Here’s a Snapshot of the Newly Released BNM Annual Report for 2022

by Fintech News Malaysia March 30, 2023Bank Negara Malaysia (BNM) released its Annual Report 2022 yesterday to detail its key initiatives in fulfilling its mandates to promote monetary and financial stability conducive to the sustainable growth of the Malaysian economy.

Here are five key highlights from the annual report:

1. Whole-of-nation approach to combat financial fraud and scams

BNM has taken a whole-of-nation approach in combating financial fraud and scams which is one of its key priorities.

The central bank had conducted the first industry-wide cyber drill exercise BNM RE4CT in 2022 with over 270 participants from 35 financial institutions to ascertain their responses against cyber threats.

From the exercise, BNM found that financial institutions were well-versed with their internal incident response and business continuity plans. However, the regulator indicated that there is room for improvement when it comes to communication with the public and media during a cyber crisis.

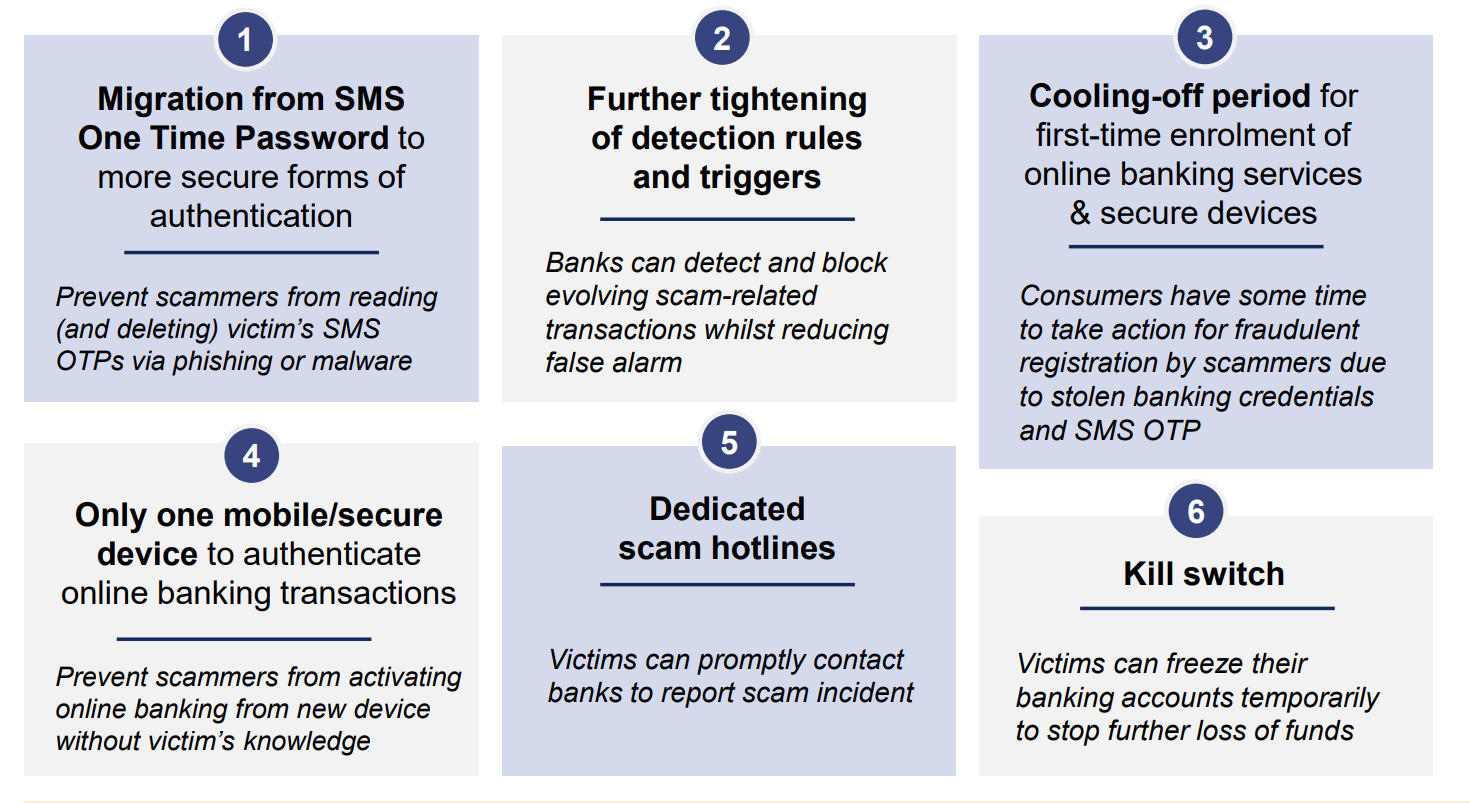

In addition to BNM RE4CT, BNM had also enforced 5 additional key measures for immediate implementation to combat scams.

Countermeasures announced by BNM

Additionally, BNM had set up a National Scam Response Centre (NSRC), a joint effort between the National Anti-Financial Crime Centre (NFCC), Polis Diraja Malaysia (PDRM), Malaysian Communications and Multimedia Commission (MCMC), financial industry and telecommunications industry.

The NSRC was established for a seamless information flow and stakeholder coordination to trace, hold and recover stolen funds and ultimately to arrest, charge and convict criminals.

