In 2024, Malaysia is set to see significant growth in its fintech industry. This is primarily due to increased digital adoption in the country, supported by government regulations, substantial funding, and a growing talent pool. These factors are vital contributors to the emerging fintech trends in Malaysia.

The fintech landscape in Malaysia is evolving dynamically, marked by the innovation of local startups and global players introducing new business models, products, and services.

Various segments within fintech, such as digital banking, Islamic fintech, insurtech, wealthtech, and payments, are experiencing rapid development.

The adoption of fintech solutions among Malaysian consumers and businesses is also rising. Additionally, the pandemic has played a role in accelerating the digitisation of financial services.

Given this backdrop, a crucial question emerges: What key fintech trends will shape Malaysia in 2024?

The evolving digital banking landscape

The year 2022 marked a pivotal moment in Malaysia’s financial history by issuing five digital banking licenses. This regulatory move opened the door for innovative digital-only banks, intensifying competition in the banking sector.

Boost Bank, AEON Bank, and GXBank are among the pioneers that have entered the market, offering digital-centric banking services. GXBank, in particular, has gained substantial traction, amassing over 100,000 customers since its launch.

In 2024, the digital banking landscape will expand further with the launch of two remaining digital banks:

- A consortium led by Sea Limited and YTL Digital Capital Sdn Bhd.

- A consortium led by KAF Investment Bank Sdn. Bhd.

These digital banks will advance financial inclusion and provide users with more convenient and personalised banking services, further intensifying market competition.

The launch of these banks is anticipated to shape the fintech trends in Malaysia for the years to come.

Development of eKYC and digital identity

Traditional identity verification methods, often involving managing multiple usernames and passwords, are becoming increasingly outdated.

Malaysia has been actively developing digital identity solutions like MyDigital ID and PADU to address this issue.

These solutions leverage advanced biometric features like facial recognition, fingerprints, iris scanning, and demographic data to streamline the authentication process.

MyDigital ID is not designed to replace the National Registration Identity Card (NRIC) but to complement it. This approach simplifies the verification process, enhancing the security, convenience, and accessibility of financial services.

PADU is a central database system consolidating data from various government agencies.

As Prime Minister Anwar Ibrahim highlighted in May 2023, the government recognised the need for improved data management, as the existing data was fragmented and incomplete.

Managed by the Department of Statistics and several other agencies, PADU aims to address this issue by centralising data and providing holistic information.

This will enable the government to implement targeted subsidies and social protection more effectively, leveraging accurate and comprehensive data.

