It’s been nearly 3 years now since we last highlighted the best fintech startups that Malaysia has to offer. Since then there have been many players who have come and gone.

As we enter 2020, it felt appropriate for us to showcase in 20 of Malaysia’s most promising fintech startups and companies. Compared to the previous list where we only highlighted startups, this year’s list will look at established players as well. In doing so, we hope to provide a more complete picture of the landscape in Malaysia.

This list intended for purely homegrown companies that are still headquartered in Malaysia. It is also arranged alphabetically and does not indicate ranking.

Axiata Digital

What does the company do?

Axiata Digital is a subsidiary under Axiata Group a telco conglomerate that is best known in Malaysia for its brand Celcom. Within the digital financial services vertical Axiata Digital operates brands like Boost and Aspirasi. Boost is among one of the early players within the Malaysian e-wallet space and Aspirasi is a digital financing platform for micro and SME businesses.

Who is behind the company

The company is lead by Khairil Abdullah, he was appointed as CEO of Axiata Digital Services in January 2015. He first joined Axiata in 2012 and served as Group Chief Marketing and Operations Officer. Prior to Axiata, Khairil was a Partner at Bain & Company, a leading global management consultancy.

Why did we select them?

While its e-wallet brand may no longer be the top dog in the space, its digital lending platform Aspirasi has a lot of potential in filling in the financing gap within the SME and micro SME space.

They have recently entered into an agreement with CIMB Bank to offer financing solutions to 700,000 SMEs. To date they claim to have distributed RM 50 million worth of microloans to 9,000 merchants.

The Axiata Digital Group has also teamed up with Great Eastern to provide affordable insurance and takaful products to consumers, micro-entrepreneurs and SMEs. This will be done through Aspirasi and its partner platforms which includes Celcom, and Boost.

BigPay

What does the company do?

BigPay prefers to describe themselves as an alternative to banking as opposed to an e-wallet, they often say they are built more in the mould of neo-banks like Monzo and Starling. Cheekily, one of its tagline “Challenge Banking” is just one alphabet short of calling itself a challenger bank.

BigPay comes with a well-designed budget management function and pre-paid Mastercard which you can load and use in any merchants around the world that accepts Mastercard

The company is under the Air Asia Group, during its earlier days Tony Fernandes in an attempt to drum up attention for the product once said that BigPay will be worth more than Air Asia and that it will give AliPay a run for its money.

Who is behind the company

The company is founded by Christopher Davison, he is originally from London where he worked in financial services, investment banking, tech VC, with a strong track record of both investing in and setting up several successful fintech and data analytics companies.

Why did we select them?

We’re fans of their budget management function which provides you visuals of what you’ve been spending on. We like the fact that it will also automatically summarise you spending when you return from a trip and at the end of every month.

The exchange rates offered by BigPay is very competitive and is fast becoming a preferred method for travellers compared to the traditional way exchange currencies at a physical money changer.

CoinGecko

What does the company do?

CoinGecko is among the largest crypto data aggregator in the world, tracking nearly 3,300 tokens from more than 260 cryptocurrency exchanges. Between 6-9 million visitors around the world rely on CoinGecko to get real-time data on cryptocurrencies.

The company provides a fundamental analysis of the crypto market. In addition to tracking price, volume and market capitalization, CoinGecko tracks community growth, open-source code development, major events, and on-chain metrics.

Who is behind the company

The company is founded by TM Lee and Bobby Ong who were both early Bitcoin traders that were frustrated with the way cryptocurrencies were being evaluated. They set up CoinGecko with the intention of bringing in more data points to help provide a more accurate assessment of cryptocurrencies. We’ve actually written a feature story on CoinGecko here if you’re interested to read more about their journey.

Why did we select them?

It’s one of the few if not the only company from Malaysia making headway in this space, and it’s giving players like CoinMarketCap a run for its money.

We like the additional metrics it provides to help users better evaluate cryptocurrencies and we’re also fans of their annual crypto crypto reports.