In an effort to raise awareness, BNM had also launched the National Scam Awareness Campaign by Association of Banks in Malaysia (ABM), Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) and Association of Development Finance Institutions Malaysia (ADFIM).

2. Doubling down on digital financial services

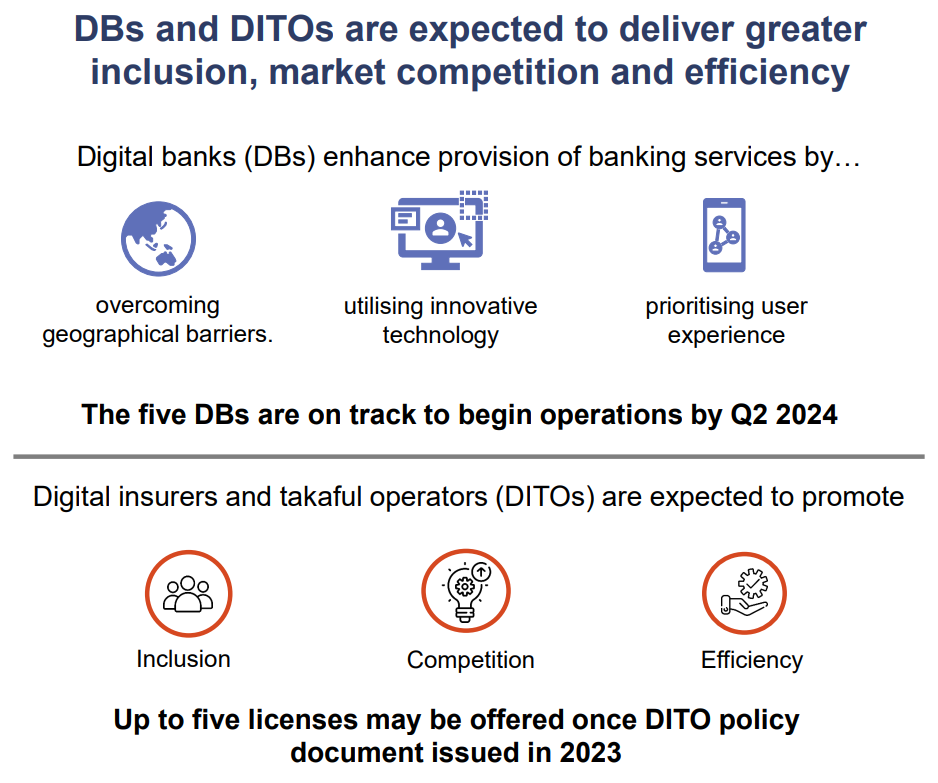

(a) Digital banks

In line with the Financial Sector Blueprint, BNM had made continued efforts to spur greater innovation and a key part of this was to facilitate the entry of new digital-first players into the financial sector.

In April 2022, five digital bank licenses were granted to (1) Axiata’s Boost Holdings and RHB Bank (conventional), (2) Grab’s GXS Bank and Kuok Brothers (conventional), (3) Sea Limited and YTL Digital Capital (conventional), (4) KAF Investment Bank, MoneyMatch, Carsome and Jirnexu (Islamic) as well as (5) AEON Financial Service and AEON Credit Service (Islamic).

These digital banks are currently undergoing operational readiness checks and may begin operations by the second quarter of 2024.

They have already begun appointing their management and board members, instituting key policies and control procedures as well as finalising their digital infrastructure.

These digital banks have also engaged independent external parties to objectively review their state of readiness. BNM will also conduct an operational readiness review before they commence operations.

Interestingly, four of these digital banks are led by led by women, namely Raja Teh Maimunah Raja Abdul Aziz, CEO of AEON Consortium’s ACS Digital Berhad, Pei Si Lai, CEO-designate of Grab Malaysia’s digital bank project, Fozia Amanulla, Deputy CEO of the consortium of Boost Holdings Sdn Bhd, and Rafiza Ghazali, Director Digital Banking KAF Investment Bank.

(b) Digital insurers and takaful operators (DITOs)

BNM had also been laying down the groundwork for new digital insurers and takaful operators (DITOs) to enter Malaysia’s financial landscape.

The central bank had issued an exposure draft on the licensing and regulatory framework for DITOs in November 2022 to introduce licensing requirements during their initial stage of operations.

Similar to digital banks, the newly licensed DITOs will be required to observe a foundational phase and comply with sound risk management and consumer protection requirements.

During this period, they would be subject to simplified requirements such as a lower minimum number of Shariah committee members and a lower minimum paid-up capital.

BNM said that it aims to finalise the policy document and will start accepting applications for up to five DITO licenses this year.

(c) Accelerating innovation

The regulator has also turned its focus on accelerating innovation through its Financial Technology Regulatory Sandbox where the central bank aims to introduce two key enhancements (i) accelerating the turnaround time to realise innovations for FIs with strong risk management capabilities; and (ii) simplifying the eligibility assessment for the sandbox.