Embracing digital innovation in insurance through DITO

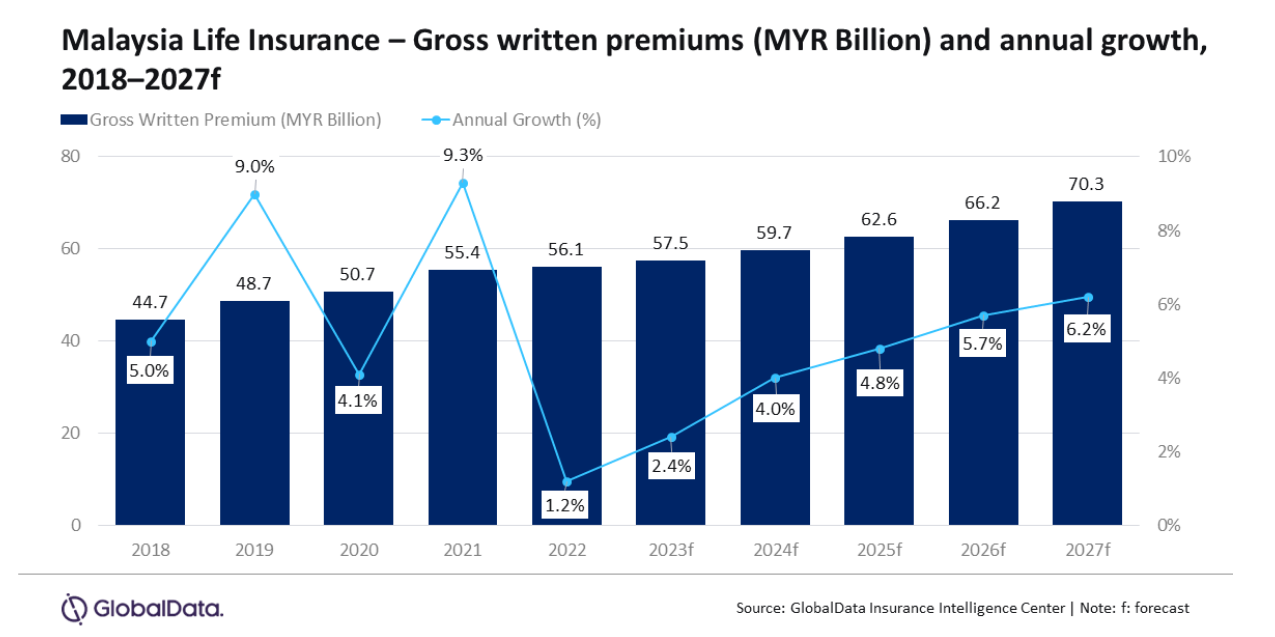

The Malaysian life insurance industry is growing, with a projected compound annual growth rate (CAGR) of 5.2 percent from RM57.5 billion in 2023 to RM70.3 billion in 2027 in gross written premiums (GWP).

The rise of insurtech has played a significant role in this expansion. The online distribution channels for insurance sales have witnessed remarkable growth, boasting a 32.6 percent year-on-year increase.

One significant development in 2024 is the Digital Insurance and Takaful Operator (DITO) licenses.

These licenses represent a pivotal opportunity for Malaysia to address underinsurance, which affects 30 million Malaysians and over 85 percent of small and medium-sized businesses.

Bank Negara Malaysia (BNM) plans to issue up to five DITO licenses to players who serve the underserved and unserved markets. The issuance of these licenses is expected to stimulate innovation and expansion across the insurance value chain.

The DITO framework will revolutionise Malaysia’s insurance and takaful sector. It’s designed to foster competition, enhance financial inclusion for vulnerable groups, and drive innovation and digitalisation.

Similarly, the licensing framework for digital banks by BNM is reshaping the banking and fintech landscape. It outlines licensing and regulatory requirements for digital banks, aiming to spur competition, improve financial access for underserved segments like the bottom 40 percent of income earners, micro and small businesses, and gig workers, and promote digital innovation.

DITO and digibank frameworks signify a significant shift towards digitalisation in Malaysia’s financial services, creating new opportunities, enhancing customer experiences through accessible and personalised services, and encouraging a more inclusive financial environment.

Startups, especially those operating within the BNM sandbox program, will be incentivised to pursue full licenses, injecting creativity and innovation into a previously conservative market.

The insurtech sector will experience an increase in funding, mirroring trends observed in other areas of fintech. This surge is exemplified by companies like BigPay and Boost, which have successfully attracted significant investment due to their innovative approaches.

For obtaining DITO licenses in Malaysia, applicants are required to maintain a minimum capital of RM40 million during the initial operational phase, typically lasting two to three years.

After this phase, these entities must adhere to the regulatory requirements applicable to traditional licensed insurers and takaful operators, which includes a minimum paid-up capital of RM100 million for each license.

Consequently, there are specific capital requirements for obtaining these licenses. Startups aiming to acquire DITO licenses must secure adequate funding. The growing investor interest in these startups likely stems from their optimism about the potential and opportunities in Malaysia’s insurance sector.

It’s also worth noting that the current Director of Financial Development and Innovation at Bank Negara Malaysia, Lau Chin Ching, hails from an insurance background, which adds a valuable perspective to the insurtech landscape.

Fueling fintech innovation and startup growth

Venture capital plays a pivotal role in fostering innovation and supporting the growth of startups in the fintech ecosystem.

In Malaysia, 2024 promises to be a vibrant year for venture capital, driven by initiatives like Penjana and the National Economic Recovery Plan. Penjana, a Malaysian government initiative, is set to boost innovation and digitalisation, particularly in venture capital.

