How Securities Commission Malaysia Balances Innovation and Risk in Regulating Fintech

by Diana Ngo April 30, 2021Innovation in fintech is happening at breakneck speed and for entrepreneurs to be able to thrive and introduce these innovations, the right environment has to be set in place.

This unenviable task often lands on the desks of regulators who find themselves walking the tightrope of balancing consumer protection, market stability, as well as introducing new and wild ideas.

On the back of a very vibrant year for fintech within the digital wealth space, we speak to Chin Wei Min, Executive Director for Digital Strategy and Innovation at Securities Commission Malaysia (SC) for our 8th episode of Fintech Fireside Asia series.

Commenting on balancing the two, Wei Min said,

“We want to make sure we continue to spur innovation and encourage market activity. At the same time, we want to make sure there’s a safeguard in place for the market, the investors, and also the operators and intermediaries who provide the services, so we have an ecosystem that’s safe and sound.”

Financial scams on the rise

With COVID-19 accelerating the adoption of digital financial services, scammers and fraudsters have jumped on the opportunity to lure credulous investors.

Wei Min said the regulator has observed a notable rise in illegal activities and financial scams in the past 12 to 24 months.

“In 2020, there was a general rise in scams and illegal activities … Last year alone, we issued 134 investor alerts and worked closely with [the Malaysian Communications and Multimedia Commission] MCMC to block about 78 sites to make sure these weren’t unauthorised or engaged in illegal activities,” Wei Min said. “We have internally set up a task force to focus on unlicensed, illegal activities, … and have also an education programme for investors.”

The SC annual report for 2020 that was released in March, showcases an increase of 158% in complaints and 123% in enquiries on the legitimacy of investment schemes last year. The trend correlates with the introduction of movement restrictions amid the pandemic and the increase in internet-related activities that ensued.

This led to the SC stepping up enforcement action against operators carrying out regulated activities without authorisation.

Earlier in April, the regulator issued a statement that it will work with the Malaysian Communications and Multimedia Commission (MCMC), Google and Apple to block access to Remitano for illegally offering crypto services, they further warned users to withdraw all their funds before they lose access to the platform.

Fintech as a driver of economic growth

At the same time, fintech is also bringing new opportunities for the financial sector, notably when it comes to financial inclusion and product diversity.

When formulating new regulation, Wei Min said the SC focuses on establishing a framework that encourages fintech development in specific areas that would benefit the market the most.

He cited the case of crowdfunding where the regulator recognised early on the potential for micro, small and medium-sized enterprise (MSME) financing.

“In Malaysia, the backbone of our economy is job, employment creation and the MSMEs. When we created the P2P financing [framework], [we went] consciously [towards] that direction, instead of [encouraging] payday and individual financing,” Wei Min said. “We said let’s look at something productive and make a conscious effort.”

“We try not to step ahead of the market but rather keep up with the market; keep pace with the market development, and at the same time, look at where our market really benefits from [fintech].”

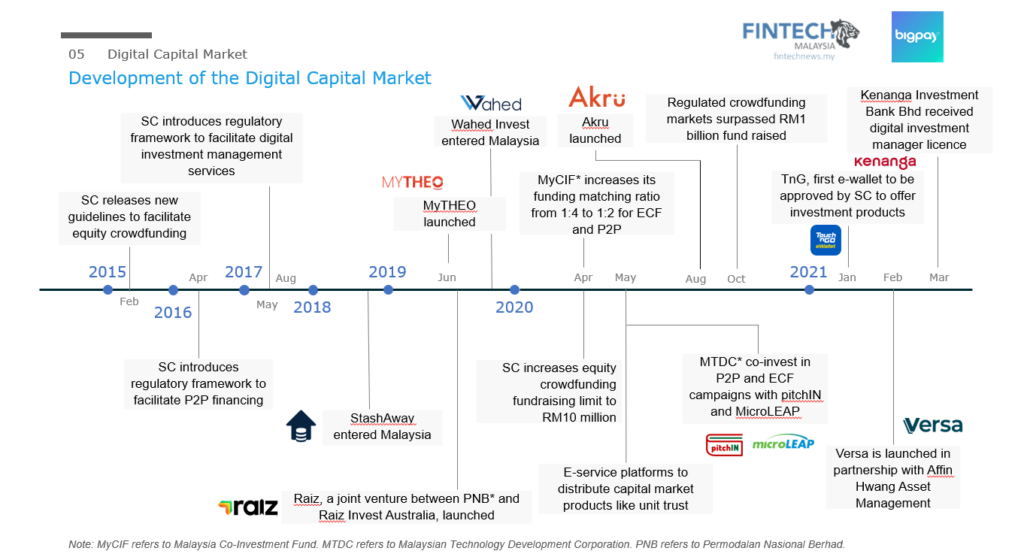

In recent times the SC has been observed to ramp up the introduction of new regulatory frameworks, starting as early as 2015 with equity crowdfunding all the way up to more recent regulations to allow for crypto exchanges and robo-advisors.

Source: Fintech Malaysia Report 2021

Many of these initiatives bore fruit in 2020, as Malaysia sees retail participation at rates that have not been seen before since the 90s.

Some of these initiatives matured last year, alternative financing options like equity crowdfunding and P2P financing have outpaced more conventional sources of financing like venture capital and private equity.

With players like StashAway, MyTheo, Wahed Invest, and Akru each introducing their robo-advisory solutions to the market, Malaysia has seen 700% new accounts opened.

On the crypto front, 2020 saw a 1000% increase in user sign-ups in regulated crypto exchanges, which is dominated by Luno who claimed that they conquered 90% of the market share in 2020.

What are SC’s priorities?

In 2021, a major focus will be put on developing Malaysia’s Islamic fintech ecosystem, Wei Min said, a push that will start with the launch of an Islamic fintech accelerator programme, which will be done in collaboration with the UN Capital Development Fund (UNCDF).

Wei Min’s announcement of this initiative seems to have gotten the market excited with several mainstream media outlets like The Star, The Edge, and Malay Mail covering the story.

“We have seen healthy growth in the overall fintech sector, and we do have [Islamic fintech] providers [covering areas such as] equity crowdfunding, P2P lending, robo-advisors … but we need to take it up a notch,” Wei Min explained.

“That’s kind of the key objective with our accelerator programme, to encourage more local and even perhaps invite international providers to come to our place to spur innovation within the whole Islamic fintech area.”

The new programme will be announced in the coming weeks, Wei Min said, and will aim to foster “true innovation … not just Islamising particular conventional products.”

“We want to see more people come forward and want to do more and hopefully we can make this ecosystem bigger and more complete.”

Discussing emerging trends observed in capital markets, Wei Min noted rising digital adoption in retail trading, and mentioned the emergence of execution-only and digital-only brokers like iFast Malaysia, which recently launched its stocks and exchange-traded funds (ETFs) brokerage services on FSMOne.com.

“Those are new activities we like to see. Not just reducing costs for investors but having additional avenues as well,” he said. “Our market is more mature now. We should cater to more needs, different demographics and behaviors.”

Wei Min also revealed during the session that they have provisionally approved Bitcoin Cash as the 5th crypto to be traded on a regulated platform, this announcement was covered by consumer tech media outlets like SoyaCincau and Lowyat.Net.

The full episode can be found via YouTube below, alternatively you can also tune in via Spotify.