E-Wallet Boost Launches Three More Insurance and Takaful Plans

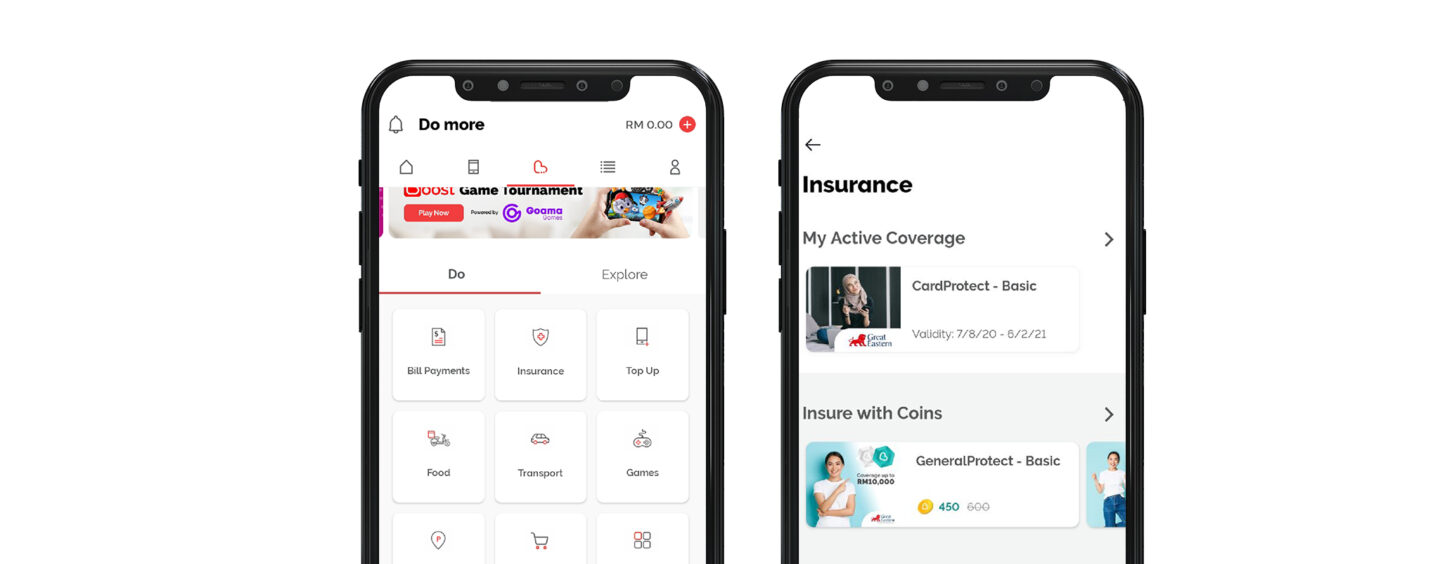

by Fintech News Malaysia June 25, 2021Axiata Digital’s e-wallet Boost has introduced three new micro-insurance and takaful plans under ‘Boost Protect’ to further provide Malaysians with affordable and premium coverage.

The addition of MozzieProtect, FamilyProtect and Critical Illness Care bring the total coverage plans to 13.

These offerings were underwritten by three Great Eastern entities; Great Eastern Life Assurance (Malaysia), Great Eastern General Insurance (Malaysia) and Great Eastern Takaful.

Great Eastern had previously invested US$70 million into Axiata Digital in June 2020, which was the largest fintech investment at that time.

As a value-added benefit, the three new plans come with COVID-19 Vaccine Fund Assistance.

Additionally, to enhance the value proposition of its micro-insurance and takaful offerings, Boost has also included a new recurring payment feature.

This feature will now allow users to automatically pay for their coverage plans on a monthly basis without the need of repurchasing or re-participating, ensuring continuous coverage.

At the same time, it helps breakdown the total coverage plan amount into monthly payments, making it even more affordable for users by easing the burden to pay a lump sum payment upfront.

The new recurring payment feature is applicable to six coverage plans, namely BillProtect, CardProtect, HospiCash, Protect Super6, ProtectActive, and SME OwnerProtect.

The e-wallet first launched ‘Boost Protect’ micro-insurance and takaful offerings back in August 2020, marking its foray into digital financial services.

Mohd Khairil Abdullah

Mohd Khairil Abdullah, CEO of Boost shared that since last August to May 2021, the e-wallet has seen more than 23 times increase in the uptake of ‘Boost Protect’ coverage plans.

“The plans are diverse that it covers a range of lifestyle needs including young adults, fitness enthusiasts, smartphone users, adults with family or elderly parents and even SME owners.

This is a big part of our commitment to provide an essential toolkit with innovative features, making it easier and convenient for you to access everything you need at your fingertips with your smartphone in this digital-first world,”

Khairil added.