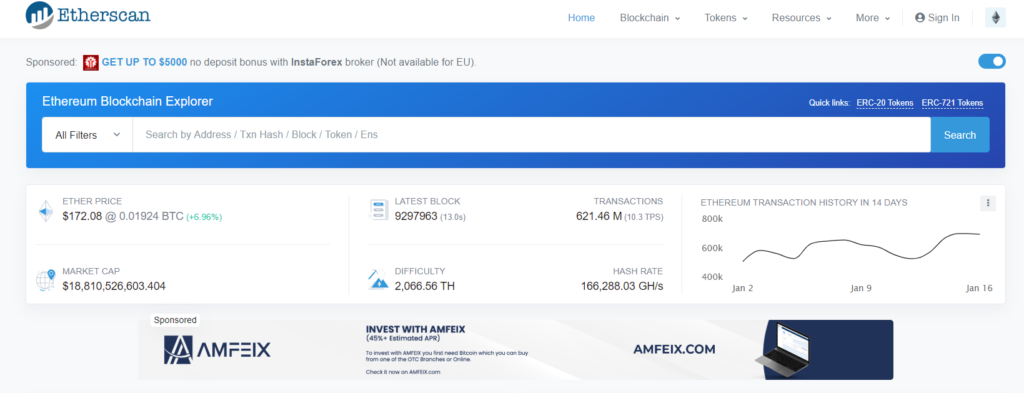

EtherScan

What does the company do?

Etherscan is Block Explorer and Analytics Platform for Ethereum, a decentralized smart contracts platform. Some have described it as Ethereums leading block explorer. Simply put it is a search engine that allows users to look up, confirm and validate transactions on the Ethereum platform.

Who is behind the company

The company is founded by Matthew Tan a relatively media-shy developer who stumbled across the word Bitcoin in 2011. Intrigued by both Bitcoin and blockchain, Matthew started building solutions around this space.

Why did we select them?

It is widely recognised within the global community as one of the big names within the Ethereum block explorer space. It has a simple and clean interface that does what you need it to do and between 4 – 7 million users rely on it every month to track transactions on Ethereum.

Fi Life

What does the company do?

Fi Life is an insurtech company offering online term life insurance. It was launched in 2015 under the brand name U For Life and has since been bought over and rebranded to Fi Life.

Who is behind the company

The company is founded by media entrepreneur Malek Ali and Tan Jiann Meng. The birth Fi Life is a result of the pair’s recent acquisition of U For Life from German reinsurer Hannover Re and New Zealand underwriting software company, Intelligent Life.

Why did we select them?

Fi Life offers a simple way for Malaysians to purchase life insurance digitally. The company provides a very competitive pure protection plan of up to RM 1 Million, which is among the highest you can buy online in Malaysia without needing a medical check-up.

Fundaztic

What does the company do?

Fundaztic is a homegrown P2P financing platform licensed by the Securities Commission Malaysia. They were among the first batch of P2P finance operators licensed to operate in Malaysia. In 2018, the company raised RM3 million in just 38 minutes on pitchIN.

Who is behind the company

The company is co-founded Jeffrey Chew, Kristine Ng, Micheal Ooi, and Gary Tan. The founding team are veterans within the finance, legal and technology space.

Why did we select them?

We like their Principal Protect scheme, which provides assurance to investors that they will not incur capital losses if they are able to meet certain conditions. We like the experience and background of the founding team. Lastly, it enables investors to start investing for as low as RM 50.

GHL

What does the company do?

Founded in 1994 GHL is one of the biggest names in Malaysia in the payments space. GHL is listed on the Main Board of Kuala Lumpur Stock Exchange and has presence across multiple ASEAN markets like Indonesia, Philippines, Thailand, Cambodia, and Singapore.

Who is behind the company

The company is led by Danny Leong who has held leadership positions in several tech companies in Malaysia. He’s been with GHL since 2014 and he is currently serving as the Group CEO.

Why did we select them?

GHL is an established player with strong traction and regional presence, processing over RM1 billion in transaction value per month.

HelloGold

What does the company do?

Founded in 2015, through their app HelloGold enables customers to save money using gold for as low as RM 1. HelloGold’s product is fully shariah-compliant and its aimed at enabling low to medium-income customers to have access to financial products like gold savings with an affordable minimum investment size.