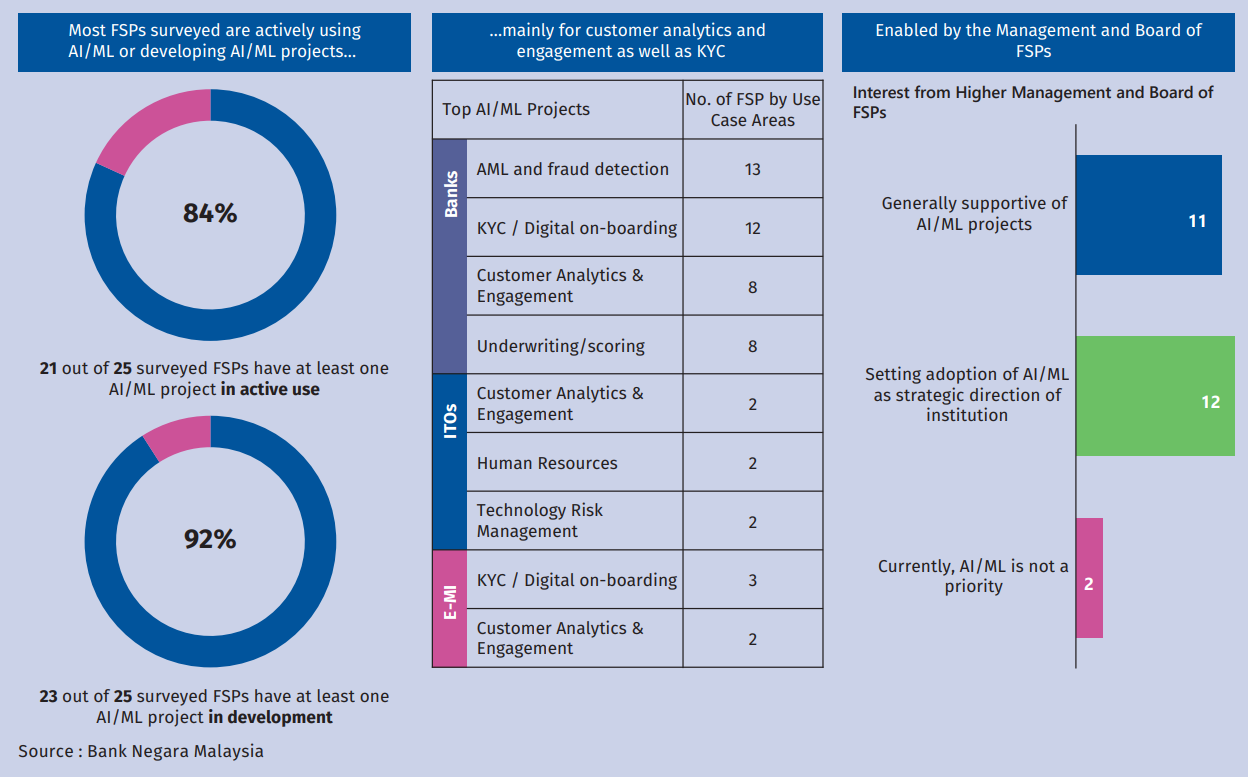

Additionally, the central bank is also studying the opportunities and risks that artificial intelligence (AI) and machine learning (ML) may pose to the Malaysian financial system.

Given that financial service providers (FSPs) in Malaysia are already actively using AI/ML technologies with more initiatives under development, BNM said that it will continue to closely monitor these developments to inform its regulatory and supervisory approach.

Even though these FSPs are expected to observe existing regulatory requirements, BNM acknowledged that refinements to existing standards could be made.

3. Accelerating domestic and cross-border digital payments

(a) Domestic payments

Ensuring that payment and money services business (MSB) services remain safe, efficient and reliable was another one of BNM’s top priorities.

