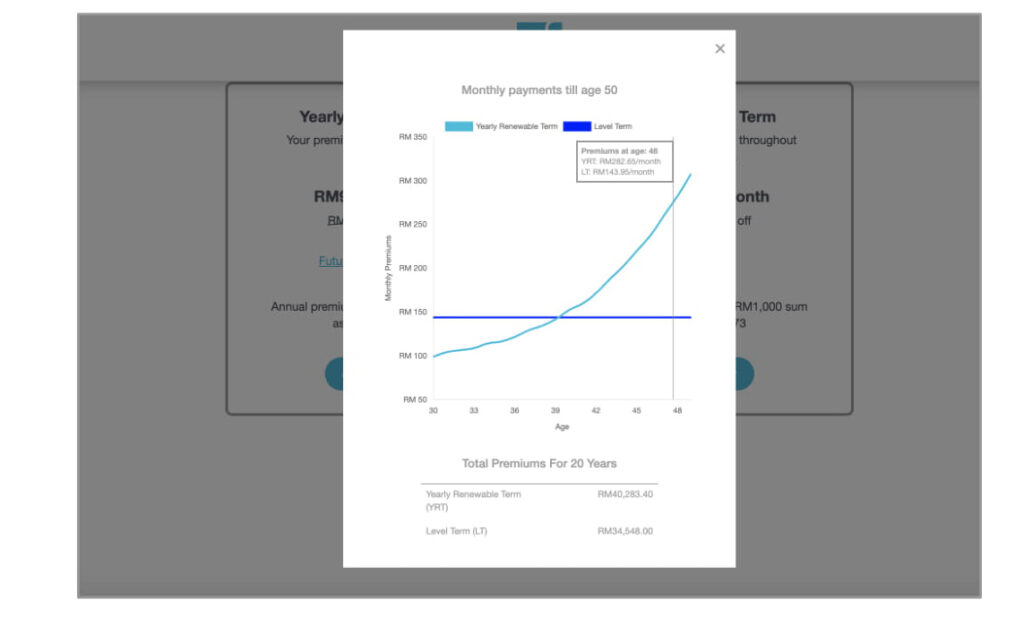

The main difference between a 20-year level term policy and a yearly renewable term policy is that premiums for the level term policy are fixed and guaranteed for the next 20 years. With a yearly renewable policy, premiums increase slightly every year with the policy-holder’s age.

Premiums for level term policies are usually more expensive in the beginning as compared to yearly renewable term policies. However, policy holders do not have to worry about higher premiums as they get older, as the level terms premiums are fixed for the 20-year duration of the policy.

The introduction of this new product allows users to purchase policies based on whether they prefer to pay less at the beginning and renew at a slightly higher rate each year or if they prefer a fixed premium for the next 20 years.

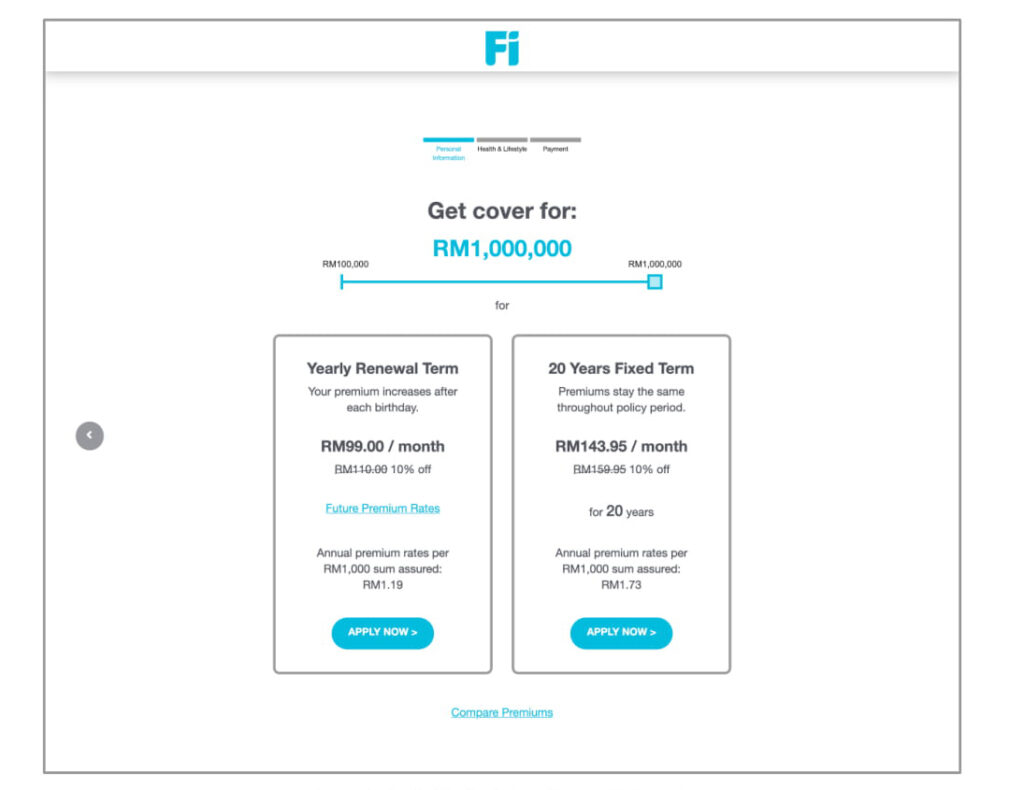

Fi Life’s Product Selection Page

Fi Life and Tokio Marine Life Insurance Malaysia Bhd co-developed the 20-year level term policy when many of Fi Life’s existing and prospective customers expressed a preference for the certainty of fixed insurance premiums over the duration of their life insurance policy.

At Fi Life’s website www.fi.life, after entering some basic details, prospective customers will receive two instantaneous premium quotes side-by-side, one for the level term policy, the other for the yearly renewable term policy.

Interactive Comparison Chart

The prospective customer can then compare and select the policy that suits their preference. Like the yearly renewable term policy, prospective customers can add a critical illness add-on to their level term policy.

To promote Fi Life’s new level term policy, Fi has issued a new rebate code LEVELNOW which will entitle purchasers of Fi Life policies to receive a 20% rebate on the first year’s premium. This rebate code is available immediately and is valid from 21st November to 5th December 2019.