Bank Negara Malaysia today issued the exposure draft for the licensing framework for virtual banks. The central bank will be issuing up to five licenses to qualified applicants to establish digital banks to conduct either conventional or Islamic banking business in Malaysia.

The new framework among other things seems to place emphasis on having applicants serve an underserved market and project a path to profitability. Such digital banks are expected to offer meaningful access to and promote responsible usage of suitable and affordable financial solutions to financial consumers.

As these virtual banks may adopt new and untested business models Bank Negara also requires the applicants to prepare an exit plan to ensure it is able to unwind without a significant impact on the financial system and consumers.

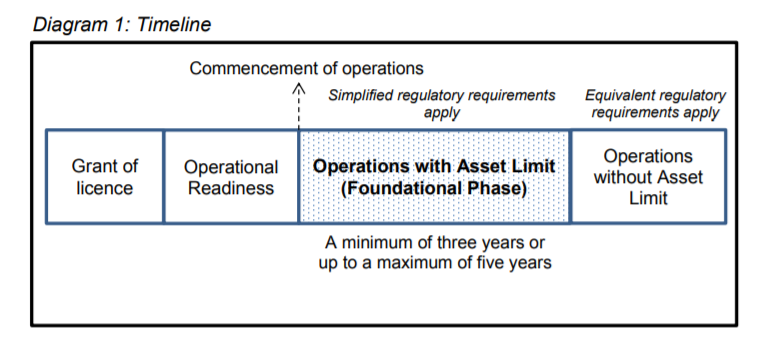

According to their media statement, they said that they have adopted a balanced approach to enable admission of innovative virtual banks while safeguarding the consumers and the financial system. In doing so they have included a three to five years foundational phase for licensees to demonstrate their viability.

During this foundational phase an asset threshold of not more than RM 2 Billion will be applied, the licensee will also be expected to maintain at all times a minimum of RM 100 million.

The Exposure Draft is issued together with the Application Procedures for New Licences under FSA and IFSA, and Application Procedures for Acquisition of Interest in Shares and to be a Financial Holding Company to provide clarity on the procedures and criteria involved in the application process to be a licensed persons under the FSA and IFSA.

The regulator aims to finalise the policy document by the first half of 2020 and application of license will be open upon the issuance of the policy document.

Bank Negara Malaysia invites written feedback on the exposure draft, all feedback should be submitted to the central bank by February 2020. Full details on the draft can be found here