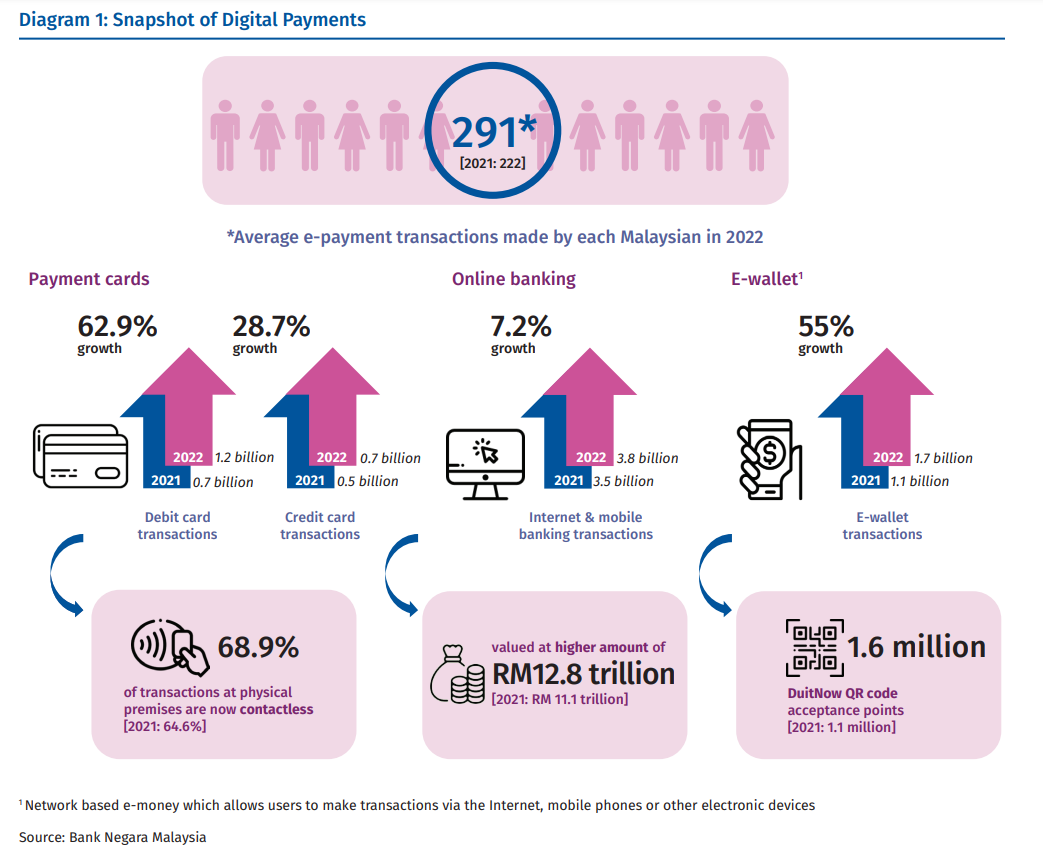

BNM reported that last year e-payment transactions grew by 31.5% (2022: 9.5 billion; 2021: 7.2 billion) where each Malaysian made 291 e-payment transactions on average.

Two-thirds of total card-present transactions are now contactless, while various industry-led initiatives to actively promote adoption of QR code payments have led to a higher number of merchants, particularly MSMEs, to accept DuitNow QR.

(b) Cross border payments

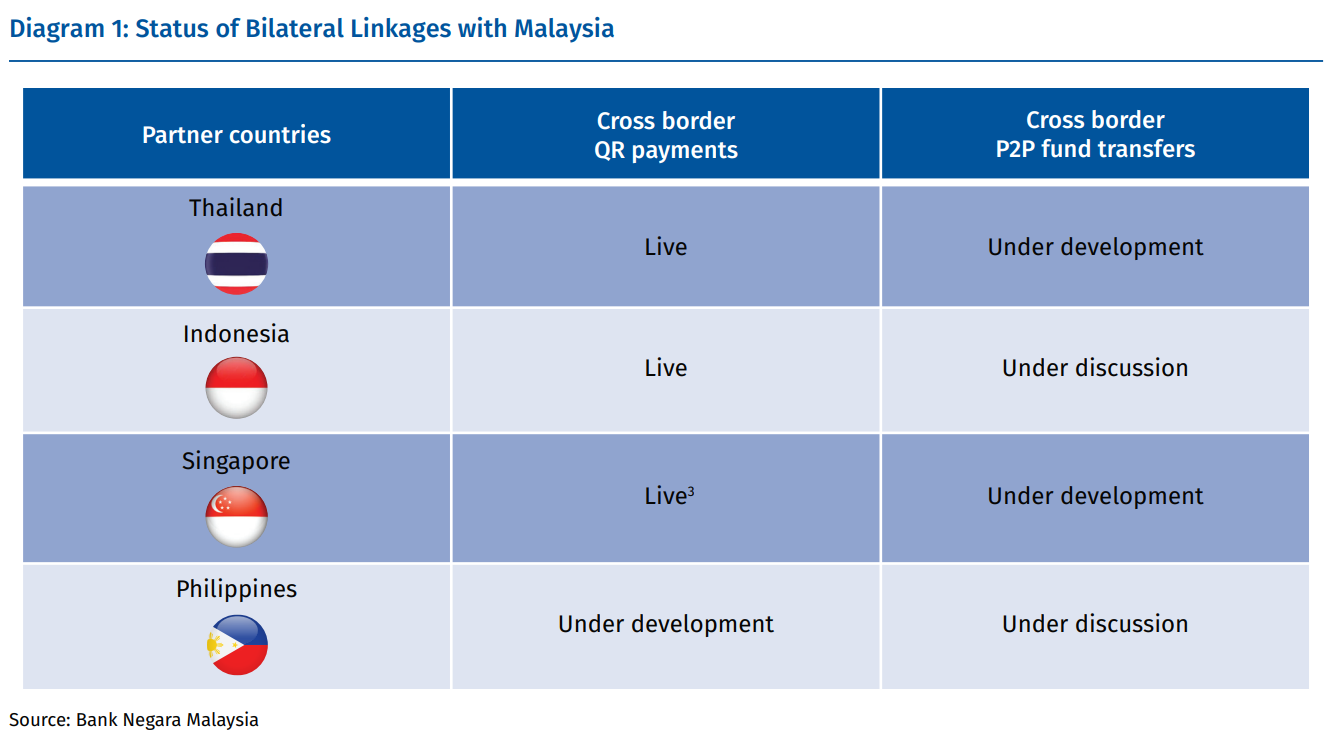

BNM has also been working on making cross-border retail payments and fund transfers faster, cheaper and more transparent by establishing bilateral cross-border payment linkages for QR payments with Thailand, Indonesia and Singapore.

Through this linkages, Malaysians travelling to these countries can make instant retail payments just by scanning QR codes displayed at participating merchants in these countries, and vice versa.

