Alliance Rolls Out Dynamic Virtual Card With Single Use Numbers That Lasts 30 Minutes

by Fintech News Malaysia April 5, 2023Alliance Bank Malaysia has introduced its new dynamic virtual credit card to make online transactions more secure in partnership with Visa, CTOS Digital, RinggitPlus’ owner Jirnexu, mobile network operator YTL Communications (YES) and TNG Digital.

A virtual card becomes available for customer use immediately after generating and assigning a random 16-digit card number which changes every 30 minutes.

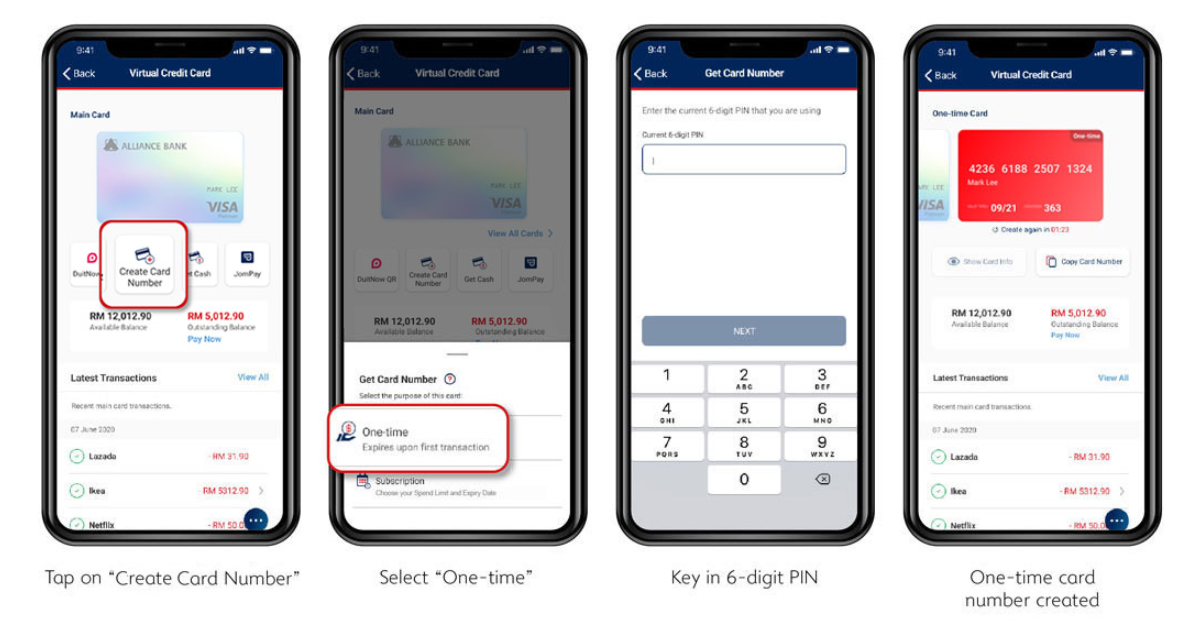

Here are the steps to get the one-time card number

Customers will also have the flexibility to determine a dedicated dynamic card number as well as the number of times it can be used for a particular subscription service.

This enables customers to track and manage their digital transactions on-the-go more conveniently and securely via their mobile phones.

The single-use dynamic card number is said to offer a more secure and safer way of making daily purchases and minimises the customers’ exposure to fraudulent risks, identity thefts and other financial scams.

Additionally, it also reduces production of plastic credit cards and helps to lower credit card footprint on online channels.

The application process is fully online with digital submission of supporting documents such as EPF statements or salary slips. Successful applicants will be notified through a push notification.

Gan Pai Li

“In line with Alliance Bank’s customer-first mindset, we constantly innovate and enhance our suite of digital solutions to meet our customers’ expanding banking needs, and also deliver a seamless digital payment experience.

The new feature on the Alliance Bank Visa Virtual Credit Card provides our customers with greater peace of mind by way of a more secure payment option, addressing concerns of credit card data breach at third party sites when they transact online,”

said Gan Pai Li, Group Chief Consumer Banking Officer of Alliance Bank.

Alan Ni

“The virtual credit card will enable users a smooth experience when fulfilling their payments, reload and purchasing needs.

Furthermore, the main edge of the virtual credit card is its dynamic card numbers which is in tandem with TNG Digital’s main aim for being a safe and secure eWallet in line with Bank Negara Malaysia’s standards,”

said Alan Ni, Chief Executive Officer of TNG Digital.

Ng Kong Boon

“With more Malaysians relying on digital commerce, we believe it is important that they feel empowered and secure when making digital payments.

Hence, we have partnered with Alliance Bank on this dynamic card number solution for the virtual credit card. We hope to give customers more confidence as they shop and pay for their purchases online.”

said Ng Kong Boon, Visa Country Manager for Malaysia.

Featured image: (From left to right) Yeoh Keong Ren, Chief Marketing Officer of YTL Communications; Erick Hamburger, Group Chief Executive Officer of CTOS Digital; Alan Ni, Chief Executive Officer of TNG Digital; Kellee Kam, Group Chief Executive Officer of Alliance Bank; Gan Pai Li, Group Chief Consumer Banking Officer of Alliance Bank; Ng Kong Boon, Visa Country Manager for Malaysia; Siew Yuen Tuck, Co-Founder of Jirnexu