Robo Advisors Are Coming To Malaysia, Here’s Why You Should Care

by Fintech News Malaysia July 2, 2018I’ll admit, I was a tad disappointed when I first learned that robo advisors aren’t some form of Jarvis or a virtual Alfred. That being said, actual robo advisors are still quite an interesting type of technology—no really, I’m serious here.

Robo advisors are a form of artificial intelligence, but their value proposition lies in their ability to automatically pick out stock investments based on the kind of investment portfolio you’d like to have.

Cutting Out The Middleman

This is meant to serve as an alternative, or even a supplement to human-run investment portfolios. Through these robo advisors, consumers can more directly interact with their investments, and put in less effort to boot.

If you’re an average joe who wants to start playing with stocks, you may have no earthly idea where to begin. Robo advisors are one way to jump into the game, as using them can be cheaper than dealing with brokers.

In fact, you can use robo advisors to do micro investments instead of shelling out the big bucks immediately.

Anyone Can Get On It

The key appeal: you won’t have to babysit your investments all the time. The algorithm should ideally calculate the probabilities and the market conditions for you. This way, you can just put money into a self-guided online system, and watch it steward and grow your money for you.

Your own time spent on your robo-investments are low, as the algorithm should help you to allocate your money into different investment assets. There is no need for meetings with brokers or reading through difficult to understand annual reports.

Basically, it’s the passive income dream that is often promoted on scammy Facebook pages or WhatsApp chains, but made real.

For the price and convenience though, you’ll be trading away a more personalised portfolio specifically catered for your lifestyle and preferred investments. You’ll also have to look at separate avenues for cash flow management and retirement planning, which a human financial advisor might be better equipped help you with.

The Natural Rise Of Robo Advisors In Malaysia

The smaller price tag and reduced entry barrier have raised the popularity of robo advisors in the market—and Malaysia is no different. Or at least, we might start seeing robo advisors courting our ringgit soon.

Fintech News has it on good authority that there some robo advisors from Singapore looking to tap into the Malaysian market. These are some of the potential suspects that may become more familiar to us in the future.

There are even talks of a local player that might be launching into the market soon.

The Securities Commission Already Has An Eye On It

There are no local players that have taken the scene by storm yet, but even since November 2017, the Securities Commission has already thought of a regulatory framework for robo advisors.

Tan Sri Ranjit Singh, Chairman of the Securities Commission of Malaysia announced that the first licenses for what is named the Digital Investment Framework Management. They were looking at issuing these licenses sometime mid-2018, which is pretty much now.

The goal is to protect investors by requiring specific conduct from any players interested in operating locally.

Some of the requirements include having a “competent person within the company” who actually understands the risks and rules of the algorithm used, and written policies that ensure the algorithm is tested every so often.

“One of the core needs of millennial investors is the need for regular savings, even in small amounts, to be channeled towards investing for the future” said Tan Sri Ranjit Singh.

As a millennial myself, I am as stated, guilty of not having a substantial amount of savings. Luckily though, a 2017 report published by The Star reveals that more young investors are jumping into the stock trading market.

Bursa Malaysia revealed that there was a 36% jump in the number of Central Depository System (CDS) account holders who are 25 years old and below, for one thing.

So our investment future may lie in the hands of robots, but as is normal with any type of investment, it’s important to remember that you shouldn’t invest any money you can’t afford to lose.

Other than that, think of this as another avenue for starting your millennial investment journey.

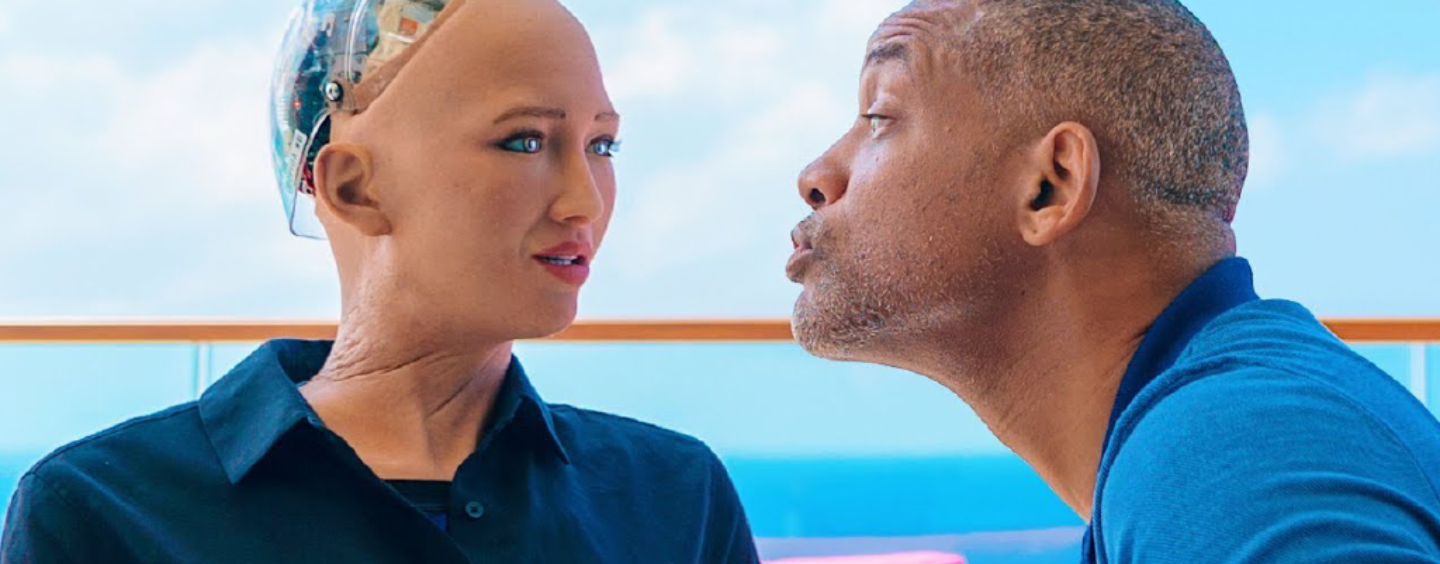

Image Credit: This video published by Will Smith on YouTube.