The central bank is also working on enabling P2P transfers between these countries through the use of mobile or national identification numbers.

This has led to increased payment connectivity in ASEAN where nine live linkages are already operational.

The linkages include seven cross-border QR payments (Cambodia-Thailand, Indonesia-Malaysia, Indonesia-Thailand, Malaysia-Thailand, Malaysia-Singapore, Thailand-Singapore, and Thailand-Vietnam) as well as two P2P fund transfers (Cambodia-Malaysia and Singapore-Thailand).

³To go live on 31 March 2023

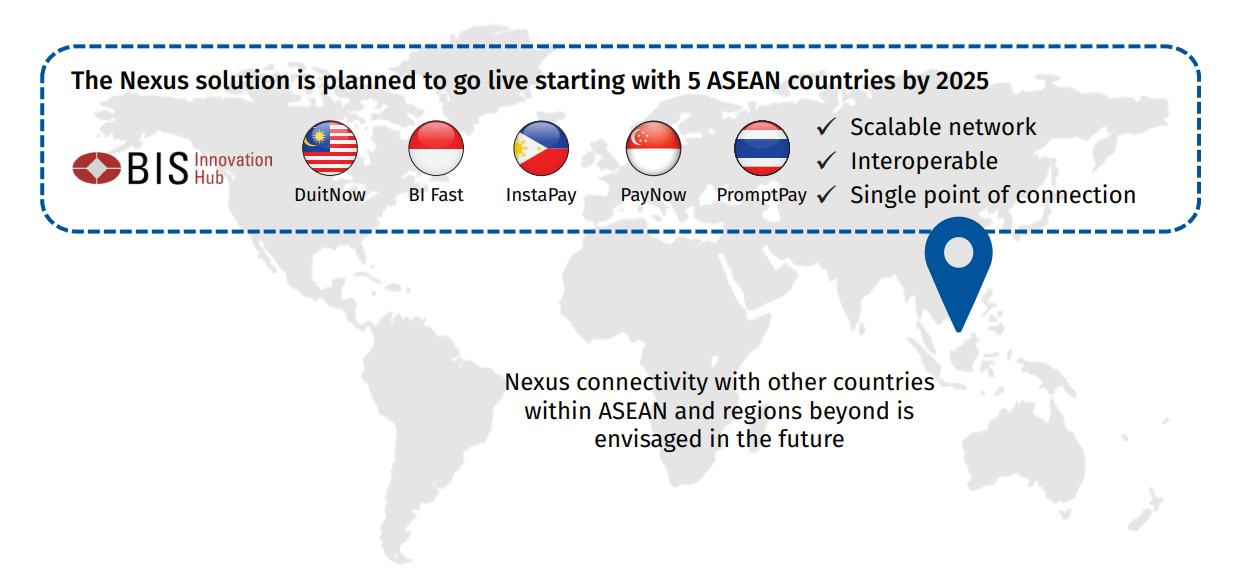

Given the challenge to establish and scale-up multiple bilateral payment linkages, ASEAN has made a push for multilateral payment connectivity through Project Nexus.

Malaysia along with the central banks of Indonesia, Philippines, Singapore and Thailand will participate in the next phase of Project Nexus with the aim to have a operationally and commercially viable model ready by 2025.

