”The “Buy Now, Pay Later” (BNPL) phenomenon has taken the world by storm. The concept is simple: customers can purchase and pay for items later, in installments, without accruing interest.

BNPL has been a godsend for many people, allowing them to buy items they otherwise couldn’t afford. However, as with anything, there is a downside to BNPL. Some people have entered into debt using BNPL, and it can be challenging to break the cycle.

According to a report, BNPL payment adoption is expected to grow in Malaysia steadily over the forecast period, recording a CAGR of 35.4 percent from 2022 to 2028. The BNPL Gross Merchandise Value in the country will reach US$6,884.7 million by 2028.

BNPL companies such as Atome and Grab Paylater allow consumers to make purchases and then spread the cost over a period of time, usually interest-free.

However, BNPL has been heavily criticised by campaigners who believe consumers are being driven into debt by the ‘get finance quick’ model. With three-quarters of users aged between 18 and 36, many young people struggle to pay off their debts.

While BNPL services can be convenient for consumers, they have also been criticized by some as being a tool that promotes unhealthy consumerism. A discussion was held on whether BNPL is a force for good or evil in Fintech Fireside Asia, a webinar moderated by Chief Editor of Fintech News Malaysia Vincent Fong.

Traditional BNPL companies have also been increasingly criticised for their high fees, late payment penalties, and aggressive debt collection practices. In response to this, a new breed of BNPL companies is beginning to emerge that are committed to providing alternatives with their unique propositions.

Can BNPL be ethical?

Ethical BNPL is a new concept that a few providers in the market are propagating. These companies offer payment plans with no interest, late fees, or hidden costs. They also promote financial literacy and provide resources to help their customers make smart financial decisions.

Essentially, it is BNPL with a difference – where the provider offers a range of life-fulfilling and life-enhancing products and services instead of just the usual payment plans.

Ablr – taking a different approach to traditional BNPL

One such company which provides a “unique” proposition to the growing BNPL scene in Malaysia is Ablr. The company integrates flexible plans and presents a different approach by embedding ethical financing through its products and services.

Ablr is a consumer-centric business that provides a suite of ethical financing solutions to help consumers buy the things they need without putting a strain on their finances.

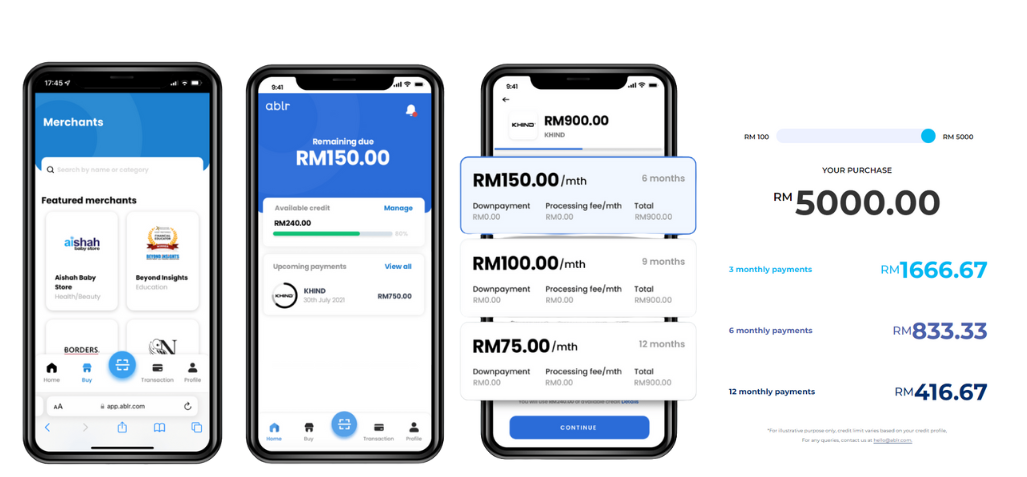

How BNPL Ablr works. Image: Ablr Malaysia

“By using Ablr, consumers can pay for their families’ healthcare treatments, childcare services, or travel experiences with easy, fixed monthly instalments, from 30 days up to 60 months, depending on the plans on offer by our growing list of merchants, said Co-founder and CEO Amanda Chin in an interview with Fintech News Malaysia.

The company started in Singapore in 2020 and made its way to Malaysian shores, where it launched in July 2022. The platform’s core focus merchant categories consist of health and wellness, education and enrichment, home and family, and travel and experience.

Ablr has a network of over 30 brands in Malaysia and Singapore, spanning over 250 merchant points. The company looks forward to deepening its engagement with these sectors, and it will stay open to other merchants that can benefit and add value to its ecosystem.

Most of Ablr’s users are predominantly females, and two-thirds (70 percent) are from Gen Z and Y. The company has seen demand for types of products and services shifting as users become working individuals or progress in their careers.

Amanda Chin

We want the products and services on Ablr and the merchants we onboard to reflect that shift and provide meaningful, essential offerings that add value throughout their life cycle,” added Amanda, who has over 16 years of experience in the fintech space with notable companies such as Touch n’ Go Group and Revenue Monster.

Gauging one’s creditworthiness

Ablr said it is equipped with data-driven credit assessments for its consumers, thus allowing them to understand a user’s financial situation. Through this, Ablr will be able to provide the appropriate access responsibly and sustainably.

Ablr will send their users a reminder a day before the due date of repayment. However, if the auto-deduction fails on the day of the intended payment, the account will be frozen from the next day onwards.

Users will also be able to make other purchases with Ablr once they have cleared their outstanding payments.

For merchants, the platform has various strategies to help ensure that approval and conversion rates remain high without compromising on the customer journey.

Hence, creditworthiness is determined through a combination of factors, including evaluating the ability and willingness to pay.

“Our approval process is different from other players in the field. We focus on consumer protection by providing appropriate access and limits to the right people,” shared Amanda.

Engagement with CCOB and alignment with Shariah principles

As a BNPL fintech company in Malaysia, Ablr is always looking at ways to support the Consumer Credit Oversight Board’s (CCOB) agenda. The company is constantly engaging with them to ensure its practices align with the board’s guidelines.

CCOB is the statutory regulator and supervisory body overseeing non-bank credit providers, carrying out its responsibilities as a competent authority under the Consumer Credit Act (CCA) which include among others, BNPL activities.

“We can lead discussions with the CCOB due to our consumer-centric approach. Engagement with CCOB helps us to be at least on par with the other financial services, as well as to support our financial service sustainably through positive behaviour to avoid propagating negative habits,” said Amanda.

Ablr has always modelled its business to be aligned with Shariah principles: transparency, value-driven, and interest-free.

“We are now at the last mile of implementation to get our certification with Amanie Advisors. We are looking at changes in the transaction structure and our marketing,” said Amanda.

The motivation for this is to provide more inclusive offerings for Malaysians and target the underserved population and eventually expand into other markets in Southeast Asia,” said Amanda.

Will Ethical BNPL survive the long haul?

The question of whether ethical BNPL will survive in the long run in Malaysia is a difficult one to answer. While the BNPL industry is rapidly growing, there are concerns about the sustainability of this alternative financing model. There are a number of factors that will play into whether or not these businesses can keep their promises of being ethical.

When push comes to shove, can they keep their commitment to being ethical when funding runs low or when VCs demand to see higher numbers? Only time will tell.

However, Ablr knows how it feels when dreams aren’t realised. The platform claims that it can put the unreachable within reach. To put purchasing power back in the users’ hands, on their own terms. With Ablr, they’ll now be able to.

Amanda disclosed to Fintech News Malaysia that Ablr is looking to move to the business-to-business (B2B) realm this year to finance merchants, suppliers, and customers.