Islamic Fintech

Banks Need to Ramp up Efforts To Win Over Digitally Savvy Muslim Customers

Banking and financial services platform Mambu released its research series named the Disruption Diaries which seeks to understand what people think of the key trends driving the development of financial services. In Mambu‘s third edition, the firm conducted a global

Read MoreSplit Emerges as First Malaysian Shariah-Compliant Buy Now, Pay Later Operator

Buy Now, Pay Later (BNPL) platform Split announced that its services has been reviewed and certified as a Shariah-compliant by the Masyref Advisory, a local advisory firm devoted to Islamic banking and finance. Split said that it is the first

Read MoreSecurities Commission, UNCDF Rolls Out Islamic Fintech Accelerator Programme

The Securities Commission Malaysia (SC) and the United Nations Capital Development Fund (UNCDF), through its Center for Financial Health programme, today launched an accelerator to develop the Islamic fintech innovation ecosystem in Malaysia’s Islamic capital market (ICM). The programme, known

Read MoreMambu Launches Shariah Compliant SaaS Banking Platform

Mambu, the newly-minted fintech unicorn, has announced the launch of the Sharia-compliant version of its SaaS banking platform. The solution caters to the needs of Islamic banks and lenders globally. It was made available to customers from the end of

Read MoreMDEC Chairman Stresses Need for Comprehensive Fintech Ecosystem in Malaysia

For fintech to thrive and reach its full potential, Malaysia must establish a conducive and comprehensive fintech ecosystem where all industry participants work towards the same goals, said Datuk Wira Dr Hj. Rais Hussin Mohamed Ariff, chairman of Malaysia Digital

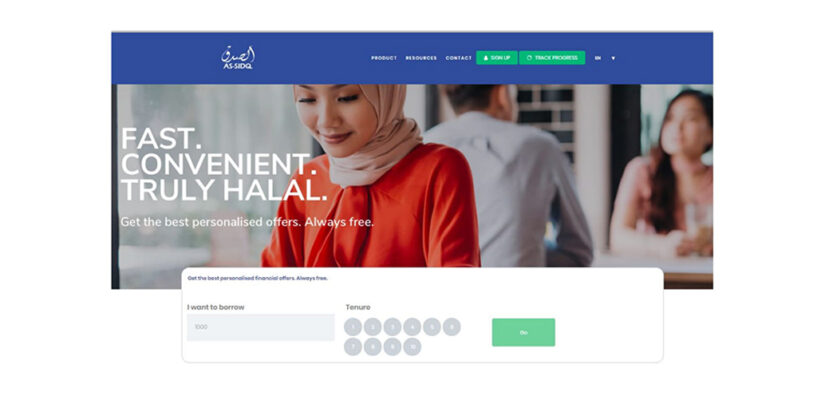

Read MoreSedania Launches Islamic Financial Marketplace Assidq.com

Sedania As Salam Capital Sdn Bhd, a wholly-owned subsidiary of Sedania Innovator Berhad, has announced the launch Assidq.com, an Islamic online marketplace. The online marketplace facilitates the customer’s Islamic financial needs through a personalised profile check with approval and disbursements.

Read MoreMalaysia is a Leader in Islamic Finance, But Why Not Islamic Fintech?

Malaysia was named a leader in Islamic finance, producing 26% of the world’s Shariah-compliant financial assets by the end of 2017—amounting to US$528.7 billion (RM2.05 trillion). The study proclaimed Asia as the largest market for both sukuk and Islamic funds. But when

Read More