Multilateral Payments Connectivity between 5 ASEAN Countries and Beyond

(c) Payment infrastructure

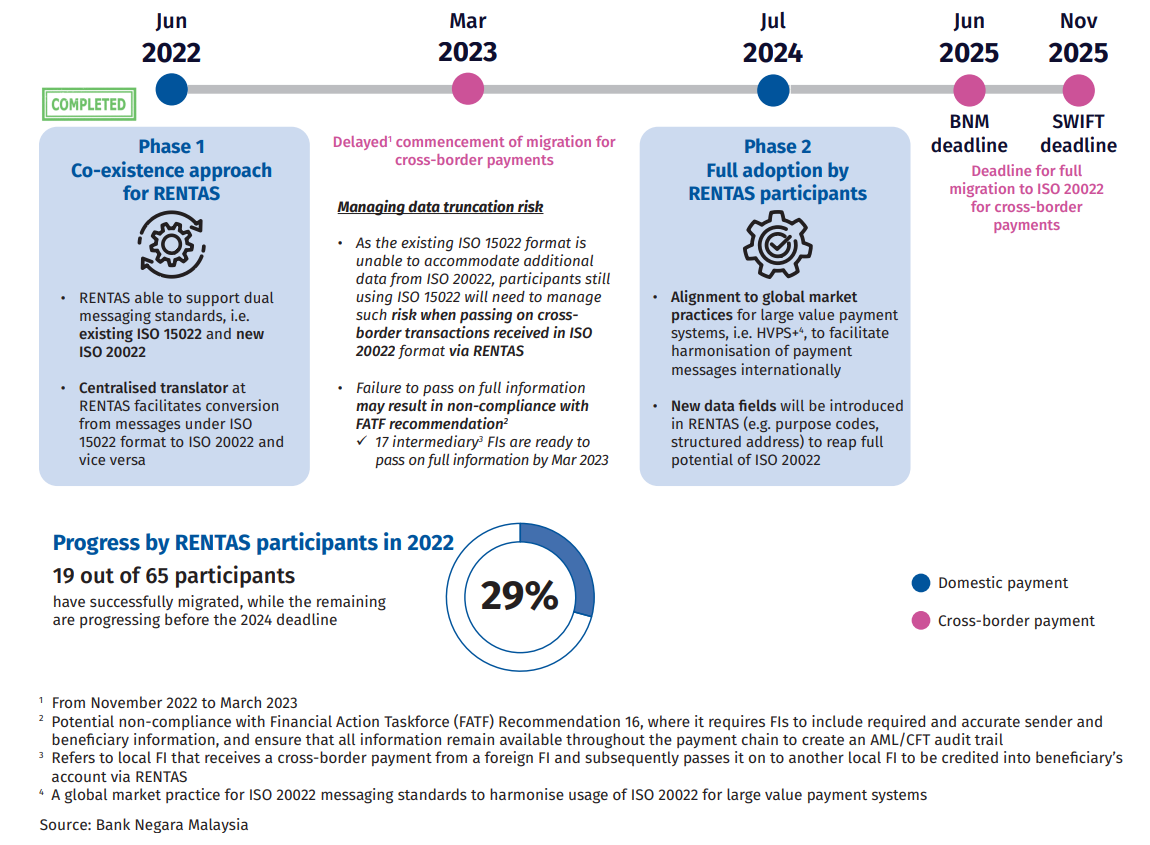

On top of that, BNM has also made concerted efforts to future-proof key payment infrastructures especially the full migration to the new ISO 20022 messaging standard for both domestic and cross-border payments.

The ISO 20022 adoption will enhance payment efficiency, strengthen risk management and offer better value-added solutions to customers.

According to BNM, individual Real Time Electronic Transfer of Funds and Securities (RENTAS) participants are on track to implement ISO 20022 for domestic transactions. Around 30% of participants have already completed their migration ahead of the domestic July 2024 deadline.

Meanwhile, SWIFT has announced that the commencement of ISO 20022 has been delayed for cross border payments and pushed the new deadline to November 2025. However, BNM has set an earlier domestic June 2025 deadline to minimise any risk of delays.

(d) Central bank digital currencies (CBDCs)

BNM has been studying the potential of central bank digital currencies (CBDCs) and distributed ledger technology (DLT) in order to future-proof RENTAS.

The proposals along with feedback from ongoing industry engagements gained from this will also inform BNM’s work under Phase 2 of its CBDC exploration project.

This is part of the multi-year CBDC exploration starting from Project Dunbar, led by BIS Innovation Hub Singapore alongside several central bank partners, which seeks to test the use of wholesale CBDC via a shared multi-CBDC platform.

The central bank aims to ascertain how these technologies could potentially alleviate the issues raised by the industry such as reducing manual compliance processes, streamlining the trade confirmation process using DLT and smart contracts, as well as explore new use cases such as asset tokenisation.

BNM has also stepped up engagements with key stakeholders such as digital asset players and financial institutions to obtain more granular market insights and data.

