The blossoming fintech sector in Malaysia has taken centre stage in recent years, demonstrating impressive growth driven by innovative technology, regulatory support and changing consumer behaviour. The alternative funding environment in Malaysia, however, differs significantly from the rest of Southeast Asia.

In the last two years, a profound shift has been occurring in the financial landscape of Malaysia, overturning the established order of venture capital (VC) funding. Peer-to-peer (P2P) and equity crowdfunding (ECF) platforms have emerged as the surprising forerunners, outstripping traditional VC funding in their ability to provide capital for not only fintech companies, but burgeoning enterprises overall.

This unexpected upturn has underscored the potential of the Malaysian market to embrace novel financial avenues, capitalising on technology, flexibility, and the spirit of collective investment, adding surprising context to the country’s investment ecosystem which varies from the rest of its neighbours.

Traditional venture capital and fintech funding in Malaysia

For the uninitiated, venture capital is a form of financing that provides capital to startups with high growth potential in exchange for equity. VC firms typically invest at any stage of a business, from seed to late stage. Some of the VC funds in Malaysia for early-stage startups are Cradle Fund, NEXEA Venture Capital, BizAngel, TinkBig Venture, and 500 Startups.

Venture capital has historically been a significant driver of fintech growth in Southeast Asia. However, the concentration of VC funding varies across the region. While venture capital investments have grown consistently over the past decade for the rest of the ASEAN-6 economies (comprising Singapore, Indonesia, Malaysia, Thailand, Vietnam and the Philippines), with Singapore and now Indonesia staking the lion’s share, in Malaysia VC funding in fintech and overall has actually fallen behind to P2P and ECF financing.