Who is behind the company

The company is founded Robin Lee and Ridwan Abdullah. Robin was formerly the CFO of the World Gold Council whereas Ridwan held a senior position with AEON Credit.

Why did we select them?

The app’s UI is sleek and easy to use, we also like their SmartSaver function which enables automated gold savings. We also like the fact that although HelloGold is built on the blockchain their key messaging it the value they bring to the customers compared to other startups who sometimes lose sight of their core proposition. To date, HelloGold serves over 100,000 users who has purchased more $10 million in gold bullion.

iPay88

What does the company do?

iPay88 is one of the earlier pioneers within the online payment gateway space in Malaysia. Founded in 2006 the company’s role in powering Malaysia’s e-commerce growth through payments cannot be understated. In 2015, Japanese tech giant NTT Data acquired iPay88, it is arguably one of Malaysia’s first successful exits within the fintech space.

Who is behind the company

The company is co-founded by the trio of Chan Kok Loong, Lim Kok Hing, and Chong Lee Kean. As a seasoned entrepreneurs, they are well known and respected within the fintech community.

Why did we select them?

iPay88 is the dominant player within the online payment processing space in Malaysia with a growing presence across ASEAN markets.

Jirnexu

What does the company do?

Jirnexu operates Malaysia’s most popular financial marketplace RinggitPlus which provides an end-to-end online application solution for Malaysians to research, compare and select banking and insurance products. They also operate under the brand name KreditGogo in Indonesia.

Who is behind the company

Jirnexu’s team founding team of 6 consists of Cedric Viver, Hann Liew, James Barnes, James Wong, Lucas Ooi, and Yuen Tuck Siew. The company’s co-founders met and realised that they share a mutual passion for giving individuals the financial advice and tools they needed to spend money wisely

Why did we select them?

RinggitPlus has 1.5 million monthly visitors and a database of 800,000 customers, they are already working with most of the major banks in Malaysia. Based on SimilarWeb data they have 73% more traffic compared to its closest competitor. Having received US$ 10 Million in strategic investment from Experian also provides them a competitive edge.

KATSANA

What does the company do?

KATSANA through its DriveMark brand aims to introduce usage-based insurance to Malaysia. DriveMark is a reward ecosystem for safe drivers, the app tracks driving behaviour and allows drivers to compete with each other to win prizes and cheaper personal and motor insurance.

Who is behind the company

DriveMark is founded by Syed Ahmad Fuqaha and Irwan Ibrahim in early 2017 as an offshoot experiment to migrate Katsana’s driver scoring algorithm into a smartphone app.

Why did we select them?

Usage-based insurance has a lot of promise, however, adoption still lacks a lot to be desired, KATSANA’s DriveMark approach in creating a separate platform that gives users control to their own data could potentially accelerate the adoption of usage-based insurance in Malaysia

MoneyMatch

What does the company do?

MoneyMatch is a cross border payments startup in Malaysia providing digital remittance services at competitive rates.

Who is behind the company

The company is co-founded Adrian Yap and Naysan Munusamy who were both former bankers who believe that Malaysians deserved better financial services than what was being offered by incumbents.

Why did we select them?

MoneyMatch pioneered eKYC account opening within digital remittance space and was the first to graduate from Bank Negara Malaysia fintech sandbox into a fully licensed digital remittance service provider. They are the first startup in Malaysia to be on Ripple’s network and in 2018 they bagged an award at the Singapore Fintech Festival.

MyCash Online

MyCash Online is an e-marketplace for the migrant community founded in 2016. They enable unbanked migrants access to digital and financial services. Their recent ECF campaign with pitchIN provided their investors with 44.2% returns.

Who is behind the company

The company is founded by Mehedi Hasan and Nurul Haq who as migrants themselves were able to see the problems faced by the community. They founded MyCash Online in 2016 with the intention of tackling these issues.

Why did we select them?

Malaysia has a strong migrant population and undocumented workers, MyCash operates in a space that few do and provide a much-needed service. They have recently expanded their services to Singapore and Australia.