4. Strengthening the Islamic financial system

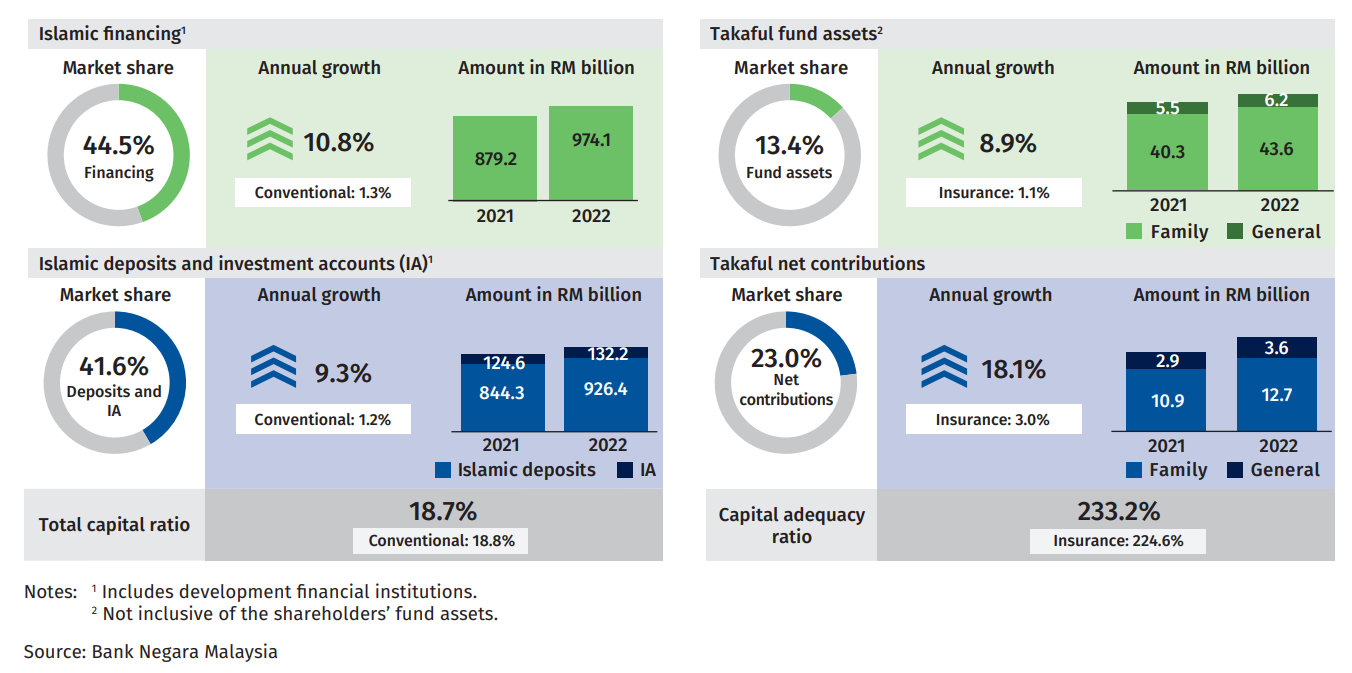

BNM had rallied efforts to sustain Malaysia as a global leader in Islamic finance. This proved to be fruitful as the Islamic banking and takaful industry sustained its growth in 2022.

Growth of Islamic Banking and Takaful Industry in 2022

BNM has also called for stronger connectivity among central Shariah boards for a more integrated global financial system. Malaysia is one of the first countries in the world to establish a central Shariah board – the Shariah Advisory Council of Bank Negara Malaysia (SAC) – in 1997.

The SAC has continued to play a key role in encouraging innovation while promoting confidence in the integrity of financial solutions based upon Shariah tenets.

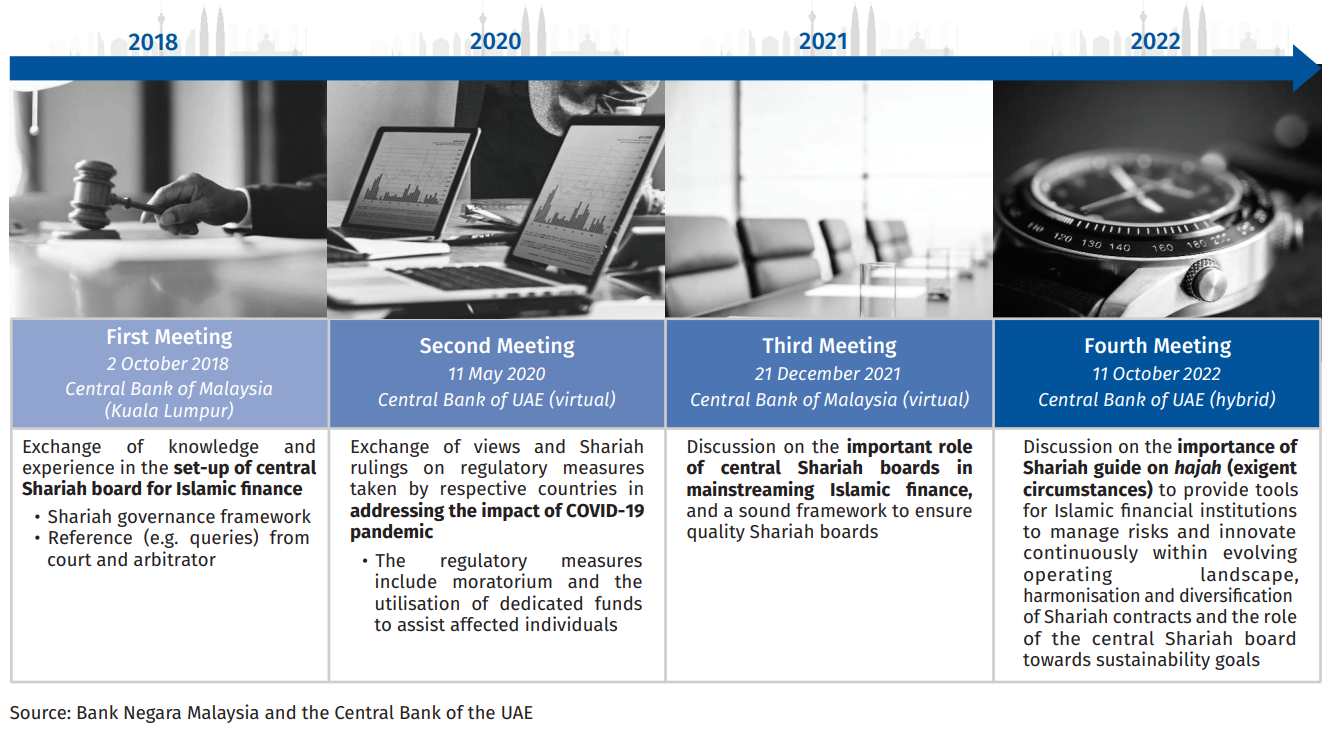

The Nature of Discussions in the Centralised Shariah Advisory Authorities in Islamic Finance (CSAA) Meetings

