As inclusivity shapes global finance, Islamic banking gains momentum, providing an alternative to traditional models in line with Shariah principles.

Australia, known for its multicultural and economic prowess, is set to welcome its inaugural Islamic bank, marking a significant step towards financial diversity.

In entering its pilot phase, Islamic Bank Australia plans to offer Shariah-compliant services to the Muslim community and others, filling a niche yet crucial gap in the Australian banking landscape.

This presents a business opportunity and underlines Australia’s commitment to cultural diversity and tailored financial offerings.

In an interview with Fintech News Malaysia, Dean Gillespie, CEO of Islamic Bank Australia, shared insights on this groundbreaking endeavour – a blend of Islamic banking tenets and modern digital strategies.

Understanding the Muslim demographic in Australia

According to the Australian 2021 Census, Muslims make up approximately 3.2 percent of Australia’s population, a figure that has steadily grown over recent years because of high birth rates and immigration trends.

The Muslim community in Australia is notably youthful, with a median age of 27, compared to the national median of 38 years. This demographic will likely have unique financial needs that align with their religious beliefs.

In response to these needs, Islamic banking focuses on principles such as the avoidance of interest and speculation, profit-loss sharing, ethical investments, and a commitment to transparency.

Prospective services by Islamic banks in Australia could include Islamic savings accounts, loans, investments, insurance (takaful), and remittance services.

Contrasting Islamic banking landscapes between Australia and Malaysia

Comparatively, Australia is still in the nascent stages of developing its Islamic banking framework, lacking the extensive regulatory support and industry diversity seen in countries like Malaysia.

However, the potential for growth in Australia is significant, driven by an increasing demand for ethical financial solutions, fintech advancements, and the pioneering launch of Islamic Bank Australia.

Malaysia boasts a well-established regulatory environment and a diverse Islamic finance ecosystem. Malaysia, known for its innovative Islamic finance solutions, including digital Islamic banks and robo-advisors, sets a high standard in the global arena.

Both Australia and Malaysia present unique challenges and opportunities in Islamic banking. By exchanging best practices and leveraging their respective strengths, these nations can enhance their Islamic finance sectors, creating a more conducive environment for the growth of Shariah-compliant banking.

The birth of Islamic Bank Australia

Islamic Bank Australia is the fruition of the vision and determination of thirteen pioneering Muslims who envisaged a unique banking solution for Australia that aligns with Islamic principles.

Backed by the UAE-based Abreco Group, these founders set a clear mission – to provide Australia’s Muslim population, which currently forms over three percent of the country’s total population, with banking services that align with their religious beliefs.

The bank, under the stewardship of CEO Dean and Chair Anthony Wamsteker, brings together rich experience and strategic insights from the banking sector.

The team, operating from its headquarters in Parramatta, Sydney, spans Western Australia, Victoria, and Queensland, representing a broad vision for nationwide financial services.

