Mobilewalla LendBetter: The Future of Lending for New-To-Credit Prospects

by Fintech News Malaysia March 29, 2023Financial inclusion and credit access are essential for driving economic growth and improving livelihoods in numerous emerging markets, including South Asia. However, extending credit to underbanked and unbanked populations comes with inherent risks, especially when dealing with new-to-credit customers who lack a credit history.

Addressing Lenders’ Challenges in Emerging Markets

In order to provide quick and trustworthy lending decisions while minimizing risk, lenders need to explore alternative approaches to enhance their understanding of new-to-credit applicants and optimize loan decisions without jeopardizing overall defaults. This is where LendBetter, a Mobilewalla solution, becomes a crucial tool.

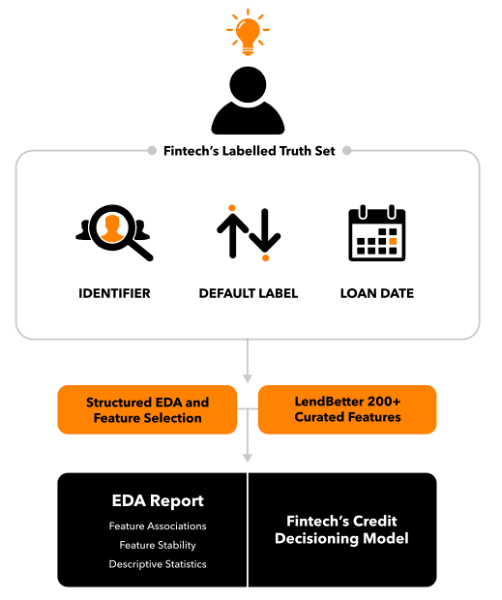

Mobilewalla LendBetter offers over 200 highly predictive features and attributes for consumer creditworthiness to address this challenge. These features enable lenders to better understand their prospective new-to-credit borrowers and make well-informed lending decisions.

In this case study, a prominent digital provider of instant personal loans in India leveraged LendBetter to establish more comprehensive profiles for new-to-credit and thin-file customers.

By opting for the most predictive features suggested by Mobilewalla, the fintech had not only enriched their understanding of these prospects, but also gained valuable insights into their most suitable borrower profile.

Improving a new-to-credit default risk model

By evaluating the impact of LendBetter’s features on thin-file applicants and augmenting the fintech’s existing model, they could compare risk scores yielded by the augmented model with those output by the original model.

The digital lender discovered that thin-file applicants were predominantly placed in high-risk buckets and, to a lesser extent, in medium-risk buckets, highlighting the challenge of evaluating creditworthiness without a credit history. Nevertheless, LendBetter’s features significantly impacted risk assessments for these levels, empowering the fintech to make better-informed credit risk decisions.

As a result of using LendBetter, the fintech reduced its portfolio risk by 15 percent by disqualifying high-risk thin-file applicants for loans or classifying them to receive a smaller loan at a higher interest rate.

Additionally, by using LendBetter, the fintech could lend more confidently to qualified consumers in the middle bucket, including those previously rejected, with higher loan amounts at lower interest rates. This helped the fintech derive a higher return on investment without adversely affecting nonperforming assets for the new-to-credit customer portfolio.

The LendBetter platform provides a unique solution to the challenge of lending to new-to-credit customers. This case study demonstrates the value of its features and attributes in enriching first-party data to understand new to credit prospects better and improve risk decisions.

Optimizing risk assessment models with Mobilewalla’s Expertise

Mobilewalla’s highly predictive features and attributes for consumer creditworthiness empower lenders to confidently provide loans to new-to-credit and thin-file customers, promoting financial inclusion and economic growth.

By comparing the risk scores generated by the original and augmented models, lenders can better understand how LendBetter’s features impact risk assessment. This understanding allows them to make informed decisions regarding loan disbursement, portfolio risk reduction, and return on investment optimization.

Furthermore, fintech companies can optimize their loan portfolio and risk decision-making processes by leveraging Mobilewalla’s feature selection and data analysis expertise. This leads to a more comprehensive lending process that benefits the fintech and their customers, particularly those who might not have had access to credit otherwise.

Please click here for more information about how Mobilewalla LendBetter can improve your business’s performance or read the case study below to learn more.