The insurance industry is changing, and its changing fast.

The forces driving the change in insurance include skyrocketing healthcare costs, rising protection gap and a shift in the way consumers prefer to interact with brands.

These new realities are pressuring the insurance industry to embrace insurtech. Prudential is among those in Malaysia’s insurance scene that have adopted this digital doctrine.

Nic Nicandrou, CEO, Prudential Asia, revealed to us that the group as a whole has stepped their tech investment to over £400 Million this year.

On Malaysia’s front we were also informed that they are looking to invest over RM 250 million in these key areas; removing inefficiencies, improving customer services, and increasing accessibility to Prudential’s services.

Part of that renewed focus into digital technologies and insurtech is their soon-to-be-launched digital health tool, Pulse. We were given the opportunity to take sneak peek at the beta version of their app during their media preview session.

Though Pulse made its first appearance at Singapore Fintech Festival 2018, Nic shared with us that Malaysia will be the first market that they will be debuting Pulse.

A Glance at Prudential’s New App

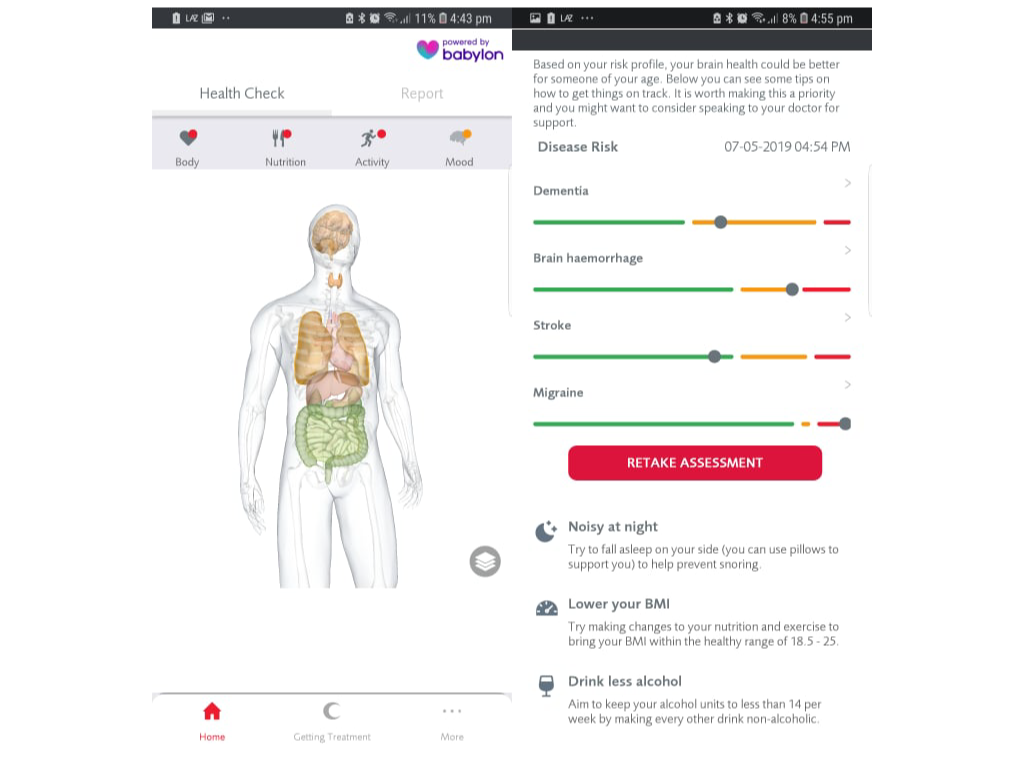

There are 4 key functions to Prudential’s AI powered digital health tool — Health Assessment, Symptom Checker, Online Consultation and Dengue Alert.

All these functionalities were made possible thanks to partnership with startups like Babylon Health, DoctorOnCall and AIME.

One of the the flashier functions within the Pulse app is the “digital twin”. Once you’ve completed a very detailed interaction with its chatbot, the app will generate an interactive diagram of your body along with some helpful graphs.

The colours represent the level of health risk of each of your organ. When you tap on one of the organs it will list down what are the risks you face and recommend options that you can take to improve the situation.

According to its partner Babylon, the symptom check function uses over 50 million data points to provide users a diagnosis. The app will then recommend if a visit to the doctor is needed.

Should that need arise users of the may opt to use their built in tele-health capabilities to get a consultation from certified doctors via video calls.

Once that’s done users can have medicine delivered directly to their doorstep and payments can also be made within the app using credit/debit card and your Boost e-wallet.

A Step in the Right Direction

The myriad of services offered within the app is definitely a step in the right direction for Prudential, this is especially true in Malaysia where 71% of health related searches happens on the mobile and the fact that 23% of apps downloaded are health related apps.

We were also pleased to learn that this app is also made available to non-Prudential customers.

However, there are some areas that the app requires improvement. The necessary interaction to generate the health assessment report is too lengthy, which took roughly 15 minutes to complete.

While it is understandable that such level of detail is necessary to generate an accurate report, perhaps it might work better to gamify that aspect of it and get users to complete that interaction in phases.

Another area that would benefit from some fine tuning is the language that’s used, while it’s clear that effort has been made to use simpler language there are still quite a number of medical jargons that many users might find difficult to understand.

For a beta version of the app it is pretty refined and I’d imagine they will iron out some of these minor kinks prior to an official launch.

The beta version of the app is now available for download in Google Play and Apple Store, it is a free-to-use app with the exception of the online consultation service.