Touch ‘n Go’s Wealthtech Offering GO+ Has Over a Million Users Already

by Fintech News Malaysia June 7, 2021Touch ‘n Go Group today announced that its GO+ users have surpassed the 1 million mark in just over two months following its launch in March 2021.

Effendy Shahul Hamid, Group Chief Executive Officer at Touch ‘n Go Group said in a statement that this milestone is well ahead of our internal estimates as it had projected to hit a million users mark at the end of this year.

Touch ‘n Go added in a statement that 73% of GO+ users are from outside the Klang Valley and that number has continued to grow.

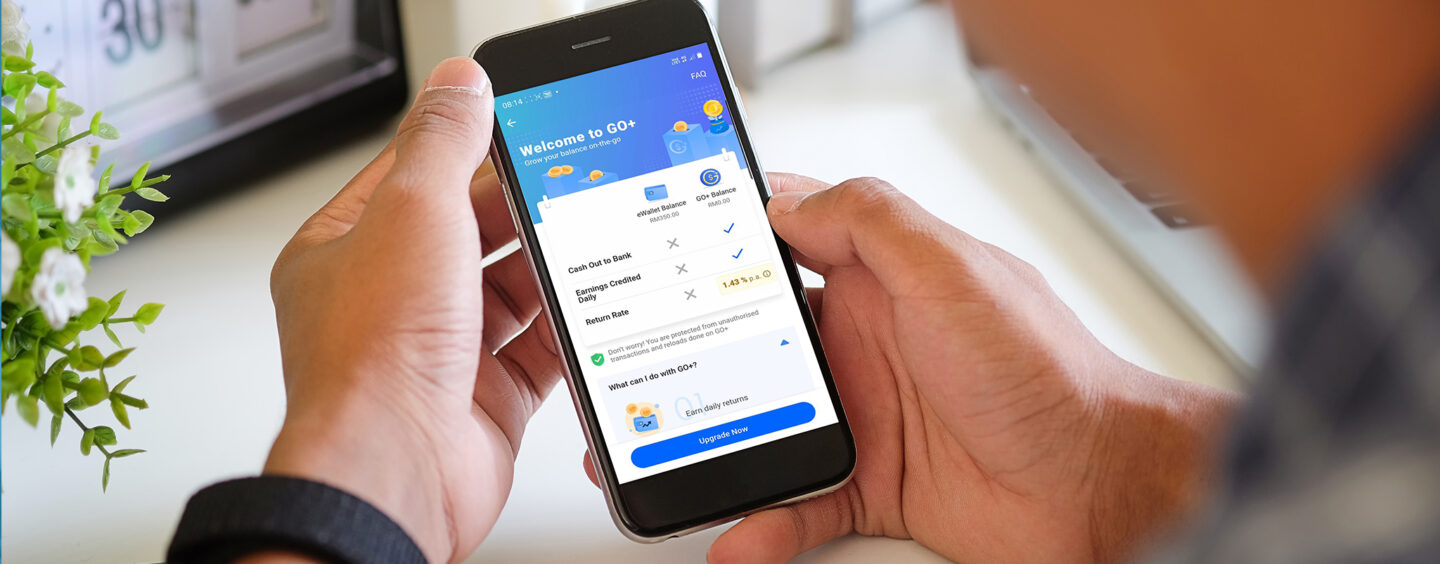

GO+ is a financially inclusive investment product that allows Touch ‘n Go eWallet users and all Malaysians to gain access to low-risk money market investments for as low as RM10.

Aside from being able to earn more than banking current accounts, GO+ balances can also be used across all Touch ‘n Go eWallet payments use-cases.

The funds in GO+ are managed by Principal Asset Management, a Malaysian fund manager.

The funds are invested predominantly into short term bank deposits with the top banks in the country such as Public Islamic Bank, CIMB Islamic, RHB Islamic Bank and Hong Leong Islamic Bank and more.

Touch ‘n Go eWallet is the first eWallet provider to obtain approval to operate as a Recognised Market Operator by the Securities Commission of Malaysia.

The approval enables the company to directly distribute capital market products, including money market unit trust funds, through the Touch ‘n Go eWallet platform, without having to be directed to a third-party application.

Effendy Shahul Hamid

“We will now build on this success and add more varied products in this category. We will also be making improvements to GO+ on the back of some very encouraging customer driven feedback and data on user experience.

Many of our users found the fungibility function between the GO+ balance and Touch ‘n Go eWallet use cases very attractive, and that drove sign-up’s. Another data point we were also encouraged by is the reach of this proposition and its agendas around inclusion,”

said Effendy Shahul Hamid, Group Chief Executive Officer, Touch ‘n Go Group.