Alibaba Cloud’s New Report Urges Financial Institutions to Embrace Cloud Technologies

by Fintech News Malaysia March 18, 2021In Malaysia, a robust digital infrastructure and governmental support have enabled the growth of fintech startups and rising adoption of technology by financial institutions.

With fintech becoming increasingly important in Malaysia’s financial sector, incumbents and fintechs alike are urged to embrace public cloud to become more agile and innovative, according to a new whitepaper by Alibaba Cloud, the digital technology and intelligence backbone of Alibaba Group.

The paper, titled The Malaysian Fintech Industry: Guidance and Solutions, gives an overview of Malaysia’s fintech ecosystem and explains why it is critical for financial institutions to move to the cloud.

The advent of fintech in Malaysia has been supported by the government and regulators, which have put digitalisation as one of the country’s top priorities. The Federal 2021 Budget, announced in November 2020, set aside RM 1 billion for digital transformation schemes, coupled with RM 150 million in grants for the digitalisation and automation of Malaysian small and medium-sized enterprises (SMEs) and nearly RM 1.2 billion for microcredit schemes.

Benefits of public cloud for fintechs and incumbents

With Malaysia’s financial sector in the midst of undergoing a major digital transformation, financial institutions must move to the cloud to improve business efficiency and become more agile, the Alibaba Cloud whitepaper says.

Adopting cloud computing will bring many benefits including reduced operational costs, faster time to market, and ensuring for business continuity, it says. Leveraging the products and solutions of Alibaba Cloud, financial institutions have access to a highly available, scalable and secure infrastructure that’s compliant with regulation. In addition to that, customers gain access to complementary global and local compliance reports, and receive assistance when seeking approval from Malaysian regulators.

Alibaba Cloud’s holistic fintech proposition ensures protection at every level including data, application and platform, allowing for the safe, fast and reliable operation of internet-based assets such as websites and apps.

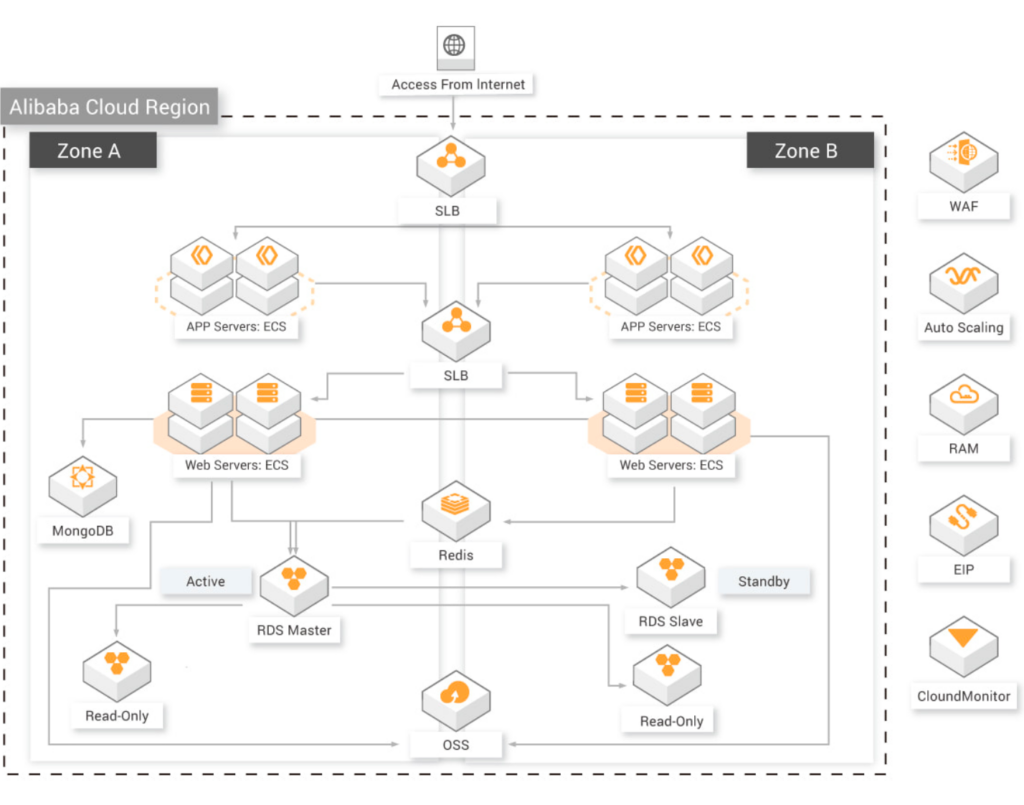

As fintech systems (especially those which involve financial transactions) are mission-critical in nature, Alibaba Cloud has 2 Availability Zones (AZ) in Malaysia and a suite of products to support fintech systems to run on HA mode. These include using Server Load Balancer to distribute traffic to applications that run in Elastic Computing Service (ECS) across both AZ, and leverage on Relational Database Service (RDS) HA edition which would replicate data from master node to slave node across different AZ and auto-failover during a disaster. Apart from that, CloudMonitor, a tool that collects operational metrics to let customers view the usage and health status of their cloud resources.

Finally, the Alibaba Cloud Financial Services offering gives access to a full suite of products to meet customers’ analysis requirements, allowing businesses to deploy artificial intelligence (AI), develop personalised service offerings, and gain access to real-time, interactive business intelligence.

In Malaysia, Alibaba Cloud is fast becoming the go-to cloud services provider for fintechs. The firm has inked partnerships with TNG Digital and Razer to develop and launch new mobile wallets, and with Sabah Credit Corporation to create a digital financial service offering aimed at improving financial inclusion. It will start off with a digital payment platform called Sabah Pay before adding services such as electronic know-your-customer (eKYC), virtual account, virtual financing, microloans, and more on top of it.

To date, Alibaba Cloud is the only global cloud service provider that has two data centers in Malaysia, providing Malaysian enterprises with a local option to build their business.

The full report can be downloaded here