Posts From Fintech News Malaysia

Maybank Announces RM18 Billion SME Financing Plan for 2024

Maybank has announced its plans to disburse approximately RM18 billion in SME financing for the year 2024, according to Bernama. This marks a 13 percent increase from the previous year, aiming to expedite the transition of its customers towards more

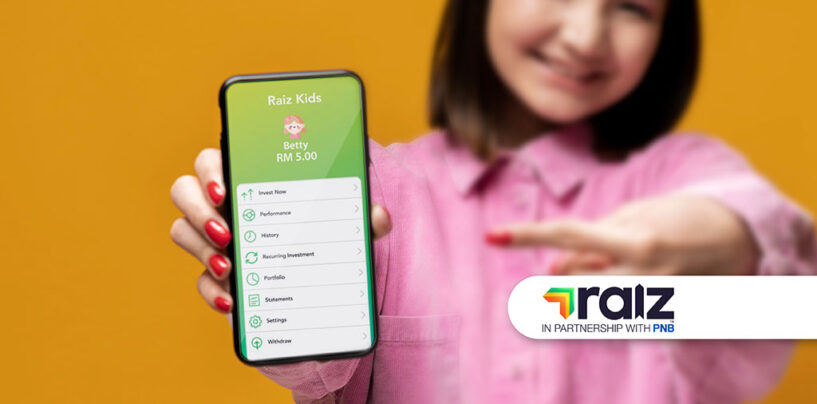

Read MoreNew Raiz App Update Allows Children to Learn Budgeting, Saving, and Investing

Raiz, a joint venture company between Raiz Invest Australia and Permodalan Nasional Berhad (PNB), is introducing an updated version of its Raiz Kids feature within its savings and investment app. The Raiz app enables its users to cultivate a regular

Read MoreVircle Taps PolicyStreet to Offer Child Insurance Plan Tied to Its Visa Card

Malaysian insurtech company PolicyStreet and Vircle, a Malaysian neobanking service provider for kids, have joined forces to launch “Vircle Club Protect,” a new insurance service designed to offer financial security for children of Malaysian families who subscribe to the latter’s

Read MoreRHB Invests RM8.6 Million in Boost Bank, Maintains 40% Stake in Digibank

RHB Bank has further invested RM8.6 million in Boost Bank, subscribing for an additional 8.6 million shares to maintain its 40% stake in the digital banking venture. According to The Star, this follows Boost Holdings Sdn Bhd’s (BHSB) similar injection

Read MoreMaybank Islamic, TM Bridge Digital Divide for MSMEs With 5G Mobile Banking Bundle

Maybank Islamic in collaboration with Telekom Malaysia (TM) has launched the “Go Niaga” mobile business banking bundle for MSMEs, according to The Edge. The Go Niaga bundle is a fusion of Maybank Islamic’s robust financial solutions and TM’s advanced Uni5G

Read MoreLuno Users Can Now Verify Their Crypto Holdings With Proof of Reserves Reports

Luno, a regulated digital asset exchange in Malaysia, has announced a new initiative aimed at bolstering transparency for its users by issuing monthly proof of reserves reports. This move is designed to assure customers that their digital assets are accurately

Read MoreKTM Now Accepts E-Wallets, Debit and Credit Cards Across 80 Stations

The Malaysian Transport Ministry, led by Minister Anthony Loke, officially inaugurated the new open payment system for the Keretapi Tanah Melayu Berhad (KTMB) commuter services. Announced during a ceremony at the Ipoh Railway Station, the system is now operational across

Read MoreSC Malaysia Fast Tracks Market Entry Process for Capital Market Players

The Securities Commission Malaysia (SC) has stepped up to expedite the market entry process for Capital Market Intermediaries (CMIs) and Recognised Market Operators (RMOs). The Focused Scope Assessment (FSA), effective immediately, promises to reduce the time required for CMIs and

Read MoreGambit Custody Names Melvyn Ho as New Co-Founder and COO

Gambit Custody has announced the appointment of Melvyn Ho as its new Co-founder and Chief Operating Officer in a bid to strengthen its position in the digital asset custody market. The company had secured in-principle approval from the Securities Commission

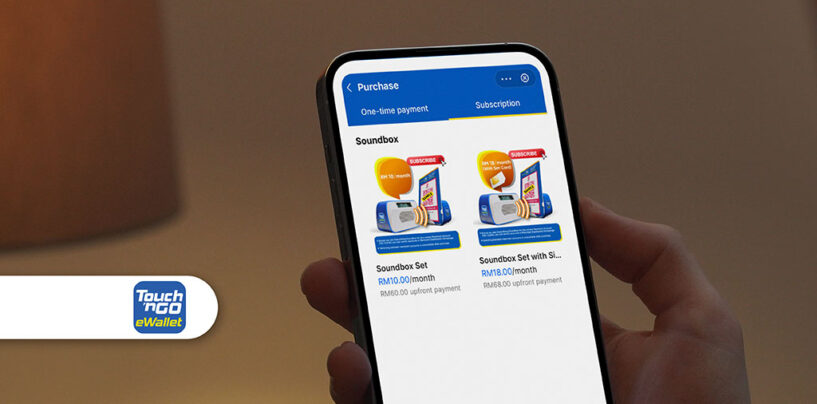

Read MoreTouch ‘n Go eWallet Offers Soundbox to Help Merchants Fight Scams From RM10/Month

TNG Digital has launched a new Soundbox device aimed at protecting merchants from payment scams through the Touch ‘n Go eWallet platform. The Soundbox device is available to merchants in two subscription models: a basic version for RM10 per month

Read More