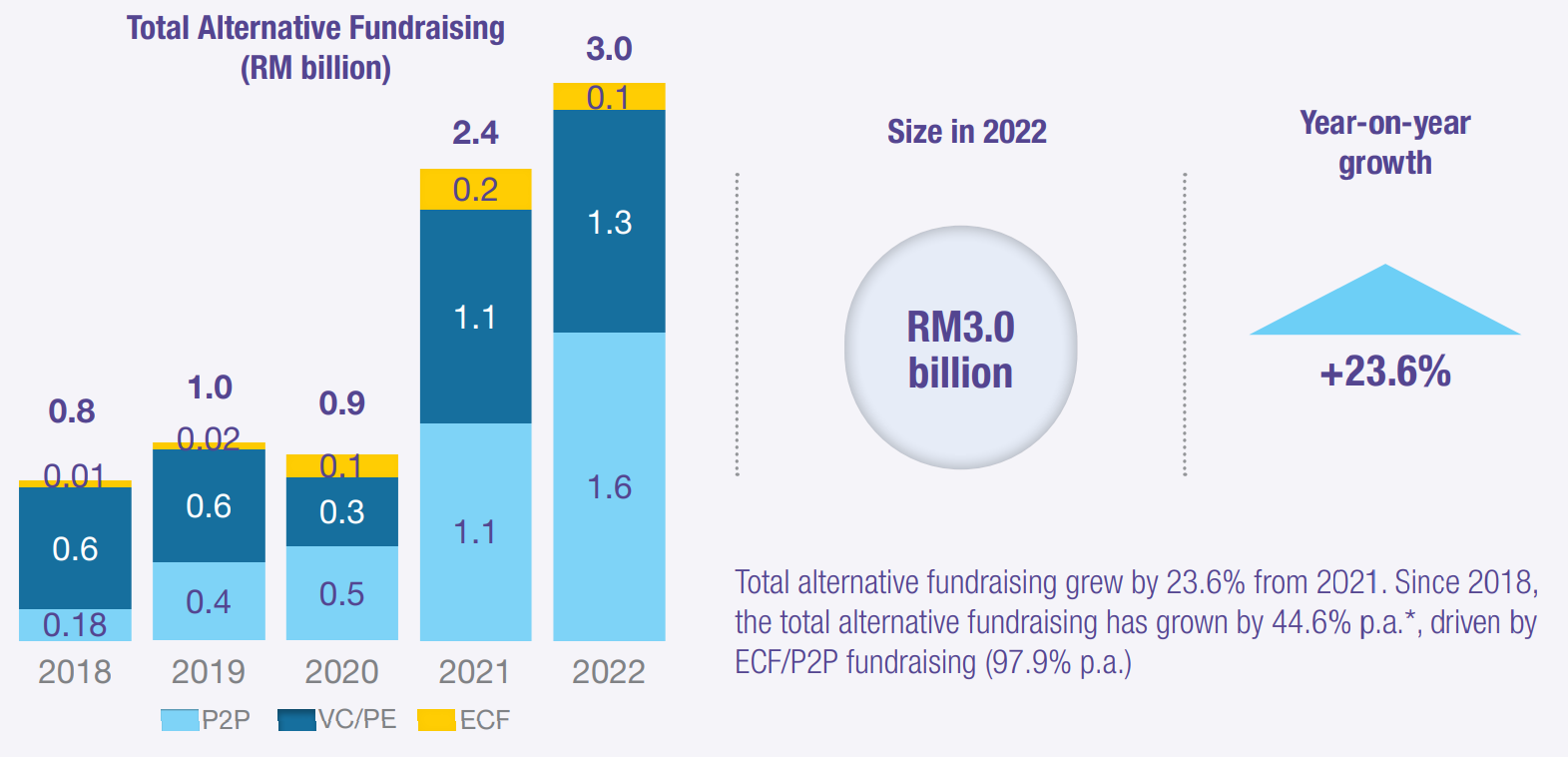

Source: Securities Commission Malaysia

Overall, the Securities Commission’s Annual Report 2022 indicates VC funding rose to RM1.3 billion in 2022 from RM1.1 billion the previous year. In comparison, micro, small and medium enterprises (MSMEs) that raised capital via alternative equity crowdfunding and peer-to-peer financing platforms saw an increase of 26% from RM1.4 billion in 2021 to RM1.7 billion in 2022.

Since being introduced in 2018, ECF and P2P platforms have helped 7,218 MSMEs raise over RM4.4 billion in total, and have eclipsed traditional VC-backed funding in Malaysia in recent years. This is in stark contrast with the other emerging economies of Southeast Asia, where traditional VC-backed capital raising tends to dominate alternative fundraising.

Alternative financing: Equity crowdfunding and P2P platforms

While venture capital remains a substantial source of funding in Malaysia, alternative financing methods like ECF and P2P fundraising platforms, are rapidly gaining ground.

Equity crowdfunding is a method of raising funds from a large pool of investors via an online platform authorised by the Securities Commission (SC) in Malaysia. ECF is suitable for startups that want to maintain control of their company and have more equitable access to capital. Some of the ECF platforms in Malaysia are PitchIN, Alta, and MyStartr.

Meanwhile, peer-to-peer (P2P) financing permits startups to obtain money from investors without going through a bank. P2P financing is suitable for startups that need quick and flexible funding without giving up equity. The process is faster and more streamlined on an online platform, which is also regulated by the SC, with the investors earning interest from the loans they provide. Some of the P2P platforms in Malaysia are Funding Societies, Islamic P2P platform Ethis, and MicroLEAP.

As per the SC of Malaysia, ECF and P2P platforms raised over US$1.6 billion in funding in 2022, representing a 26% year-on-year increase. These figures indicate a shift in financing trends in Malaysia, wherein the growing preference for alternative funding sources challenges traditional venture capital.

ECF and P2P platforms offer promising benefits, such as streamlined processes and the democratisation of investment opportunities. This inclusivity provides smaller fintech startups and MSMEs with better access to financing options previously only available to larger enterprises.

