5 Key Trends That Have Emerged in Malaysia’s Banking Scene in 2018

by Vincent Fong December 14, 2018Renowned cosmologist Carl Sagan once said, “You have to know the past to understand the present.”

A statement that rings true across all facets of life, as we approach the end of 2018, it’s worthwhile for us to look some of the key trends that have emerged in the local banking scene this year to help us navigate the tumultuous new world of 2019.

In 2018 and even years before it Malaysian consumers are rapidly adopting the digital lifestyle in almost all aspects of their daily life activities.

This inevitable change in consumer behavior is forcing banks to digitise their business operations swiftly. In order to stay competitive and relevant, banks need to quickly digitalise their front end and backend IT systems to meet the expected experience of consumers today.

Discussions with bank executives are commonly centered on how they can smoothly transform their legacy internal IT infrastructure to the latest and advanced business/operation models which will enable them to outsource some of the non-core IT platform and processes.

Most aspects of the banking and financial sector landscape globally are already undergoing digital transformation to enhance their customers’ experience and to remain relevant in the competitive edge. Malaysia being part of the world economy is catching up rapidly with these changing trends as well.

In a report published by Ernst & Young recently, 66% of banks in Malaysia will reach digital maturity by 2020.

With much of the Malaysian banks under its illustrious list of clientele, we spoke to, Nizam Arshad Chief Technology Officer and Wan Ahmad Kamal Wan Halim, Executive Vice President, Enterprise Sales, of TM ONE, the business solutions arm of Telekom Malaysia Berhad (TM), to get a sense of what they feel would be the five (5) key trends that Malaysia banks should look out for and share some of their insights.

Moving Beyond Chatbots When Investing in AI

Image Credit: Freepik

Nizam observed that in 2017- 2018, many of the Artificial Intelligence (AI) projects within the banking space in Malaysia were largely focused on chatbots functionalities.

He stressed that while there are clear value propositions to deploying chatbots such as ease of use and increase in customer satisfaction, many banks in Malaysia have yet to scratch the surface of AI’s true transformational potential.

He highlighted an area that AI will excel at providing value for the banking segment is in fraud prevention. With continuous and rapid evaluation or large amount of data, AI can enable banks to detect irregular behavioral patterns and alert their customers immediately.

Nizam also pointed out that credit risk is another key area in which bankers should consider deploying AI. By analysing customer data such as payment patterns, outstanding balances, data from credit agencies like CCRIS and CTOS along with alternative data sources like social media – banks can more accurately assess the credit worthiness of its customers.

He predicts that in 2018-2019, we will observe more instances of banks embarking on various AI projects other than just chatbots. Nizam also added that TM ONE is currently building on its existing expertise in this area; and is ready to be commercialised very soon.

As the World Goes Digital, So Must the Workforce

Image Credit: Freepik

Malaysia’s shifting customer expectations affect not only the way banks serve their customers, but also how they equip their employees with the relevant skills to face the increasingly digitalised working environment.

Many traditional roles within banks will soon need to evolve because of digitisation. Wan Ahmad Kamal stressed that banks need to reform their workforce management strategy and explore new ways to increase productivity.

While some roles will evolve slightly, some he opined, will be changed drastically. Indeed, digital technologies will bring a great deal of convenience for everyone. However, Wan Ahmad Kamal believes that human touch and empathy are irreplaceable and will still have an active role to play in the future.

In Europe, it is becoming more common for relationship managers to have video banking as their main channel of contact with their customers. He believes that this form of converged solution is the perfect combination of convenience and human element in banking.

The increasing investment on Cybersecurity

A recent study by Frost & Sullivan indicated that the potential economic loss in Malaysia due to cyber-security incidents can reach up to 4% of Malaysia’s Gross Domestic Product (GDP).

This situation is made worse by the fact that due to shortage of cyber-security professionals in Malaysia, banks may soon find that it will become increasingly difficult and expensive to fully manage cybersecurity in-house.

Nizam believes that besides training and up-skilling their employees, the option of combining their in-house professional security practices with a managed services provider will become more appealing to banks.

In keeping with this view, he added that TM ONE is continuously enhancing its capabilities on cybersecurity services. Existing services include managed on-premise cybersecurity services, cloud security services and cybersecurity professional services such as security posture assessment (SPA).

