Visa: Nearly 70% Of Malaysian SMEs Are Keen on Using Digital Banks’ Services

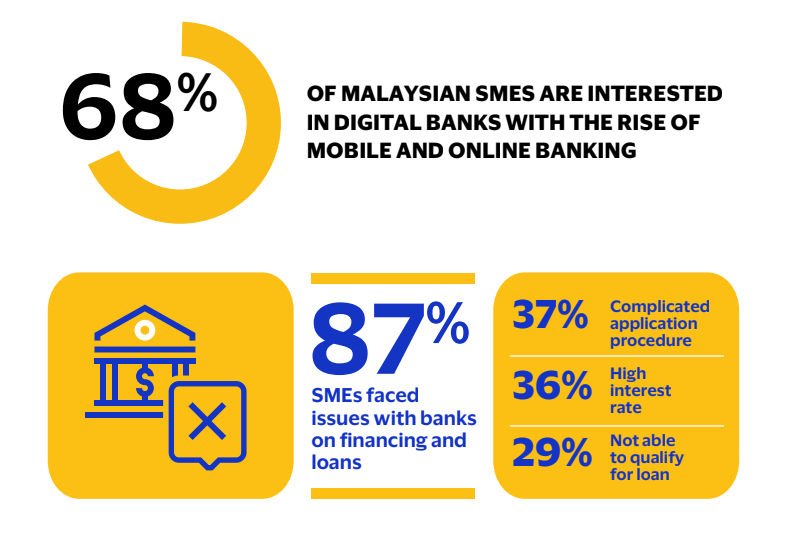

by Fintech News Malaysia June 30, 2022Close to seven in 10 Malaysian small and medium enterprises (SMEs) expressed their interest in engaging with digital banks, according to Visa’s SMB Digital Banking Study.

This is quite timely given the Bank Negara Malaysia’s recent announcement on the five digital banking licenses being awarded.

Digital banking could potentially address the top-of-mind challenges faced by almost nine in 10 Malaysian SMEs, including access to financing due to complicated application procedures (37%), high interest rates (36%), and loan approvals (29%).

Based on the study, SMEs shared that the top reasons for wanting to use services offered by digital banks include having less physical interaction when performing their banking activities due to COVID-19 concerns (44%), and digital banking being perceived as a faster and more convenient way of banking (35%).

Findings from the study also highlighted that SMEs prefer financial loan features such as micro-loans (33%), cash advances of three to six months (26%), and Buy Now Pay Later solutions (16%).

In addition, eight in 10 Muslim SMEs who used Islamic banks as their main bank showed more interest to use digital banking than their non-Muslim counterparts (55%).

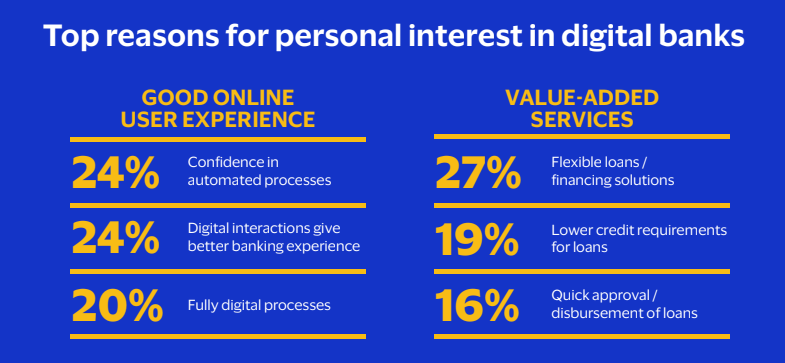

They cited reasons such as confidence in automated processes, and digital interactions providing a better banking experience for their high level of interest.

In the study, SMEs shared that the need to check Shariah compliance has delayed fund transfers, and automated processes offered by digital banks might reduce the time needed for making these transfers.

Ng Kong Boon

“The SMB Digital Banking study showed the need for existing banks and new players to solve the needs and challenges faced by SMEs in Malaysia, especially for the underserved segment. Across the SME spectrum, micro-SMEs had the lowest awareness about digital banks (67%), even though they would benefit most from the financing solutions, especially since almost half of them (46%) do not qualify for traditional bank loans,”

said Ng Kong Boon, Country Manager for Malaysia at Visa.

“We believe that new digital banking players and existing banks will transform the banking and payment experiences for both consumers and businesses, and create relevant solutions that can fulfil the needs of SMEs. SMEs is an important segment for Visa, and we want to work with our bank partners and new digital banking players to support them as they grow their businesses and navigate the new digital ecosystem,”

he added.