How the Financial Sector Can Capitalise on Consumer Security to Build Value

by Johanan Devanesan July 25, 2023In the modern era, the average consumer spends around eight hours per day online, equating to a third of their lives. This ranges from work and shopping to socialising or merely relaxing, highlighting the ever-increasing relevance of online cyber security.

Today’s consumer now requires cyber security solutions that not only protect their devices, but also safeguard their ‘digital moments’. “The term ‘digital moments’ describes any activity that takes place in the consumer’s digital day-to-day such as online shopping, online dating, online banking, sending and receiving emails, paying bills and much more,” detailed a recent whitepaper from embedded security specialists F-Secure.

All-rounded cyber security is a universal concern, especially with increased consumer awareness in the aftermath of the pandemic. But the F-Secure research based on consumer surveys in the Asia-Pacific (APAC) found that the region is acutely aware of their potential susceptibility to cyber threats — presenting unique opportunities for organisations that they trust to provide consumer security that protects their digital wellbeing.

The study further deep dives into how Touch ’n Go eWallet, part of Malaysia’s Touch ’n Go Group and rated as the country’s foremost eWallet with over 19 million registered users, has embraced embedded security to remain relevant to consumers in this climate, increasing its value offering and ultimately bolstering its revenue.

Awareness and Demand for Securing the Digital Day-to-Day

The whitepaper disclosed that, while “the consumer cyber security threat landscape in the APAC region is vast and complex”, 62% of APAC consumers believe they could likely become victims of cybercrime or identity theft in the future.

What’s notable in the study is that these consumers are actively seeking solutions from companies they already trust — thereby creating a value generation opportunity for organisations such as banks, insurance providers, fintechs, and other financial service providers.

The digital day-to-day activities of consumers encompass a wide array of actions such as online shopping, banking, and socialising. These “digital moments” require security as much as devices themselves, given the potential threats and risks associated with them. With the continuous digitalisation of various sectors and the rise in consumer cyber threats, the role of trustable security solutions has never been more paramount.

APAC Consumer Cyber Security Landscape

And that role is incredibly important right now. A 2022 survey highlighted by F-Secure showed consumer behaviour and concerns in the APAC region, noting that at least half (50%) of APAC consumers have experienced at least one form of cyber crime in the past 12 months, with Malaysian respondents having faced it the most at 58% of those surveyed.

As noted, a majority (62%) of APAC consumers feel they are at risk of being affected by cyber crime or identity theft going forward, indicating the heightened awareness of consumer cyber security threats in the region. Banking threats and identity theft were top concerns, along with credit card fraud and online shopping fraud, indicating the necessity of protecting customers’ digital moments.

Addressing Rising Consumer Cyber Security Trends

The whitepaper reported key cyber security threats and trends facing the global consumer include infostealers, a type of malware designed to mislead users by posing as legitimate software; phishing attacks that trick users out of private information or convince them to click on links or attachments that lead to malware; scams that fall into the categories of online shopping, investment, business impostors, vacation and travel and romance; malicious mobile apps that take over users’ accounts; as well as threats and malware in consumer smart home IoT devices that often have poor security and long replacement cycles.

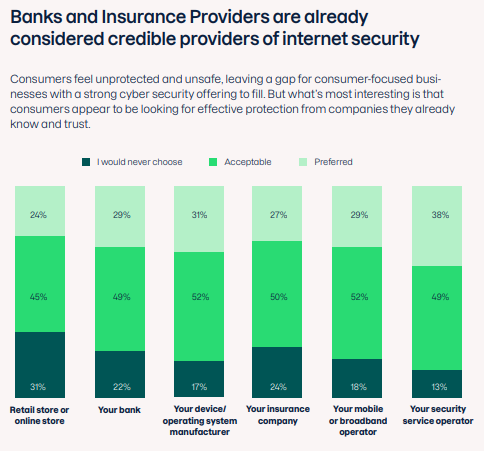

According to a December 2022 survey by F-Secure, consumers value and are willing to pay for online security benefits, with shopping and banking protection being most sought after. Consumers feel unprotected and unsafe, highlighting a gap for businesses to fill with strong consumer cyber security offerings.

Customers are not only seeking all-rounded security, but privacy and identity protection as well. This is reflected in the proliferation of digital identity solutions to secure apps and personal accounts, with the identity and access management market is pegged to expand by another 10.3% by 2030.

So the demand for an effective yet easy-to-use and understand security offering is there, and F-Secure offers such a comprehensive cyber security portfolio, supplying banking, malware, family and privacy protection along with frictionless and simplified ID monitoring, password management and cyber assistance.

The Value of Trusted Providers

The research illustrates that consumers are more likely to accept cyber security solutions from companies they already know and trust, with banks and insurance providers being top contenders. This presents an opportunity for businesses to improve customer loyalty, satisfaction, and retention, while differentiating from competition and adding value to their services.

“Just over three quarters of consumers globally consider their bank to be either an acceptable or preferred provider of cyber security, while a further 77% of consumers feel the same about their Insurance Provider,” the whitepaper points out. “What’s perhaps most significant is that a hefty 82% of APAC consumers would consider switching their Mobile or Broadband Service Provider, Bank or Insurance Provider for one that offers a clear cyber security service.”

How Touch ‘n Go eWallet Embeds Value & Relevancy

Fintech companies like Touch ‘n Go eWallet have identified cyber security threats to its users in general, and seek solutions to help them. “Touch ’n Go eWallet needed a solution that added value and helped them stay relevant and top-of-mind for their customers, with goals to move customers from single to multiple use cases and become the trusted consumer partner for all manner of payment types”, stated the case study.

As a key player in Malaysian e-payments that pioneered the country’s progression towards becoming a cashless society, the fintech business is in the unique position of innovating its offering while remaining top-of-mind as a trusted payments provider. To foster this, F-Secure and Touch ’n Go eWallet engaged in a partnership to co-create a simple, frictionless embedded security solution, not force ambiguous safety features that did not fit the eWallet provider’s business model.

With over 200 merchant touchpoints for its consumer base, F-Secure embedded security provides easy to grasp, round-the-clock identity monitoring, continuously canvassing for stolen personal data and sending instant alerts if a breach is detected. To maintain the app’s seamless customer experience, a Cyber Help hotline service is also provided to tackle critical issues such as identity theft.

By integrating F-Secure’s embedded security solution into their offerings, the preeminent eWallet in Malaysia with a significant user base has been able to provide a new value stream to their customers and champion consumer security.

Additionally, since Touch ’n Go eWallet is seen as a reliable provider of other offerings like credit scores and loans, F-Secure’s well-rounded security portfolio which includes online banking, privacy and password protection has been able to help transition customers towards other security use cases within the app. This helps Touch ’n Go eWallet maintain trust with existing users, while building a trustworthy relationship with new users who are security-conscious.

F-Secure: A Trusted Provider

With over 30 years of experience, F-Secure’s AI-powered solutions have been recognised for their superior protection by independent organisation AV-Test. It offers a flexible business model, easy integration and deployment, premium support, and services beyond technology including marketing and sales enablement.

Today, consumers not only trust but also expect their existing financial service providers to be their cyber security providers. With 96% of F-Secure partners reporting satisfaction with local support, there is potential to increase value, trust and revenue for businesses by securing every digital moment for consumers.

Find out how F-Secure can make every digital moment more secure with simple, frictionless security experiences that increase value and trust and generate revenue for the bottomline. Download the full whitepaper Supercharge your offering with consumer cyber security here: