Key Highlights From Securities Commission Malaysia’s Annual Report 2022

by Fintech News Malaysia March 27, 2023The Securities Commission Malaysia (SC) has released its annual report for 2022 which highlights its efforts in promoting market integrity, investor protection, and the development of the Malaysian capital market.

Dato’ Seri Dr. Awang Adek Hussin

The SC Chairman, Dato’ Seri Dr. Awang Adek Hussin, said the Malaysian capital market remained orderly and continued to finance the economy, with total funds raised hitting a record high of RM179.4 billion. This exceeded the 5-year pre-pandemic average of RM121.4 billion.

This was achieved despite increased global market volatility and headwinds where Malaysia fared better than its global counterparts.

The global capital market had registered weaker performance in 2022 with the continued tightening of financial conditions in major markets, inflationary pressures, and the repercussions of the Ukraine war.

Key highlights outlined in SC’s annual report 2022

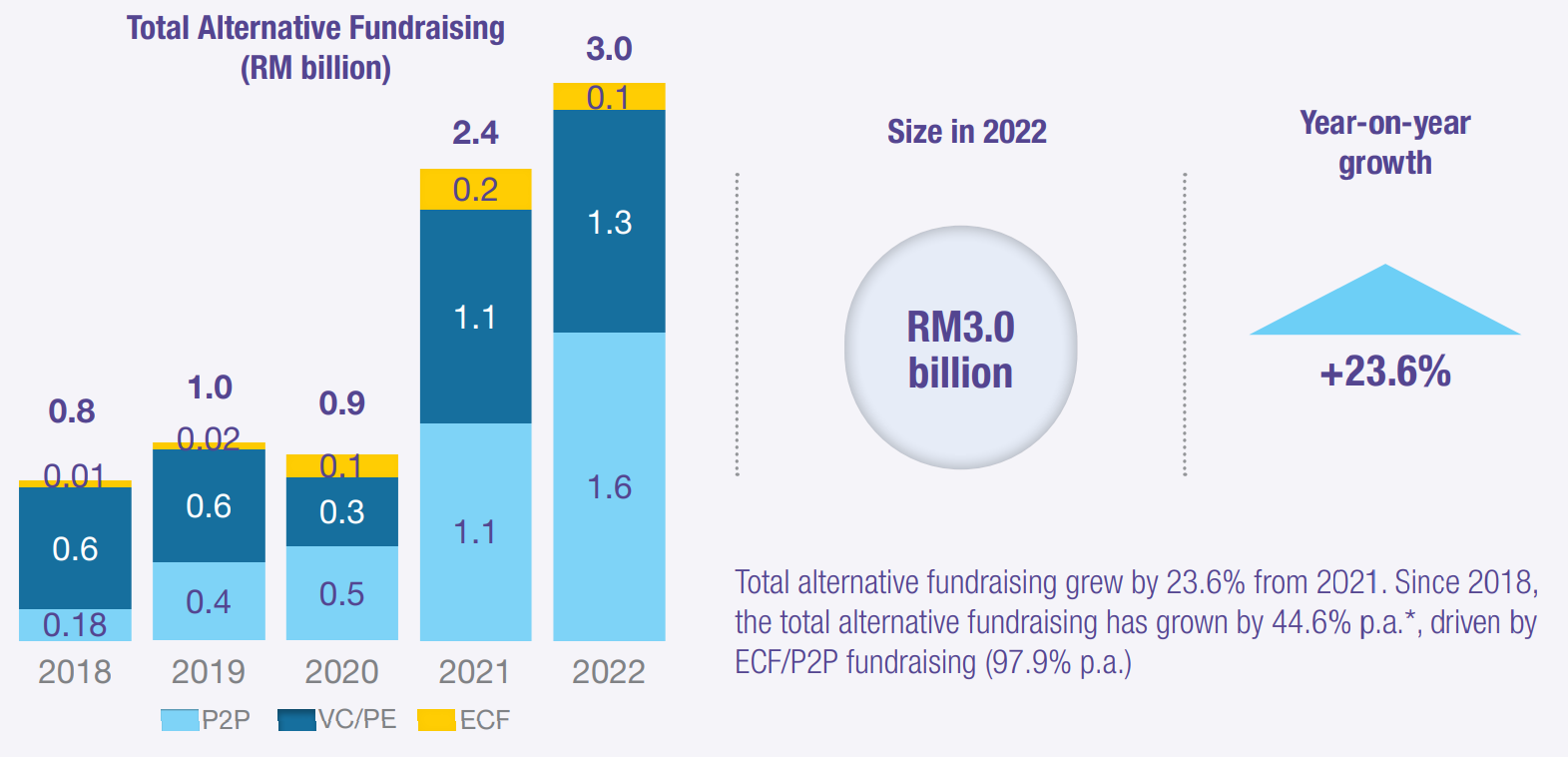

1. Equity crowdfunding (ECF) and peer-to-peer financing (P2P) platforms continue to facilitate the funding needs of micro, small and medium enterprises (MSMEs). The total funds raised saw an increase of 26% from RM1.4 billion in 2021 to RM1.7 billion in 2022. Since their inception, ECF and P2P have helped 7,218 MSMEs raise over RM4.4 billion.

2. The Islamic capital market (ICM) comprising total sukuk outstanding and Shariah- compliant equity market capitalisation, saw a marginal increase by 0.6% compared to the previous year. According to the SC, ongoing efforts to broaden and deepen the ICM were made, including the issuance of the Guidelines on Islamic Capital Market Products and Services to facilitate efficient access to the ICM ecosystem.

3. The capital market continues to prioritise good corporate governance and sustainability practices. As of 1 March 2023, 30% of the top 100 public listed companies (PLCs) are led by women, and all top 100 PLCs have at least one-woman director on the board.

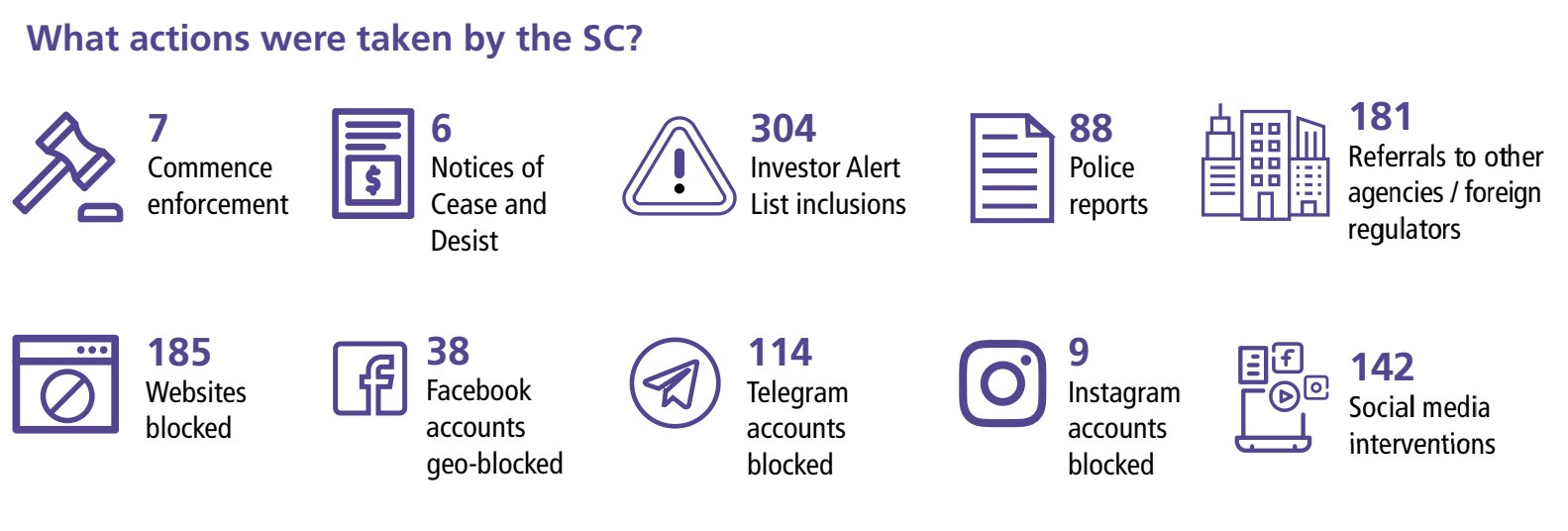

4. The SC had established an internal task force to address scams and unlicensed activities. This measure aims to ensure that such activities are identified and dealt with in a timely manner. In 2022, 185 websites were blocked and 304 new entries were added to the SC’s Investor Alert List, compared to 143 websites and 134 new entries in 2021.

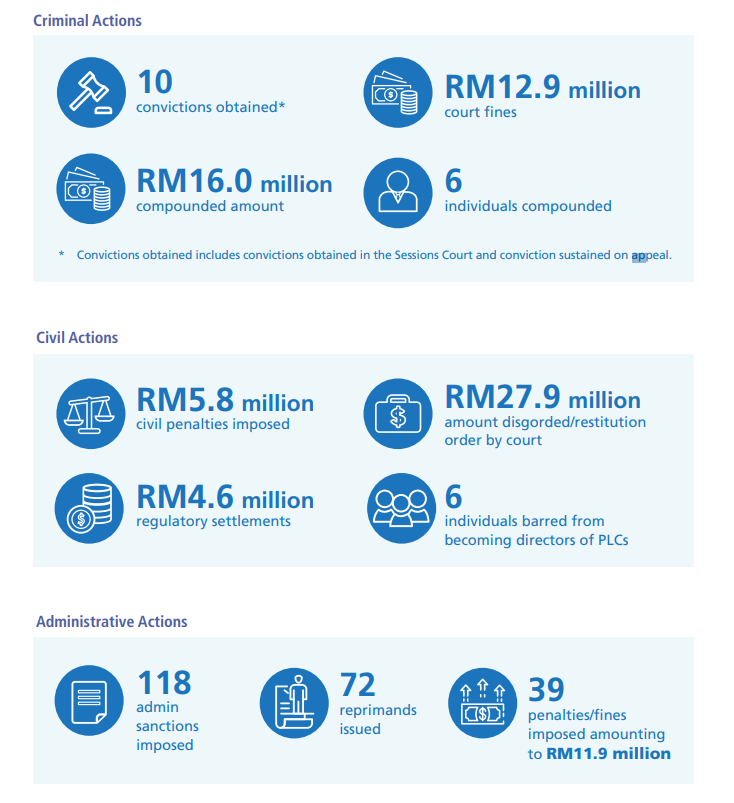

5. In 2022, the SC took criminal and civil actions related to various serious breaches such as disclosure breaches, securities fraud and unlicensed activities which resulted amongst others, numerous criminal convictions and RM12.9 million in total fines.

6. Three special feature articles published in the annual report; (1) Towards Greater Investor Protection: Understanding Investors’ Vulnerabilities, (2) Reinvigorating Capital Formation for Sustainable Economic Development, and (3) Behavioural Insights to Address Retirement Savings Inadequacy.

Sustainability among SC’s key areas of focus this year

Dato’ Seri Dr. Awang Adek said some of the areas of focus in 2023 include regulatory reforms, enhancing the fundraising ecosystem, advancement of the ESG agenda, facilitation of technology adoption and improving of corporate governance.

The SC will also prioritise sustainability and talent development to ensure the capital market continues to contribute to broader social and environmental goals. He concluded,

“As we look towards the future, the SC remains committed to pursuing initiatives that will further strengthen Malaysia’s capital market, and enhance its role as a catalyst for economic growth and development,”

The SC had also released the Audit Oversight Board Annual Report 2022 and the inaugural Capital Market Stability Review 2022 today.