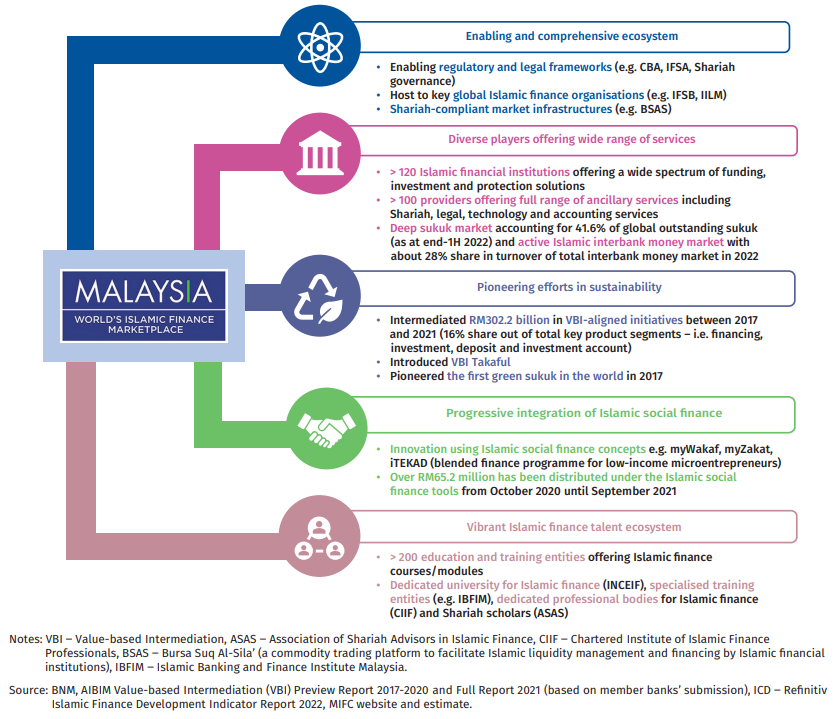

It is worth noting that the Islamic finance in Malaysia has evolved into one of the most developed ecosystems with diverse solutions and resilient players since BNM’s launch of the Malaysia International Islamic Financial Centre (MIFC) in 2006.

Moving forward, BNM aims to enhance the connectivity of market participants, businesses and investors to Islamic finance opportunities in Asia and the Organisation of Islamic Cooperation (OIC).

Additionally, areas such as areas such as sustainable finance, halal trade facilitation and Islamic fintech will also be prioritised.

Comprehensive Islamic Finance Ecosystem in Malaysia

5. Transitioning to a greener financial system

Bank Negara has made continued efforts to focus on strengthening the financial sector’s climate resilience over the past four years.

The regulator has establish the key pillars of climate resilience including a framework for classifying assets based on alignment to climate outcomes, regulatory and supervisory expectations on managing climate risks, climate-related disclosure requirements and infrastructure to meet critical data needs.

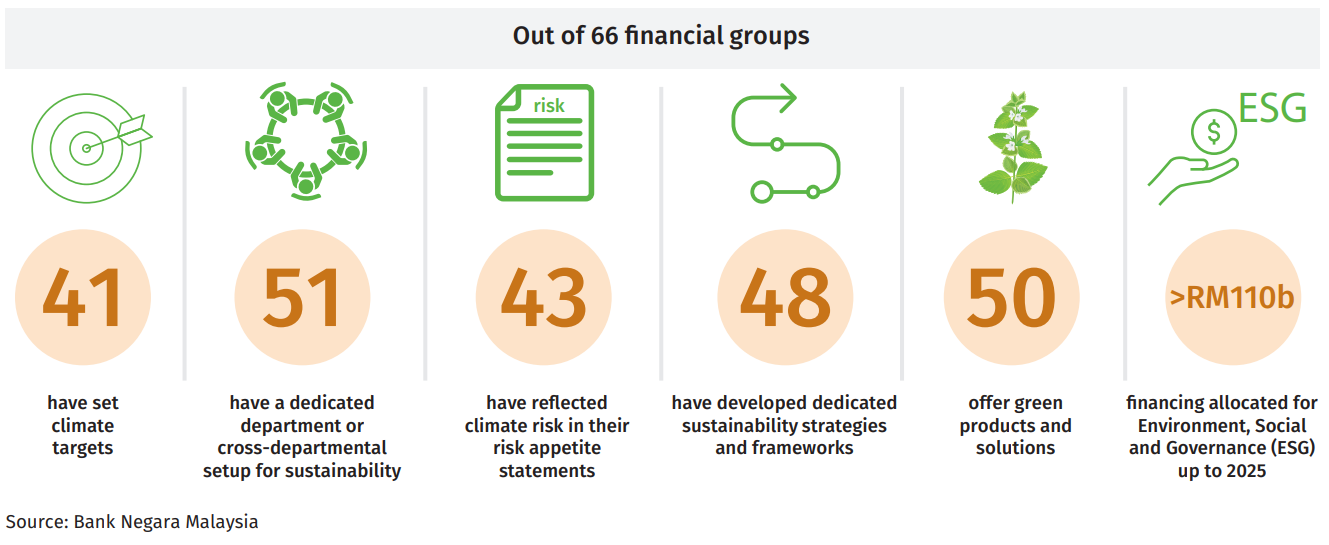

This has accelerated efforts by financial institutions to transition towards a greener economy as a large number of these organisations now consider climate change in their operations, risk management and business decisions.

This has influenced how they form strategies, manage risks, carry out processes as well as offer products and solutions.

For a more comprehensive approach, an increasing number of financial institutions have also started actively engaging their customers on the topic of climate risks and transition plans.

Progress Observed in the Financial Industry in 2022