Digital Banks Could Be the Key to Promoting Financial Inclusion for Malaysia’s B40

by Rebecca Oi February 21, 2023Financial inclusion is a vital aspect of economic growth, and it is critical to ensure that all individuals have access to financial services. Unfortunately, in Malaysia, many people from the B40 group (the bottom 40 percent of income earners) still face financial exclusion.

Industry findings estimate 55 percent of the country’s adult population is under-banked, and just 39 percent of Malaysians can get a loan from their banks.

The lack of access to financial services severely affects the B40 group, as they are more likely to rely on informal and unregulated financial services, which often come with high-interest rates and hidden fees.

Many B40s have turned to MSMEs (Micro, Small, and Medium Enterprises) to survive, either by starting their businesses or working for small businesses.

However, starting an MSME is not without challenges. Many B40s lack the skills and resources to launch and manage a business successfully. In addition, access to financing is often limited, making it difficult for them to invest in their businesses and expand their operations.

In addition, Malaysia’s digital financial literacy among the lower-income groups is lower than the national average. Many individuals in this group lack the knowledge and skills to use digital financial services such as e-wallets, online banking, and other digital payment methods.

The Malaysian government seeks to enhance financial inclusion

The government of Malaysia has recognised the importance of financial inclusion and has implemented several initiatives to promote it. In 2019, the country introduced its National Strategy for Financial Literacy. This five-year comprehensive plan seeks to enhance the low levels of financial literacy prevalent in the country.

The strategy was collaboratively developed by Bank Negara Malaysia (BNM) and five other financial institutions, such as the Securities Commission Malaysia (SC) and the Ministry of Education.

BNM has identified financial inclusion as a primary goal and aims to create an inclusive financial system that provides convenient accessibility, high take-up rates, responsible usage, and increased customer satisfaction.

In recent years, the bank has undertaken the Financial Capability and Inclusion Demand Side Survey 2021-2022 (FCI 2021-2022) and the SME Financing Survey 2021 to obtain valuable insights into the current financial capability and inclusion in Malaysia.

According to the FCI Survey 2021-2022, about 74 percent of Malaysians utilise digital financial services. Furthermore, the Global Findex 2021 Report from the World Bank showed that 79 percent of Malaysian adults use digital payments.

Among them, 42 percent started using it for the first time during the pandemic. The increased use of digital payments has also resulted in a rise in the utilisation of other financial services, including savings and lending.

Financial Inclusion Framework 2023 to 2026

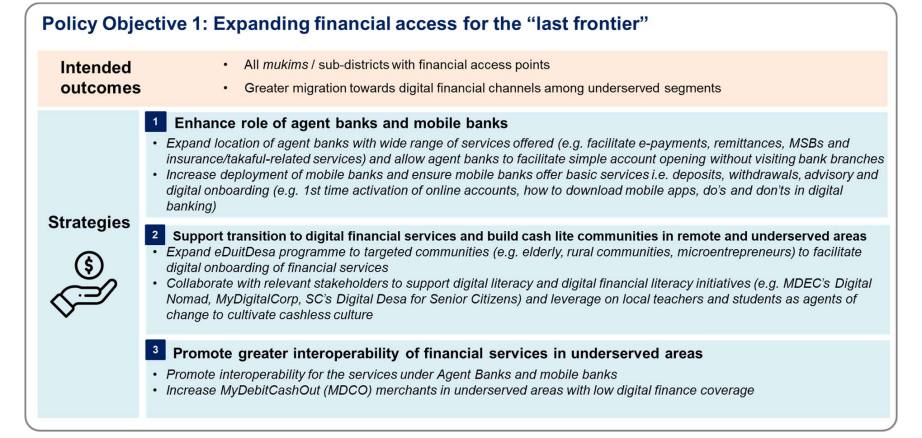

In February 2023, BNM issued a discussion paper on the Financial Inclusion Framework from 2023 to 2026. One of the aims of the framework is to address the financial barriers faced by the unbanked population, particularly those in remote and underserved areas, and to ensure that financial services are accessible and available to all segments of society.

Malaysia has made significant progress in expanding access to financial services, with 96 percent of mukims (sub-districts) in the country having access to financial access points. However, despite these efforts, there are still significant challenges in reaching the “last frontier” unbanked population, particularly those in remote and underserved areas.

The Financial Inclusion Framework aims to make financial services accessible and available to all segments of society, including those currently unserved and underserved. To achieve this goal, the framework proposes initiatives to increase the number and reach of financial access points, such as mobile banking services and the expansion of agent banking services.

