It’s been two years now since I sat down at Securities Commission Malaysia’s press conference when its then chairman Tan Sri Ranjit Singh revealed to us that the regulator will be issuing the Digital Investment Manager framework to pave the way for robo advisors in Malaysia.

Of all the developments within the Malaysian fintech space, the introduction of robo advisor to Malaysia is among my favourite in recent times.

There’s a good reason for that too, because one of fintech’s main rallying call has always been financial inclusion. If you measure financial inclusion by the number of adults with bank accounts, Malaysia ranks among the highest in South East Asia. However, when you look utilization of financial products, you’ll see a very different picture.

Broadly speaking, Malaysians simply aren’t investing or planning for their retirement enough, as evidenced by the fact that over 41% of Malaysians rely on their EPF savings as the main source of retirement funds. On top of that, EPF statistics also indicate that 68% of Malaysians are not achieving the minimum basic savings of RM 240,000 recommended by EPF.

When you combine those two facts with the reality of Malaysia’s ageing population will double between the period of 2015-2040, you’ll start to see why having financial products that democratises access to wealth services like robo advisors is crucial to Malaysians.

Despite the best efforts from the industry to collectively raise awareness among consumers about this new method of investment in Malaysia, I still often get questions from my non-fintech circle of friends about what a robo advisor is and how they can get started investing with one.

So, I thought it might be worthwhile to breakdown a little bit about robo advisors and to provide a simple guide on how you can get started.

What is a Robo Advisor?

While it’s still relatively new in Malaysia, the term robo advisor has been around for over a decade, roughly around the same time the first iPhone was launched. Many would point towards Betterment as the first company to coin the term robo advisor.

Simply put, robo advisors are wealth management platforms that automate the process of investing money on the user’s behalf, typically with little or no human intervention.

A typical robo advisor will start out by identifying the user’s financial circumstances and risk profile and from there it will help determine what investment portfolio is best suited for the person. Upon determining these factors, the robo advisor will then typically help the user to select the right type of ETFs to invest in based on the user.

What is an ETF?

ETF stands for an Exchange-Traded Fund which in essence is a basket of stocks that you can invest in. An example of a well-known ETF out there in the market is the S&P 500 which consists of the 500 largest public-listed companies in the US. Similarly, in Malaysia we have the FBM-KLCI which consists 30 biggest listed companies that collectively represent the Malaysian stock market.

ETFs have been considered by some as one of the biggest financial inventions of the 20th century, they have low trading and holding costs compared with unit trusts and because they enable diversification across a wide range of asset classes, they are seen as an attractive vehicle for long-term investing. In addition, since they are listed on exchanges, they are highly liquid.

Which Robo Advisors in Malaysia can I invest in?

Currently, there are 3 robo advisors in Malaysia that are licensed by the Securities Commission to provide their services locally, they are namely; MYTHEO, StashAway and Wahed Invest.

For the purposes of this guide, I’m going pick MYTHEO as an example and walk you through their background, how to get started with them, what I like about them and things I feel that could be improved.

Right off the bat, I’ve always been a proponent of supporting local fintech companies, and of all the robo advisors in Malaysia that the regulator green-lit to operate, MYTHEO is the only homegrown one.

I first learned about MYTHEO when I attended their press conference in June earlier this year, the company is formed as a joint-venture between Silverlake Group and a Japanese fintech player, Money Design.

The names of the companies involved immediately caught my attention, those who are familiar with the banking software world will know that Silverlake is a pioneer in this space, providing financial software to roughly 40% of banks in South East Asia and those keeping track of the fintech industry still will also be privy to the fact that Money Design is the first robo advisor authorised to operate in Japan.

Getting Started

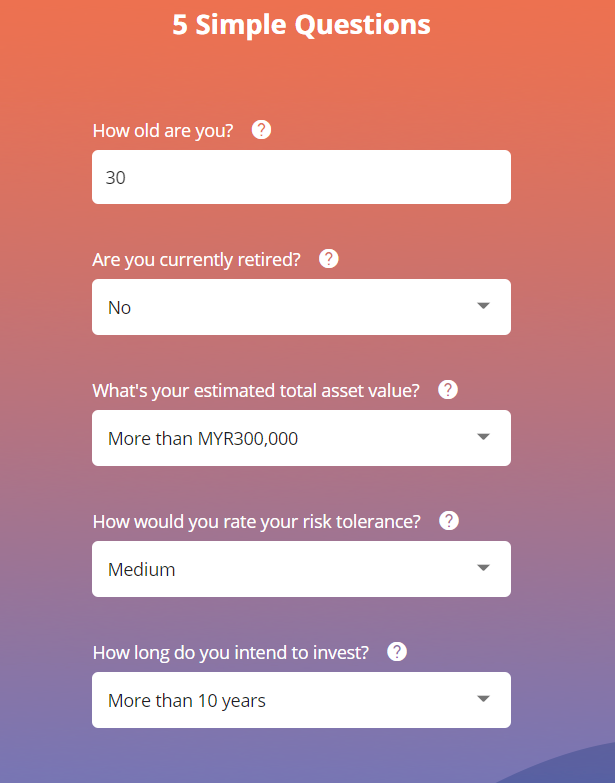

You can sign up for their services via desktop or by downloading their app which is available on both Apple AppStore and GooglePlay Store. Once you’re there, you begin by answering 5 simple questions for them to customise your investment portfolio.