Strategic launch and expansion

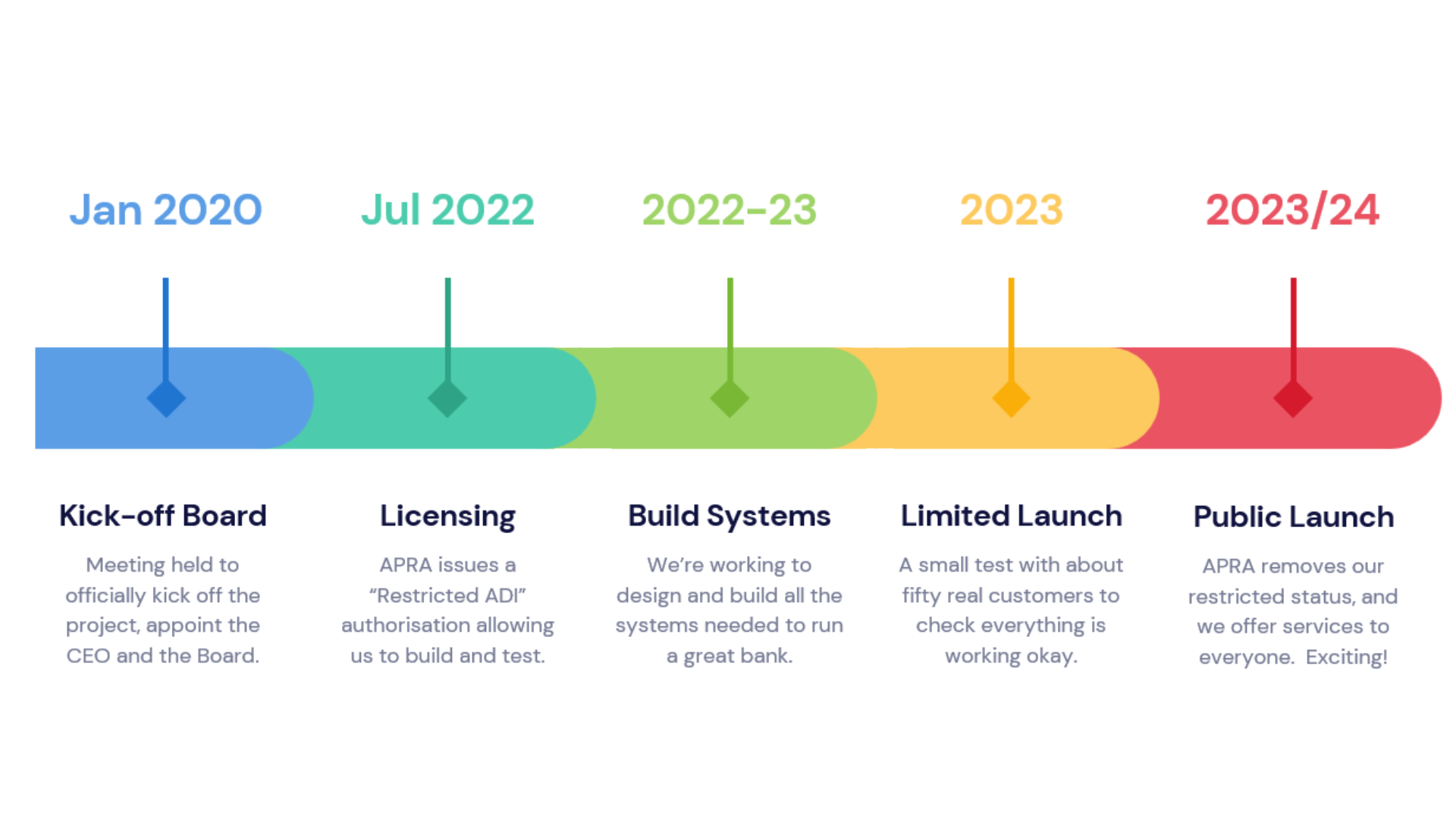

Islamic Bank Australia initiated a phased launch plan after acquiring a restricted banking license.

“The first stage, the ‘limited launch’ phase, involves testing the bank’s services with a select group of about fifty customers. This group mainly consists of staff, family, and friends,” Dean explained.

Source: Islamic Bank Australia

The successful completion of this phase will pave the way for full (Australian Prudential Regulation Authority) APRA approval to open the bank’s services to the public.

The target for this broader launch is set in the middle of 2024, a year in which the Muslim population in Australia is expected to surpass one million.

Digitally driven, Shariah-compliant services

Islamic Bank Australia has a unique opportunity to establish itself as a trailblazer in the digital banking arena. Acknowledging that customers will gauge their experiences against those provided by other banks, the institution is devoted to delivering an exceptional digital journey.

Dean Gillespie

“Given that most Muslim Australians are young and digitally engaged, 88 percent of them under 50, we recognise the critical importance of investing in cutting-edge digital technologies and interfaces,” said Dean.

