Touch ‘n Go eWallet to Impose 1% Reload Fee to Deter Credit Card ‘Cash Out’

by Fintech News Malaysia February 5, 2024TNG Digital will impose a 1% fee on all credit card reloads for its Touch ‘n Go eWallet service, starting from 23 February 2024.

The company has announced that reloads made through DuitNow transfers and debit cards will remain free, aiming to promote these as cost-effective alternatives for users.

This policy adjustment comes as a response to the high costs associated with credit card reloads, which TNG Digital has absorbed since the platform’s launch.

It also addresses the issue of users exploiting the credit card reload feature to transfer money back to bank accounts, a practice that incurs additional expenses for the company.

TNG Digital is encouraging users to instead opt for DuitNow which is equipped with advanced security features such as biometric authentication and device binding.

Upon registration with Touch ‘n Go eWallet, users receive a DuitNow account number, which can be found in the eWallet’s ‘Profile’ section.

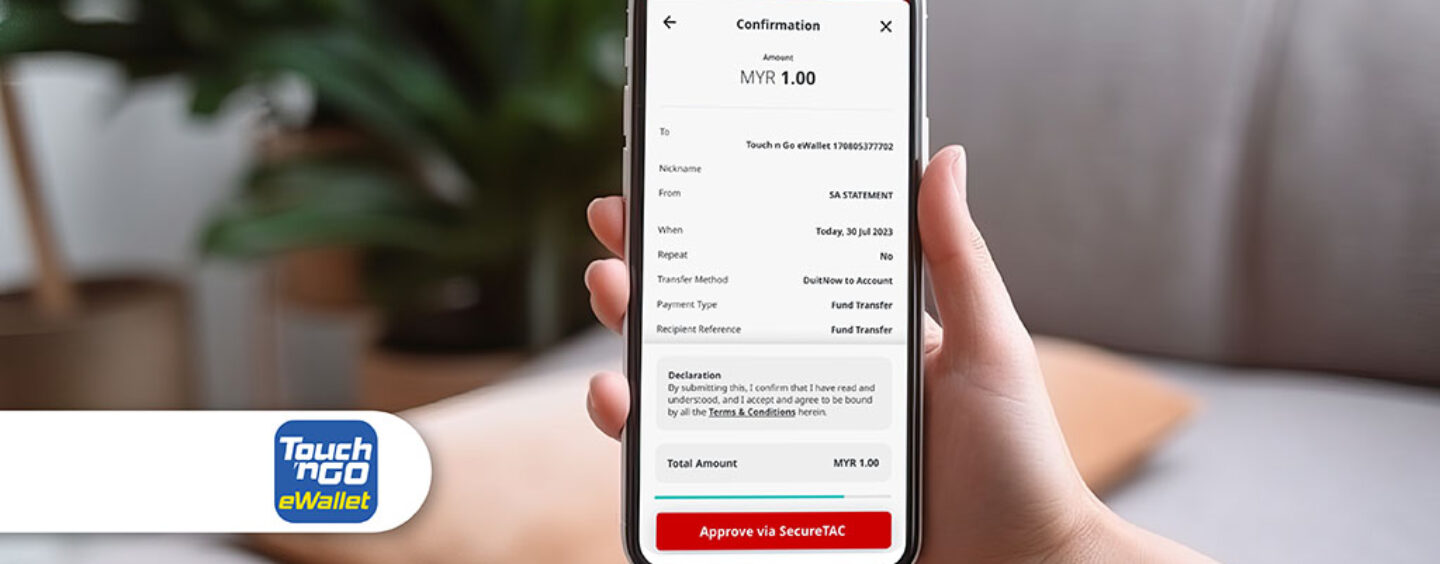

For transferring funds, users simply need to log into their bank’s application or website, navigate to the transfer section, select ‘Touch ‘n Go eWallet’ as the destination, and input their eWallet’s DuitNow account number.

The process mirrors that of a standard bank transfer, with the added recommendation to save the account number for future use.

Alan Ni

Alan Ni, Chief Executive Officer of TNG Digital said,

“As the largest financial institution serving over 20 million e-KYC verified users, we must find a fine balance between convenience, security, and the long-term cost sustainability of our company.

To provide consumers more options, we still allow credit card as one of the reload channels, but we also urge users to reload their eWallet via DuitNow Transfers or debit cards, which are both free of charge.”

Featured image credit: Edited from Freepik