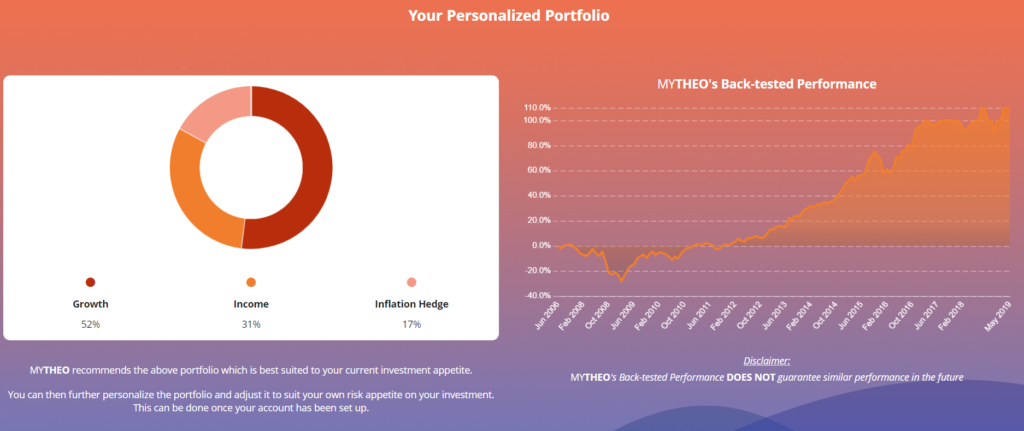

Once you’ve answered these questions, MYTHEO will automatically generate a personalised portfolio which places weightage on growth, income and inflation hedge. Using sliders, you can further customise how much weightage you would like to put on each category, depending on your own preference.

Once you’ve deposited your initial sum of money, MYTHEO will then invest your money in more than 25 ETFs selected from MYTHEO’s universe of 59 ETFs based on your portfolio.

When you’ve completed these steps, you’re pretty much all set, you can manually add money into your portfolio or make use of their Regular Savings Plan to automate monthly transfers based on whatever sum that fits your budget.

Also, if you feel like experimenting with different portfolio allocations, risk tolerances and investment period there are options for you set up multiple portfolios.

Its CEO, Ronnie Tan shared with Fintech News Malaysia that between the period of January 2019 to October 2019 they’ve seen the following returns for their 3 portfolios; Growth – 16.82%, Inflation Hedge 17.4% and Income 11.5%

How much do Robo Advisors like MYTHEO charge?

Like many robo advisors globally, MYTHEO focuses on the idea to allow consumers to access wealth services at a low fee, they charge between 0.5% – 1% fee for their service. You can start investing your money from as low as RM 100.

More info on their fee structure can be found here

Verdict on MYTHEO

What I like about MYTHEO?

- They have a wide range of ETFs (a universe of 59 ETFs), which allows for further customization. Currently, there are 231 possible variations that can be personalised for the user’s portfolio.

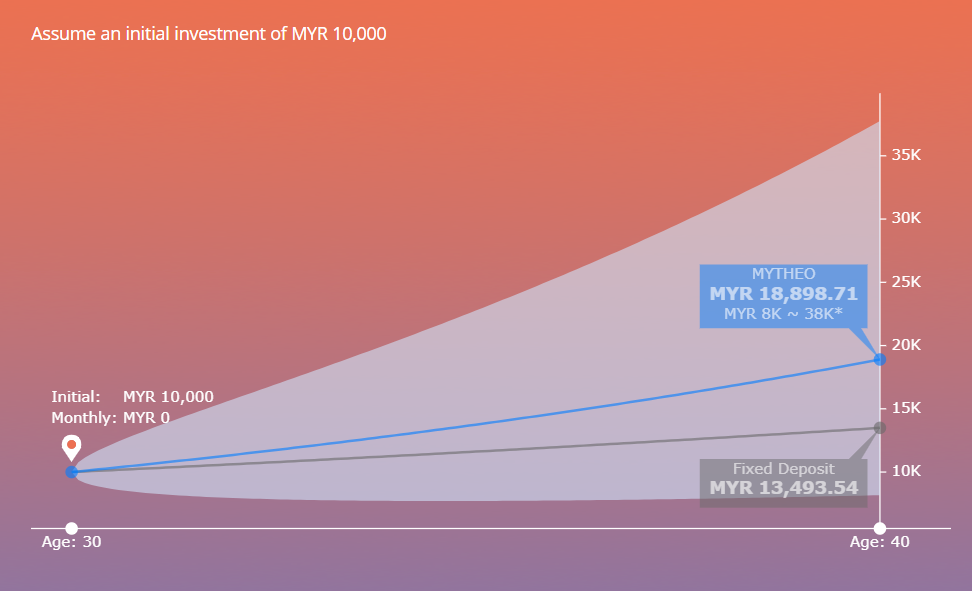

- Compared to their competitor, MYTHEO projects your profit based on age instead of year, which can be helpful in contextualising and planning for your retirement.

- Easier to view the list of ETFs I invest in versus its competitor which requires me to open a monthly statement.

What I think can be improved about MYTHEO?

- There’s no need to introduce me to the service on the login screen if I’m a registered user. It would be more intuitive to just let me log in right away.

- This could be a personal preference, but I’m not a big fan of the default colour theme, but fortunately, there is a dark mode.

- Broadly speaking, there are some minor tweaks that be done to improve the look and feel of the app.