Islamic Bank Australia’s restricted banking license enables the bank to test its products with a limited number of clients for up to two years. The bank will refine its systems and develop a state-of-the-art mobile banking application during this period.

By prioritising an outstanding digital experience, the bank aims to attract Muslim Australians and a wider audience seeking a technologically advanced and user-friendly banking solution.

Leveraging digital tools to foster financial inclusion

Education and literacy are core aspects of Islamic Bank Australia’s commitment to financial inclusion, particularly when understanding Islamic banking products.

Recognising the unfamiliarity of its unique products, like profit-sharing term deposits to the Australian market, Dean said that the bank is developing digital tools designed to simplify and demystify these offerings.

This will make the bank’s products and services more accessible to potential customers, irrespective of their familiarity with Islamic banking.

Image: Islamic Bank Australia

In addition to educational initiatives, the bank strongly emphasises providing streamlined digital services that cater to customers across Australia. With a focus on accessibility, the bank allows individuals to download its mobile app anywhere in the country.

“Customers can download the bank’s app, scan their passports or driver’s licenses, and instantly set up a bank account, regardless of location. This digital-first approach is consistent across all of the bank’s product offerings,” said Dean.

Upholding Islamic principles in the digital era

Maintaining compliance with Islamic principles, such as the prohibition of interest (riba) and the requirement for transactions to be backed by tangible assets, has been a guiding force in shaping Islamic Bank Australia’s digital strategy.

“The bank has designed its systems from the ground up to guarantee Shariah compliance. It has adopted Australia’s first Islamic core banking system, facilitating the digital delivery of unique Islamic banking products.” shared Dean.

Islamic Bank Australia also prioritises obtaining necessary approvals from Shariah scholars to ensure that all products and transactions meet the stringent requirements of Islamic finance.

By combining robust Shariah compliance with cutting-edge digital infrastructure, the bank provides customers with the confidence that their financial needs are being met within the bounds of their faith.

These products will be accompanied by comprehensive educational resources, ensuring transparency, fairness, and clarity in every transaction.

Building a diverse customer base

Islamic Bank Australia’s digital strategy is not exclusive to the Islamic community; it is designed to appeal to all Australians.

The bank aims to attract a broad range of customers by offering competitive, ethically-minded products while delivering exceptional customer service.

The ethical principles integral to Islamic banking, including the prohibition on dealing with haram (forbidden) industries, extend to excluding businesses with major polluters or live animal exporters.

“We believe this ethical stance will resonate with Australians who appreciate responsible banking, regardless of their religious affiliations,” said Dean.

Ensuring accessibility and inclusivity in a digital era

While Islamic Bank Australia is committed to a digital-first strategy, it also recognises the importance of personal interactions.

The bank is conscious that certain segments of its customer base may not be technologically proficient or prefer more traditional interaction with their bank.

“To cater to these customers, Islamic Bank Australia will offer alternative options for engagement, such as phone calls or video conferencing,” said Dean.

By offering a range of interaction options, the bank aims to provide an inclusive banking experience that caters to all customers’ needs and preferences.

Ushering in a new era in Australian banking

The launch of Islamic Bank Australia heralds a new era in the Australian banking sector. The significance of this development goes beyond just the establishment of a new bank; it represents the birth of an institution that combines the ethical foundations of Islamic banking with a state-of-the-art digital approach designed to cater to the needs of Australia’s diverse population.

As CEO Dean Gillespie aptly said,

“Starting a bank from scratch offers unique opportunities. It allows the seamless integration of the best digital experiences, infrastructure, and banking systems to create the ideal banking service.”

This flexibility and customer-centric approach, coupled with the ethical guidelines central to Islamic banking, uniquely position Islamic Bank Australia within the financial landscape.

The road ahead for Islamic banking in Australia is paved with promise and potential.

This article is a part of the Digital Islamic Banker series, produced by Fintech News Malaysia in collaboration with Backbase. Find how digital banking is taking off for Standard Chartered Saadiq in Malaysia.