Ata Plus Sees First Successful Equity Crowdfunding Exit with Skolafund

by Fintech News Malaysia October 9, 2019Skolafund, a crowdfunding platform for students in need announced that it has been completely acquired by one of Asia’s biggest donation crowdfunding platforms.

Skolafund successfully fundraised on the Ata Plus Equity Crowdfunding (ECF) platform in February 2017. The deal reportedly gives investors in the ECF round a return of 10% on their investments.

Fintech News Malaysia reached out to both parties to confirm the acquiring party but both Skolafund and Ata Plus declined to comment citing that the party prefers to remain anonymous.

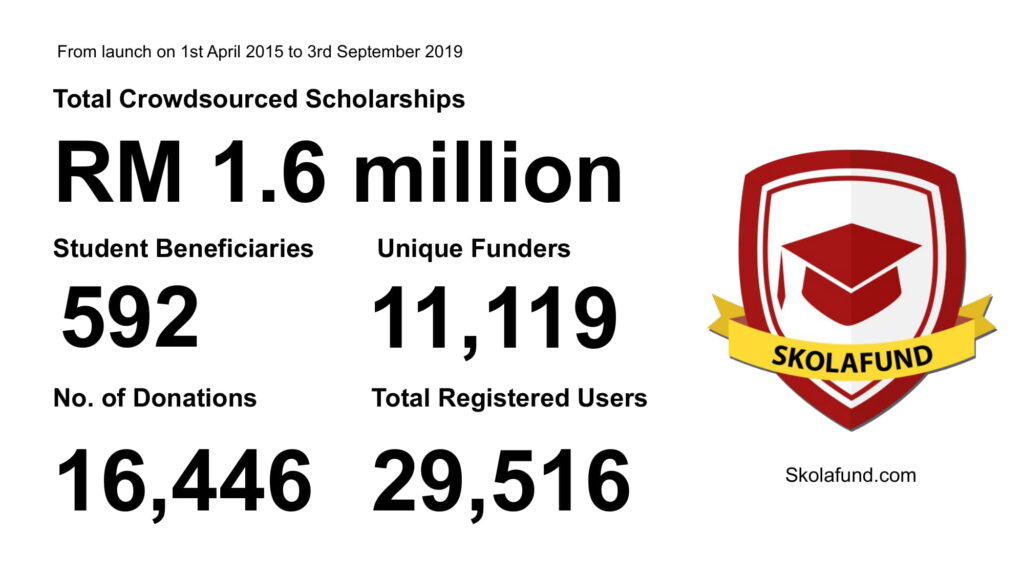

According to their press release, to-date, Skolafund has crowdsourced scholarships to the tune of RM1.6 million, benefitting 592 students from less-privileged backgrounds. Skolafund has acquired a total of over 29,000 registered donors with 11,119 of them actively contributing in a campaign. In total, they added, 350 campaigns were launched and 189 of them were 100% funded.

It is planned that through this acquisition, Skolafund’s platform will be merged into the acquirer’s regional platform, strengthening the total offering. Tengku Syamil, Skolafund’s CEO and co-founder, sees this step forward through very bullish eyes.

Tengku Syamil

“With this significant development, we are on a sounder footing to continue serving the disadvantaged in our communities, whether through aid on education, or other ways – like medical and humanitarian assistance. This also means we can reach more people and be more accessible across Southeast Asia,”

said Tengku Syamil.

Elain Lockman

said Elain Lockman, Co-founder and Director of Ata Plus.

““We are over the moon with this announcement,”ot only for what it means to Skolafund, but equally to their investors that came in at the ECF round. It is Malaysia’s first exit story in ECF and this augurs well for the future of this asset class and also dispels the myth that investing in Impact Enterprises does not give a financial return,”

Elain added.