Archive

Bank Negara Malaysia to Evaluate Merits of Digital Currencies Through POCs

Central bank-backed digital currencies (CBDCs) are rapidly on the rise, with 86% of central banks around the world researching the potential of CBDCs, 60% experimenting with the technology and 14% piloting the technology. CBDC is the digital form of fiat

Read MoreMastercard-Backed Pine Labs Rolls Out Buy Now, Pay Later Offering in Malaysia

Pine Labs, an Asian merchant commerce platform backed by Mastercard, announced the launch of its Buy Now Pay Later (BNPL) offering in Malaysia. The company provides a tech-first offline payments solution where on a single terminal multiple credit issuers can

Read MoreRipple Acquires 40% Stake Cross Border Payment Specialist Tranglo

Ripple, announced that it has agreed to acquire 40% of cross-border payments specialist Tranglo. This partnership will allow Ripple to meet growing customer demand in the region and expand the reach of On-Demand Liquidity (ODL), which uses the digital asset

Read MoreMalaysia’s Incumbent Banks Gears up for the Entry of New Digital Banks

In Malaysia, incumbents are gearing up for the entrance of the country’s first digital banks, accelerating digital transformation, planning standalone ventures, and partnering up with fintechs, top executives from CIMB Group, Bank Islam, RHB Banking Group, and Backbase said during

Read MoreTouch ‘n Go Expects 1 Million Users for Its New Wealthtech Offering GO+

Touch ‘n Go Group (TNG) formally announced today the launch of GO+, a financially inclusive investment product for which it expects 1 million users in 2021. GO+ allows TNG’s Malaysian e-wallet users above the age of 18 years old to

Read MoreBoost Now Supports DuitNow QR Payments

Homegrown e-wallet Boost announced that it is now part of the PayNet Real Time Retail Payment Platform (RPP) and will adopt DuitNow QR, effective today. DuitNow QR is Malaysia’s national QR code standard established by Payments Network Malaysia (PayNet) under

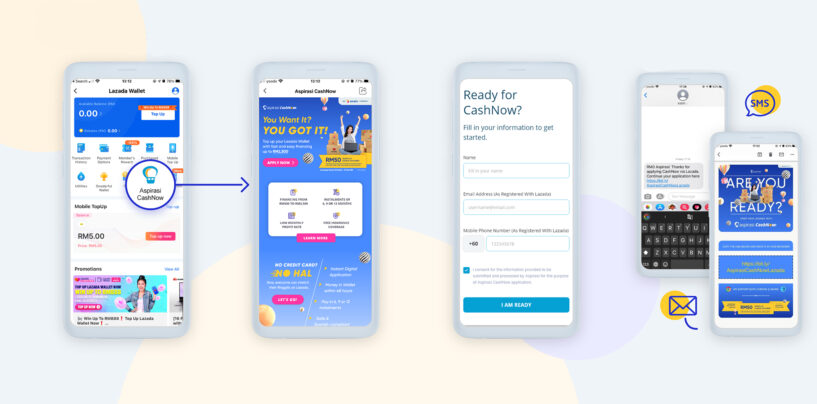

Read MoreAxiata’s Aspirasi Rolls Out Consumer Microloans up to RM 2,500 on Lazada

Aspirasi, a digital micro-financing and micro-insurance service provider under Axiata Digital, is now offering a flexible and fully-digital financing solution for online shoppers through Aspirasi CashNow. Available on e-commerce platform Lazada Malaysia, Aspirasi CashNow is open for application by all

Read MoreZurich Malaysia Partners Singaporean Fintech to Simplify Financial Planning

Zurich Malaysia (Zurich) and Singapore-based fintech BetterTradeOff, today launched ‘Up | MyZurichLife’, a financial planning solution exclusively for MyZurichLife’s users to help them plan their finance. The solution took root after BetterTradeOff won the Malaysian round of the Zurich Innovation

Read MoreReports of the Death of Challenger Banks Are Greatly Exaggerated

Against the backdrop of the cacophony of noise and emerging trends in Asia, it’s difficult even for the keenest of observers to determine what trends will shape the future of fintech in Asia. On the 6th episode of Fintech Fireside

Read MoreFrom Relationships to Platforms – the Shift in Corporate Banking

Banking has undergone a major shift in recent years thanks to the advent and advancement of digital banking technology. This shift has also been accelerated by the COVID-19 pandemic, with lending, trade finance and cash management functions all under pressure

Read More