To Become Digital Leaders, Banks Must Foster a Culture of Innovation — Here’s How

by Fintech News Malaysia June 8, 2021For banks, becoming digital leaders takes more than a stylish mobile app interface and a shift in the organisational structure; it also requires a culture that embraces experimentation and risk-taking, senior executives from banking institutions in Malaysia and fintech software provider Backbase said.

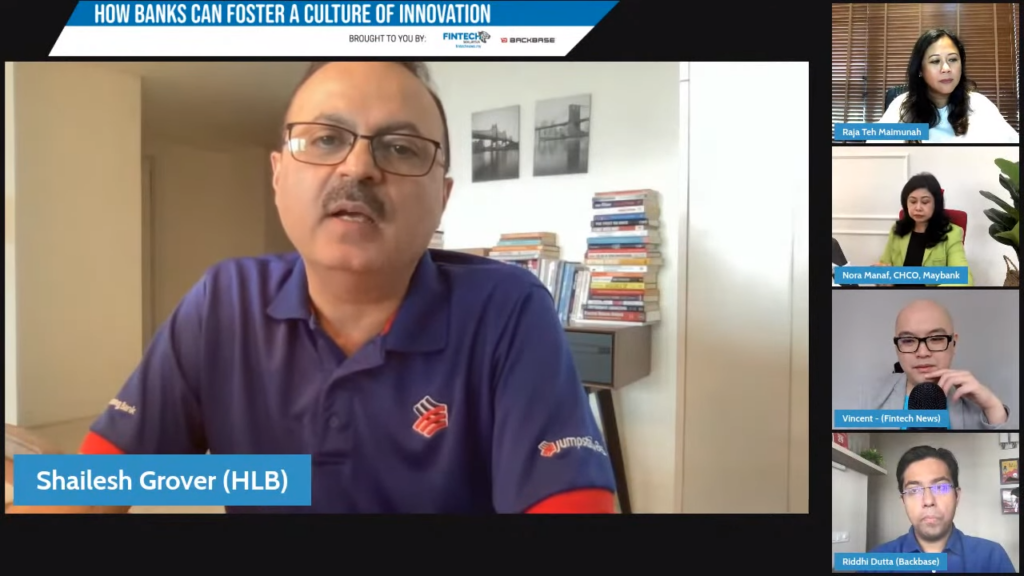

During a webinar hosted by Fintech News Malaysia, C-levels at Hong Leong Bank, AmBank Group, Maybank and Backbase delved into why it is key for financial institutions to instill a culture of innovation, the key challenges they’ve faced in their digital journeys, and shared some of the initiatives they’ve put in place to retain and attract new talent.

For Shailesh Grover, Chief Digital and Innovation Officer at Hong Leong Bank, innovation starts with changing the mindset of those in the organisation to encourage them to challenge to status quo and take calculated risks.

“The kind of talent you need now is a blend between banking experience and completely non-banking,” Shailesh said. “It’s not that banking-experience is not important, but you also need people with a different thinking, a different set of eyes, because otherwise, we keep on doing the same thing differently, and that’s not good enough.”

But attracting these kinds of talent can be a daunting task, especially for banks, which are often perceived as risk-averse and slow, he said.

Shailesh also cautioned against creating an island of innovation within the bank, stating that it’ll end up pitting the business heads against the innovation team.

“It’ll never work, you become the enemy very quickly if you don’t work with the rest of the bank. The intent is not to build dependency on the innovation team, the intent is to change and take them on a journey and ensure that a sustainable culture is created”.

He adds, “you can see examples from other banks who created these pockets of innovation, and you can see the frustration from the rest of the organisation, they hate them with a passion because they are seen as the poster child”.

To retain talent, Datuk Nora A Manaf, Group Chief Human Capital Officer at Maybank, said the bank has been focusing on providing employees with greater flexibility and more options.

Even prior to the pandemic, Maybank had a significant portion of its staff, about 20%, on a “flex work arrangement,” Manaf said, but in November 2020, the bank officially rolled out a “work from home” plan. Today, it’s got more than 3,000 people officially and permanently part of the “mobile workforce,” she said.

“We execute on diversity and inclusivity,” she said. “Whether that’s how you work, where you work, the hours you want to put in or not. And a package is negotiated based on that.”

For Raja Teh Maimunah, Managing Director of Wholesale Banking at AmBank Group, banks have the resources and capabilities to innovate, but that doesn’t mean they feel the urge to do so.

Sharing her experience as a board member, Maimunah said that perhaps the most challenging part was to convince a group of non-tech savvy, older people of the need for change.

“Most of the people who sit on the board, collectively, they are like 500 years old, which was challenging,” she said. “When the journey started for me, some of them weren’t using smartphones so you can imagine the kind of mind shift we needed to address.”

And because the drive to change needed to come from the top, a lot of the work revolved around “educating upwards”. Part of her efforts to do so internally is to bring in external speakers from the likes of Grab and Ping An to provide the board of directors more exposure to digital trends.

“You need [the board] to give you money and their blessings to make changes within the organisation. Once the ones at the top are brought in, then it flows down,” Raja Teh Maimunah said.

Similarly, Datuk Nora stressed the role of strong leadership in instilling a culture of innovation and the top-down strategy Maybank has been relying on.

“You make sure you have the right leader, the right person, so that person takes ownership to clear the path for everything that needs to be done,” Datuk Nora said. “By doing that initially in pockets, it eventually grows and catches on.”

Riddhi Dutta, Regional Head for ASEAN and South Asia at Backbase, said that while incumbents are recognising the need to innovate, many are failing to understand what this really means and still believe that a nice mobile app and sleek interface will do the trick.

“Quite often we hear banks coming to us and say ‘I want a new mobile app … [and] I want this to be as it is but in a different shape and form.’ It’s still the same, you have not really innovated,” he said.

“You [need to] look at your processes, front to back … but there are banks that are like ‘no, we know it all.’ There’s an important culture shift that needs to happen, because yes, you know a lot, but there are also others that might be doing things better than you and you can learn from them. When you tie culture and processes, that’s where you get true innovation.”

The full webinar can be found here, if you enjoyed our content do consider subscribing to our YouTube Channel