As a trusted digital infrastructure provider, Nizam is confident that TM ONE is able to provide network cyber security protection with services like Managed Network Security and Managed Application Security equipped with Advanced Threat Protection capabilities. All these services will be managed by TM ONE through its Cyber Security Operations Centre (SOC).

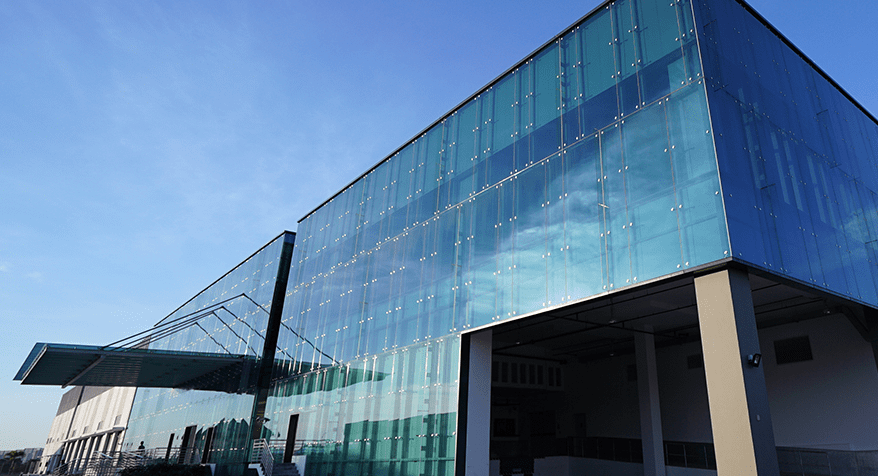

Data Residency Challenges Will Be a Thing of the Past

When dealing with personal data, Malaysian companies, including banks, are subject to the Personal Data Protection Act (PDPA). The PDPA states that personal data cannot be processed outside of Malaysia.

While this law serves to protect Malaysian consumers, it also greatly limits a bank’s ability to choose its cloud computing provider.

Nizam said this is precisely why TM ONE has proactively invested heavily in its Tier III Twin Core Data Centre. The Iskandar Puteri Data Centre (IPDC), has connectivity to four (4) cable landing stations in Malaysia as well as to TM’s Point of Presence (PoP) in Singapore.

With virtual hybrid cloud facilities like IPDC built in the country, he believes that data residency rules will no longer be a hindrance to achieving greater agility, scalability, efficiency and flexibility.

Collaboration is the Future

Image Credit: Freepik

Banks in Malaysia are increasingly warming up to the idea of collaborating with both local and international fintech companies. Wan Ahmad Kamal said, through observations with much of his conversations with major banks, almost all banks have varying degrees of initiatives to engage the fintech community.

He commented that while banks are eager to innovate, his customers often share with him their struggles with being encumbered by legacy systems and processes.

He also shared that in recognising the need for fintech and banks to work together, TM ONE is actively engaging fintech companies to look at potentially building customised innovative solutions together in efforts to strengthen their offerings to the banks.

But Wait, What About Blockchain?

Nizam was quick to point out that it would be difficult to have a conversation about the outlook of the banking space without bringing up the word blockchain.

While he recognises the technology’s potential to revolutionise many aspects of banking that enable reduced time of transaction, operational cost in banking operations, banks should definitely look into it. He feels the outlook for blockchain to move beyond pilot projects in banking is geared more towards medium to long term.

With the main objective of deploying internal valuable resources on strategic projects to create higher value to the business and satisfy the needs of new digital lifestyle consumers with an advanced digital banking services, Nizam believes that local banks can now rely on trusted partners with complete suite of digital services offerings like TM ONE to provide “non-core” IT business systems.

Moving Forward

What should banks anticipate for 2019? With the speed of things nowadays, it’s difficult to pinpoint exactly what the trends will be seeing as how none of have a crystal ball readily available.

However taking a stab at it is always a worthwhile endeavor compared to staying passive.

TM ONE tells Fintech News Malaysia that they will be planning a webinar next year outlining some key trends they should observe

Featured Image Credit: © CEphoto, Uwe Aranas via Wikimedia Commons