Axiata and RHB today confirmed market rumours that have been floating around for months that they are in talks to jointly bid for Bank Negara Malaysia’s digital banking license.

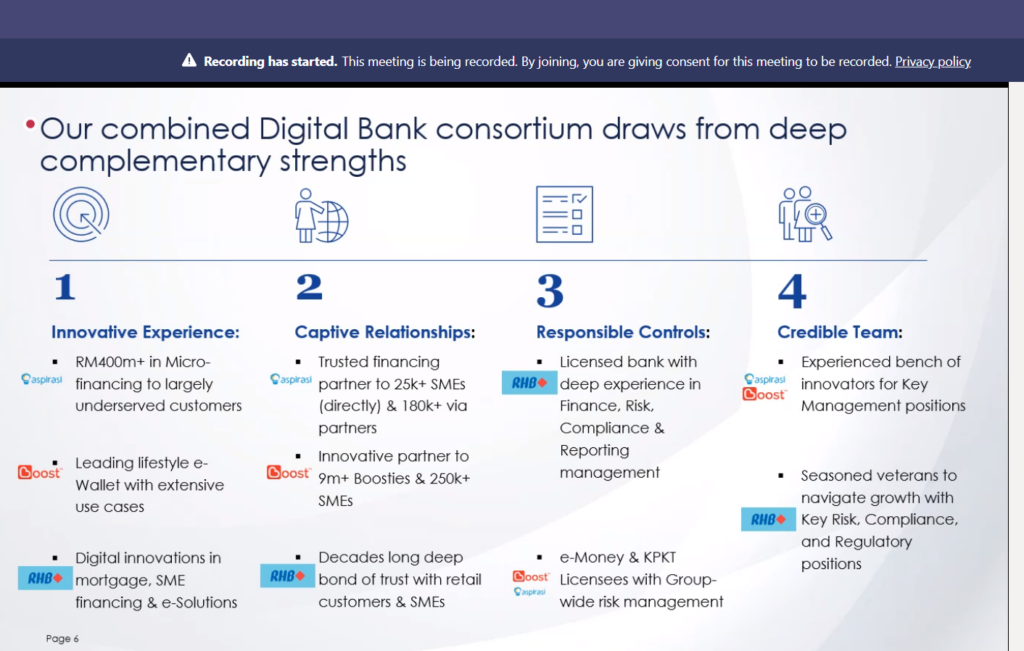

Boost Holdings, a subsidiary of Axiata Digital which houses the group’s digital financial services, will own a majority stake of 60% while RHB will own the remaining 40% in the digital bank, subject to approval from Bank Negara Malaysia.

Axiata’s telco arm has also signed up as a major commercial partner on joint go-to-market activities with the digital bank on products and services which will benefit the customers of both parties.

Both parties consider this partnership as a robust platform to drive innovation, increase competitiveness and accelerate the country’s digital transformation and financial inclusion ambition.

RHB and Axiata are also exploring more opportunities to enhance their joint customer ecosystems. They said that in recognition of the strength of their respective SME ecosystems, one potential initiative involves providing combined solutions to SMEs.

Axiata currently serves more than 250,000 merchants and micro businesses via their Boost e-Wallet and Aspirasi microfinancing businesses.

Addressing comments of why an incumbent bank with an existing license would need to separately apply for a digital banking license with Axiata, Dato’ Khairussaleh Ramli, the Group MD of RHB acknowledges that while they already have the necessary regulatory approval to be able to conduct digital services as a bank, he sees the license as an extension of their digital offering but with a differentiation.

He added that the new entity will go into the underserved segments like micro SMEs and the gig economy which he said they would not have done on their own and by tying up with Boost, they have found the right partner to enter this market with.

Echoing RHB’s Group MD, Sheyantha Abeykoon, CEO of Boost Holdings stressed that the new entity will not be just a digitised version of a conventional bank.

The CEO has not been selected yet, they as still undergoing an evaluation process for a suitable candidate.