The government has allocated RM1.2 billion to this sector, with a matching amount from the private sector. Penjana Kapital, a government entity, manages these funds, targeting key areas like fintech, agritech, edutech, and healthtech.

One significant development is the consolidation of the government’s venture capital agencies, including Penjana Kapital and Malaysia Venture Capital Management (Mavcap), under the supervision of Khazanah Nasional, Malaysia’s sovereign wealth fund.

This consolidation aims to streamline venture capital activities and leverage Khazanah’s expertise and network in the venture capital space.

Khazanah Nasional has recently invested strategically in the SME digital financing platform Funding Societies. Though the investment amount remains undisclosed, it will significantly enhance Funding Societies’ reach in Malaysia.

The company aims to serve over 25,000 MSMEs by 2025, extending beyond its current presence in Kuala Lumpur, Selangor, Penang, and Johor. This expansion includes growing its Islamic financing offerings, which have already seen over RM100 million in Shariah-compliant financing since May 2023.

Khazanah also led an RM67 million Series B funding round for PolicyStreet, focusing on serving the underinsured market.

The 2024 Budget, announced in October 2023, provides additional incentives and support for the venture capital industry. These include extending the tax exemption for venture capital fund managers until 2027, increasing the tax deduction for angel investors from RM500,000 to RM1 million, and allocating RM50 million for the Cradle Fund.

This government agency provides early-stage funding and coaching for startups. This influx of capital and support for the venture capital industry is expected to drive the growth and innovation of local startups.

Additionally, it will help attract foreign investors and talent to Malaysia, positioning the country as a hub for fintech innovation.

Islamic fintech gains traction

In 2024, Islamic fintech is emerging as a promising sector within Malaysia’s financial landscape. This sector caters to the growing demand for ethical and inclusive financial solutions, appealing to Muslim and non-Muslim customers.

With Islamic finance assets projected to grow to US$4.9 trillion (approximately RM22.0 trillion) by 2025, Malaysia is poised to play a pivotal role in this expanding market, holding an estimated 24 percent share.

Islamic fintech is growing rapidly due to several factors. First, there’s a high demand among young, tech-savvy consumers for ethical and transparent Islamic financing products and services.

Second, Malaysia’s supportive regulatory environment, including licenses and incentives, fosters this sector’s growth.

Finally, Islamic fintech provides a competitive advantage by enabling conventional firms to tap into a broader Islamic finance market, offering specialised and value-added services to a diverse customer base.

Several factors shaping the growth of Islamic fintech:

- New Islamic Digital Banks: In January 2024, an Islamic digital bank, AEON Bank, commenced operations in Malaysia. The bank is pioneering Shariah-compliant products and services to underserved population segments, marking a significant step in Islamic fintech.

- Islamic Robo-Advisors: Malaysia hosts licensed Islamic robo-advisors, including MyTHEO and Raiz. These platforms cater to the growing interest in ethical and Shariah-compliant investment options.

- Islamic Finance Platforms: Some platforms that offer Islamic social finance in Malaysia are GlobalSadaqah and Ethis.

Conventional fintech players in Malaysia have also introduced Islamic offerings, including Shariah-compliant peer-to-peer financing, crowdfunding, and supply chain finance.

Some examples of conventional fintech players that have introduced Islamic offerings include Capbay, Funding Societies, and pitchIN.

Anticipating robust growth and innovation in 2024

As the year unfolds, the nation’s financial technology ecosystem is set to evolve further, promising even more exciting developments. Amid this backdrop, these 5 fintech trends in Malaysia are expected to play a pivotal role in shaping the industry’s future landscape.

Malaysia’s fintech industry will continue its strong growth trajectory in 2024, aided by progressive regulations, funding, increasing digitalisation and promising segments like Islamic fintech.

With a blend of regulatory support, entrepreneurial spirit, and a dynamic market, Malaysia’s fintech industry is poised for a promising future, bringing transformative financial solutions to its people and the broader Southeast Asian region.