MYTHEO

What does the company do?

MYTHEO is the only homegrown company approved by the Securities Commission Malaysia to operate a Digital Investment Manager or better known as robo-advisor to most. The company was joined as joint-venture between Japan’s first robo-advisor Money Design Co. and Silverlake Group a leading software provider in the banking space.

Who is behind the company

The company is led by Ronnie Tan who has served as the Managing Director of Silverlake Capital Market Solutions since 2001. Ronnie has 35 years of experience in the financial , investment and capital market industry.

Why did we select them?

Its the only homegrown company that secured a license to operate a robo-advisor which offers an affordable and user-friednly option for the masses to invest in capital markets through ETFs.

pitchIN

What does the company do?

pitchIN is the leading equity crowdfunding platform operator in Malaysia. Through their platform they enable SMEs to raise funds and retail investors investment opportunities in early-stage companies.

Who is behind the company

The company is co-founded by Sam Shafie and Kashminder Singh. Besides operating pitchIN they both founded and still operate WatchTower and Friends and tech startup accelerator.

Why did we select them?

pitchIN is a clear market leader within the equity crowdfunding space commanding more than 75% share of funds raised through equity crowdfunding in Malaysia.

PolicyStreet

What does the company do?

PolicyStreet is an insurance technology company which customises and offers insurance to individuals and businesses. It is the first homegrown insurtech to be awarded a Financial Adviser approval by Bank Negara Malaysia, which enables the firm to give unbiased insurance recommendation and financial planning services

Who is behind the company

The company is founded by Lee Yen Ming, Wilson Beh and Winnie Chua. They are an experienced group of former banking and insurance professionals.

Why did we select them?

The company has achieved a sum assured of more than RM1 billion and sold more than 20,000 policies.

SINEGY

Founded in 2017, SINEGY is the only Malaysian homegrown crypto exchange that was recently granted conditional approval by the Securities Commission Malaysia. Their exchange currently allows for trading of Bitcoin, Ethereum and XRP.

Who is behind the company

The company is led by Penang-born Kelvyn Chuah, who started his career in Wall Street, his professional career started in market-making and eventually included arbitrage in foreign equities. He has established trading desks across several institutions before returning to Malaysia to pursue other ventures prior to SINEGY.

Why did we select them?

It is the only Malaysian company granted approval by the regulators to run a crypto exchange. The company traded more than US$ 16 Million in their first 6 months.

Soft Space

Founded in 2012, Soft Space among one of the most innovative payments service provider in Malaysia with over 20 financial institutions in 10 countries adopting its solution.

Who is behind the company

The company was founded by Chang Chew Soon who prior to founding Soft Space held senior positions within tech teams. It is now led by Joel who has been serving as its CEO since 2017.

Why did we select them?

From being the first to bring mPOS systems to the market to powering the world’s first tap on phone payment solution, Soft Space has been no stranger to innovation. They’ve also shown good traction across markets and are constantly rolling out new solutions.

TNG Digital

TNG Digital is formed as a joint venture between Ant Financial and Touch ‘n Go. They are best known for the e-wallet brand Touch ‘n Go eWallet.

Who is behind the company

The company is led by Ignatius Ong, an ex-Malaysian Airlines veteran who served as a Group Chief Revenue Officer. He was recently appointed the CEO of TNG Digital in August 2019.

Why did we select them?

We like their Money-back Guarantee Policy which helped a lot of skeptics make the jump to try e-wallets. Their UI has improved significantly. The design is clean and the app is unencumbered.

They have now secured 125,000 merchant points and over 7 million users.

Tranglo

Tranglo is a cross border payments specialist. They are supporting remittance functions for major global brands like TransferWise, WeChat Pay, AliPay and many more.

Who is behind the company

The company is currently lead by Jacky Lee a veteran within the cross border payments space. He joined Tranglo as the VP in 2016 and was promoted to be the CEO in 2018. Tranglo is founded by HY Sia in 2008.

Why did we select them?

They have processed over $5 Billion worldwide and on the trajectory to grow further having just secured a global partnership with Ant Financial and WeChat Pay