Contrasting Malaysia’s fintech fundraising environment with Southeast Asia’s

Comparatively, the broader Southeast Asian region has yet to fully embrace alternative financing. For instance, in Thailand and Vietnam, regulatory frameworks for ECF and P2P platforms are still in the nascent stages. Hence, these countries have not experienced the same surge in ECF and P2P funding as Malaysia.

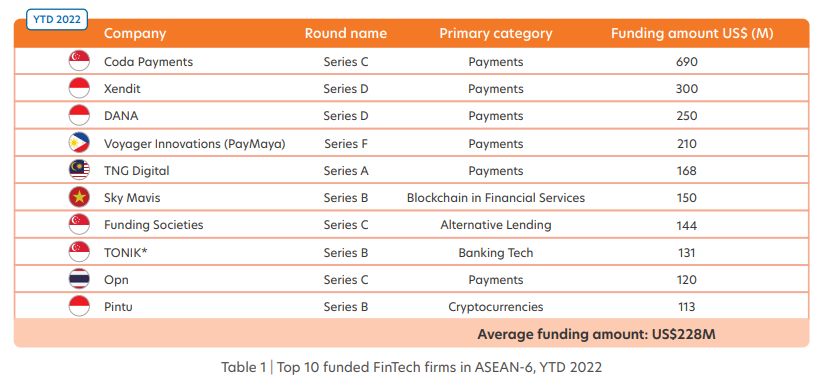

Meanwhile, in mature fintech markets like Singapore, venture capital remains the dominant form of financing, despite regulatory efforts to promote alternative financing platforms. According to the FinTech in ASEAN 2022: Finance, Reimagined report by UOB and pWc Singapore, fintech funding resurged in Southeast Asia driven by Singapore and Indonesia, which accounted for more than three-quarters of the total funding in the region.

Source: UOB, PwC Singapore and Singapore Fintech Association

More than half (55%) of the 163 funding deals that took place in 2o22 went to Singapore-based fintech firms. In contrast, Malaysia accounted for a mere 5% of VC-driven fintech funding in the UOB report, on par with emerging economy Vietnam in funding share and lower than every other nation, including the Philippines.

Even more revealingly, only one funding round constituted a mega-round for a Malaysian fintech, which was a US$168 million Series B round for payments firm TNG Digital. With the total 2022 funding in Malaysia equating to US$215 million, the single TNG funding round of US$168 million attributed for the vast majority of it.

Source: UOB, PwC Singapore and Singapore Fintech Association

In fact, only two Malaysian fintechs have ever raised in excess of US$100 million from VCs. TNG Digital and BigPay have raised a total of US$243 million and US$155 million in funding, respectively. A distant third is payments firm Boost, which has so far amassed total funding amounting to US$70 million.

The next biggest VC-led investment recipient in Malaysia is supply chain finance platform CapBay, which ironically is a P2P financing platform itself. The present outlook raises questions on the health of the venture capital investing environment in Malaysia, if they favour fintechs, or if alternative fundraising mechanisms like ECF and P2P platforms are the way to go for startups in the country to raise capital, unlike other fast-growing economies in Southeast Asia.

That trend looks set to continue in 2023 and likely beyond, as per the SE Deal Review: Q1 2023, with both equity funding amounts and volume of deals plummeting for startups headquartered in Malaysia, far below Singapore and behind every other major economy in the region including Thailand, Vietnam, and the Philippines.

Source: Deal Street Asia DataVANTAGE

The evolving fintech funding landscape in Malaysia

So while venture capital continues to be a substantial source of fintech funding across Southeast Asia, alternative financing platforms are challenging the status quo in Malaysia, driven by a combination of regulatory support and innovative technologies.

As the fintech ecosystem in Malaysia matures, the role of ECF and P2P platforms is likely to increase, providing a balanced, competitive and vibrant funding landscape. This trend reflects the unique evolution of Malaysia’s fintech sector and its divergence from the broader Southeast Asian market.

The stage is set for Malaysia to serve as an example to other Southeast Asian countries for how to successfully implement and regulate alternative financing platforms, fostering a more inclusive and robust fintech landscape.