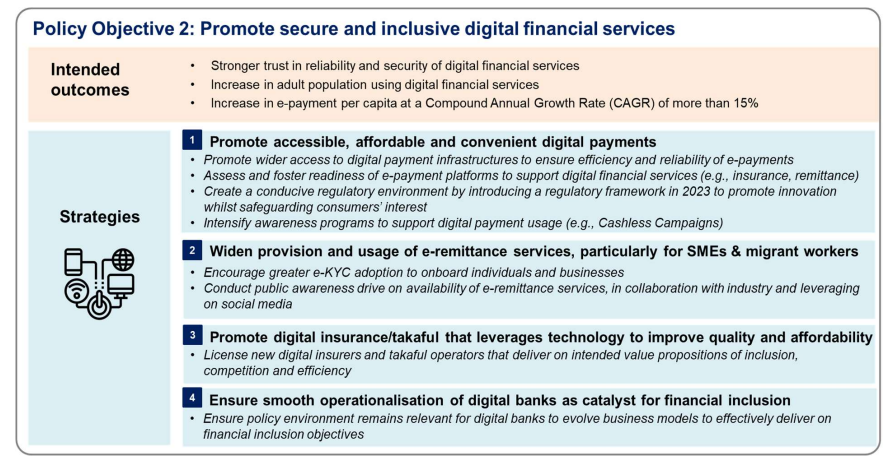

The framework includes policies aimed at strengthening the role and capabilities of financial institutions in promoting financial inclusion. This also includes enhancing the Small and Medium Enterprise (SME) financial ecosystem, equipping consumers with improved financial capabilities and promoting secure and inclusive digital financial services.

Promoting financial inclusion in Malaysia through digital banks

Digital banking has the potential to improve financial inclusion in Malaysia significantly. With the widespread use of smartphones and internet connectivity, digital banking can offer convenient and accessible financial services to underserved and unbanked populations.

By providing essential banking services such as savings, payments, and remittances, digital banks can help individuals and small businesses access financial services that were previously unavailable to them.

Moreover, digital banking can offer lower transaction costs and faster and more secure transactions, further increasing financial inclusion in Malaysia.

During an interview with Fintech News Malaysia, leading executives from Axiata Digital, RHB Bank, Standard Chartered, and Temenos, a banking software provider, expressed their expectation for a significant transformation in the banking industry, driven by innovative business models and the widespread adoption of advanced technologies.

Bank Negara Malaysia issued digital banking licenses

Recognising the potential of technology in achieving financial inclusion and enhancing customer experience, BNM has incorporated technology-based innovative channels, products, and services, such as digital banking, as part of its strategies.

In line with this, BNM has issued digital banking licenses to five qualified applicants in Malaysia, a significant development in the country’s financial industry.

The conventional license winners were Boost Holdings, RHB Bank Berhad, and Kuok Brothers Sdn. Bhd collaborates with GXS Bank Pte. Ltd., a joint venture between Grab and Singtel. In addition, Sea Limited, a fast-growing Southeast Asian tech company, partnered with YTL Berhad of Malaysia and secured a selected bid.

On the other hand, the Islamic licenses were awarded to a consortium consisting of notable Malaysian startups such as Carsome and MoneyMatch, which KAF Investment Bank leads. Another recipient was the financial services division of AEON, which teamed up with US-based neobank MoneyLion.

This move is expected to promote financial inclusion, drive innovation, and provide better digital banking services to customers, ultimately benefiting the economy in the long term.

Assisting the B40 to reach financial freedom

Mohd Rashid Mohamad, Group Managing Director / Group Chief Executive Officer of RHB Banking Group delivering his speech at the inaugural RHB #JomBiz Award Ceremony.

RHB Bank Berhad held a Grant Award Ceremony to celebrate the success of RHB #JomBiz, an initiative aimed at providing education and assistance to local micro and small entrepreneurs in Malaysia.

The project is designed to support and foster the growth of local micro-entrepreneurs from the grassroots community amidst challenging economic conditions. During the ceremony, RHB awarded seed funding of up to RM30,000 to more than 40 participants to help them kick-start their businesses.

In addition to providing financial assistance, RHB Bank Berhad plans to enhance the digital capabilities of the micro-entrepreneurs, making them ideal candidates for the bank’s upcoming digital bank.

This upskilling initiative aims to equip entrepreneurs with digital tools and knowledge to help them better navigate the digital landscape and stay competitive in the ever-evolving business environment.

“The programme aims to improve participants’ understanding of digitalizing their businesses, which involves offering technical and practical guidance to support them in expanding and managing their enterprise using digital banking products and services,” said the Group Managing Director and Group Chief Executive Officer of RHB Banking Group Mohd Rashid Mohamad.

RHB intends to broaden its customer base by serving the “unserved and underserved community” with financing and an array of banking solutions via its digital bank.

‘The digital bank launch will be no later than Q1 2024. As we are developing the digital bank from the ground up, it will take a while to complete. We need to establish a new core banking system, infrastructure, and product offerings that align with Bank Negara’s regulations,” said Mohd Rashid.

RHB Bank also aspires for micro-entrepreneurs to grow into small and medium-sized enterprises (SMEs) in which they can leverage RHB’s SME e-Solutions.

Jeffrey Ng the Managing Director of Group Community Banking of RHB Banking Group, said the bank’s enhanced SME e-Solutions provide customers with value-added features – all on a single platform which includes point-of-sale, payroll and accounting, and cash management solutions.

To date, more than 6,000 SME customers are on RHB’s e-Solutions platform.