QR Payment Linkage Between Indonesia and Malaysia Has Now Gone Live

by Fintech News Malaysia May 8, 2023Bank Negara Malaysia (BNM) and Bank Indonesia (BI) today announced that the cross-border QR payment linkage between both countries has officially gone live.

This will enable more Indonesians and Malaysians to make instant retail payments in either country by scanning Quick Response Code Indonesian Standard (QRIS) or DuitNow QR codes at physical stores or online merchants using services offered by participating financial institutions.

The commercial launch of this linkage sees the number of participating financial institutions which include non-banks increase. The full list of issuers and acquirers from both countries is available here.

The launch of this linkage follows from the successful completion of the pilot phase of the linkage announced in January 2022.

Tan Sri Nor Shamsiah Mohd Yunus

Tan Sri Nor Shamsiah Mohd Yunus, Governor of Bank Negara Malaysia said,

“Many more users from Malaysia and Indonesia will benefit from a secure, more seamless and more efficient experience to make and receive cross-border payments. This in turn has significant potential to boost economic activities, including tourism spending in our two countries.

The payment linkage will also help expand markets for some businesses and facilitate increased settlements in local currency, thereby improving financial outcomes.”

Perry Warjiyo

Perry Warjiyo, Governor of Bank Indonesia said,

“Cross-border QR payment linkage between Indonesia and Malaysia is concrete evidence of strengthened cooperation on Regional Payment Connectivity to promote faster, cheaper, more transparent and more inclusive cross-border payments, particularly for the benefits of micro, small and medium enterprises.”

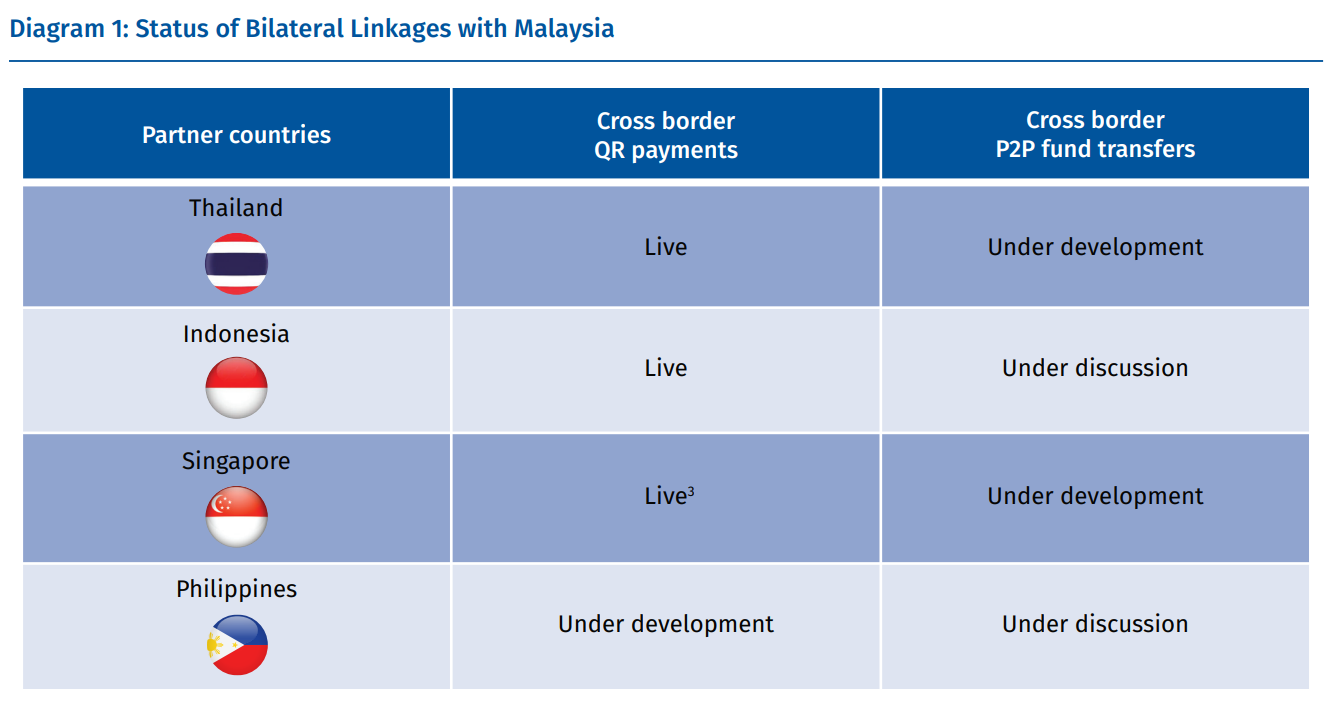

So far, Malaysia’s payment linkage with Singapore and Thailand has gone live to enable cross-border QR payments.

The central bank is also working on enabling P2P transfers between these countries through the use of mobile or national identification numbers.

Source: BNM’s annual report 2022