Vircle Introduces Malaysia’s First Cashless Nurturing Solution For Schools

by Fintech News Malaysia June 11, 2020The much-anticipated reopening of schools has been revealed to begin in phases from 24 June onwards, with strict guidelines being reviewed by the government to help curb the spread of COVID-19.

As students resume activity at schools, they will once again have to handle bank notes and coins for their daily needs.

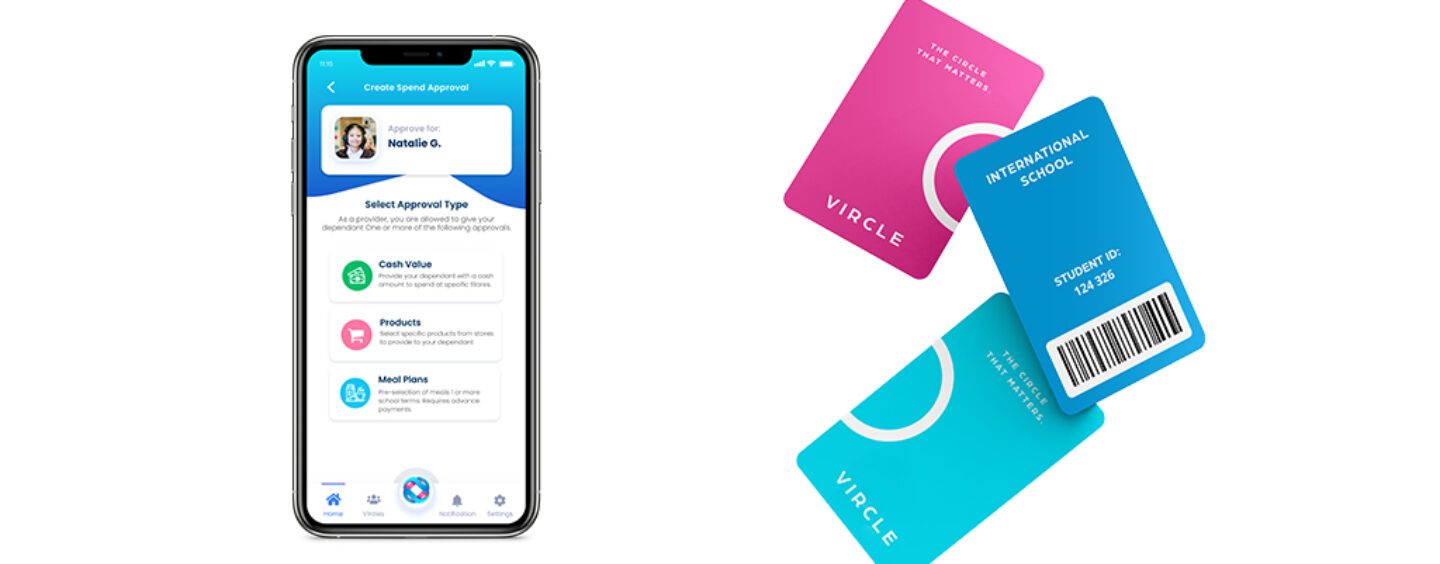

Concerned parents will have to look towards ensuring their children’s health and safety needs are met fully following schools reopening. To that end, Vircle has launched its parent-controlled cashless payment and nurturing solution, providing a convenient, contactless alternative to bank notes and coins.

With additional features allowing parents to be more involved with their children’s spending and eating habits digitally, Vircle provides a solution that delivers beyond the immediate COVID-19 needs, to being a lifelong partner to parents in the journey to nurturing smart, healthy and financially literate children.

The newly launched Vircle app enables parents to build a safe trust circle into which they can onboard their children into the cashless world. The Vircle E-wallet enables parents to provide digital spend allowances to children accompanied by usage rules, and have visibility and insights into how such allowances are being spent.

The purchase and consumption behavior of children is then converted into powerful health, nutrition insights and financial literacy actions to help parent nurture street smart children.

Gokula Krishnan

“As a parent myself, my children’s well-being is top priority for me, especially as they resume schooling. The holistic development of our children matter to us, COVID-19 will come and go but as parents we want our children to be successful, not only in the classroom but also in life in general.

This is why we are committed to providing the best parental control cashless experience that is truly financially inclusive for children, and a nurturing platform that stretches beyond the digitization of payments. While there are many solutions made available today that enable cashless transactions, Vircle is built by parents for parents, is extremely child-friendly and the first to enable both a parent and child to co-exist in a single E-wallet platform.”

said Gokula Krishnan, Founder and CEO of Vircle.

Gokula said that his startup was built upon 18 months of intense research and development involving banking, finance, child development and mental wellness experts.

Co-founders Gokula Krishnan and Paresh Khetani realized there was a much bigger opportunity around child nurturing which can be addressed through a properly designed parental control cashless platform.

Vircle’s unique platform meant they had to innovate from scratch, eventually becoming Malaysia’s first parental controlled cashless payment and nurturing solution.

To do this, Vircle had to go through a long and rigorous regulatory compliance process alongside their financial services partner Fass Payment Solutions Sdn. Bhd. (Fasspay), a subsidiary of Soft Space.

The reopening of schools will lead to canteens resuming operations where students may need to pre-order their meals and consume them in their classrooms.

Schools that partner with Vircle will allow parents to select, pre-order and monitor the meals consumed by their children at school. As COVID-19 conditions ease out, parents may gradually move from pre-order plans to giving children the freedom and control to select and purchase items in a true cashless manner.

With an estimated one in two adults found to be overweight or obese and nearly one in five contracting diabetes, Malaysian eating habits need to be improved, and fast.

Nutrition is the foundation of a healthy life and Vircle continues to innovate here, gamifying food consumption based on nutrition scores that motivate children to compete within a school or between Vircle schools by making healthier food choices.

As child allowances go digital with Vircle, so does the ability of parents to start teaching children financial literacy skills, like the ability to regularly save by setting daily, weekly, and monthly goals.

This is very much in line with the National Strategy for Financial Literacy 2019-2023 and teaches children to start spending and saving responsibly from a young age.

Bringing accessible and affordable holistic life skills to children around Malaysia is Vircle’s ultimate goal as it looks to expand its reach to more educational institutions in the coming weeks.

With over 14 leading schools committed to launch Vircle in stages across Malaysia and more coming onboard, Vircle is bullish on its’ future and is planning to release new and compelling nurturing features and capabilities regularly to keep parents, schools and children engaged.