Unlocking APAC’s Cross-Border Commerce Opportunity with Embedded Payments

by Fintech News Malaysia March 9, 2022In Asia Pacific (APAC), the rapid development of cross-border e-commerce has fueled demand for cross-border payment capabilities and embedded financial solutions as small, online businesses embrace digital technologies to broaden their reach and go global, a recent report by Currencycloud shows.

Embedded finance enables any company to embed pre-built financial solutions via an API integration into their offerings. These solutions can be anything ranging from payments and lending, to other specialised services such as insurance coverage, and investments.

There are many reasons for the rise of embedded finance, including friendly regulations, acceleration toward a cashless society, and the growth of e-commerce.

But above all, it is the ease of use and convenience these solutions provide that has gotten consumers hooked.

Customers can now make cashless payments right from a ride-sharing app, or they can apply for personal loans at the point of purchase with the tap of a button.

For businesses, embedding financial services means improved customer experience as well as increased stickiness. Asia’s fintech leaders and super-apps, including Grab, GoJek, WeChat and Kakao, are evidence of that.

By partnering with third-party providers and banks, these platform players have built vast ecosystems of virtual products and services and are now ingrained into users’ daily lives, providing not only online messaging, social media and marketplaces, but also digital payments, online investment products, and consumer loans.

The embedded finance trend has picked up at such a fast pace that US-headquartered private equity firm Lightyear Capital forecasts that the global aggregate revenue from embedded financial solutions will balloon by 922% between 2021 and 2025 to reach US$230 billion.

Within the next ten years, the space is projected to grow into a US$7 trillion industry.

Embedded finance forecast Source: Lightyear Capital

Enabling cross-border commerce

During a December 2021 Hot Topic Briefing, experts from the Emerging Payments Association Asia (EPAA) and cross-border payment firm Currencycloud discussed the rise of embedded finance in APAC.

A subsequent whitepaper detailed the different topics covered during the discussion, outlining the key technologies and drivers pushing businesses towards embedded finance.

According to the paper, technologies including near-field communication (NFC), tokenisation and QR codes are offering a rich trove of opportunities for the seamless provision of financial services through mobile apps and websites as well as wearables.

COVID-19 has changed consumers’ behavior in a meaningful way, forcing people to embrace contactless payments, the paper says.

As adoption of payment methods including digital wallets and smart cards continues to rise, it appears that the next stage of evolution will be wearable payments.This trend will be driven by customers’ demand for greater convenience, growing adoption of the Internet-of-Things (IoT), and development in virtual reality/augmented reality (VR/AR) technologies, one research firm predicts.

Not only that, but a changing regulatory landscape characterised by open finance regulations and market liberalisation pushes will help facilitate the exchange of data between market participants, and offer the opportunity for a larger group of businesses to participate in the provision of financial services.

Against this backdrop, embedded finance is now stepping into its third maturity level where the concept is being applied to other areas of finance and banking, including credit, insurance, investment and cross-border transactions, the paper says.

Five maturity levels of embedded finance, Source: Powering cross-border payments through a modular approach

In APAC, one trend that’s making embedded cross-border payments so relevant today is the booming cross-border e-commerce market.

For example, China, one of the most mature markets for cross-border e-commerce across the region, has seen its sector reach US$1.5 trillion, according to Deloitte.

Of that amount, 72.8% went towards cross-border business-to-business (B2B) e-commerce, a segment that’s expected to grow to US$2.2 trillion by 2026.

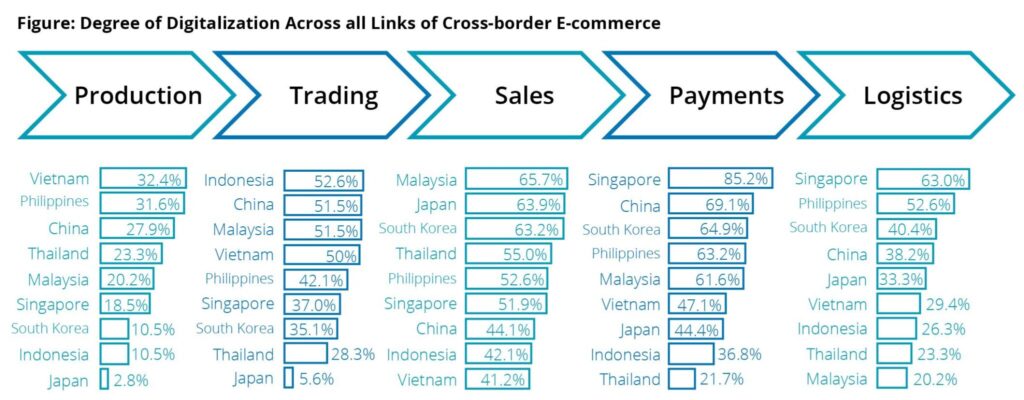

Degree of digitalisation across all links of cross-border e-commerce, Source: Deloitte

Singapore is another developed cross-border e-commerce market with consumers increasingly embracing the opportunity to spend with overseas businesses.

In 2020, 73% of online consumers in the city-state indicated having shopped from overseas merchants, according to a JP Morgan study.

At the time, the cross-border e-commerce market in Singapore was worth S$2.91 billion (US$2.15 billion), and accounted for 35% of the nation’s overall Singaporean e-commerce market, showcasing the dynamism.

In APAC, SMEs have been the main drivers of digital transformation in cross-border trade, and now make up 85% of the region’s cross-border e-commerce sector, according to Deloitte.

They are increasingly engaging in global trade, aided by cross-border e-commerce platforms such as Shopee and Lazada, but also embedded finance technology providers like Currencycloud, to help them sell their products to broader markets.

SMEs are driving these changes as well as existing opportunities for massive growth in the coming years.

Founded in 2012 in the UK, Currencycloud provides a ready-made suite of solutions that businesses can embed easily via APIs, allowing companies of all sizes and industries to offer their customers virtual accounts, multi-currency wallets, currency exchange services, and more.

Learn more about embedded finance in APAC and how Currencycloud supports banks, fintechs and other businesses with their cross-border payments needs here.