Alliance Bank’s New Credit Card Touted to Be One of the Safest in Malaysia

by Fintech News Malaysia May 24, 2023In recent times, there has been an unfortunate flurry of financial fraud cases such as scams, security breaches, unauthorised access to bank accounts and unauthorised credit card transactions.

It was recently reported that losses from financial scams totaled RM39 million from October 2022 to January 2023, based on over 16,000 contacts to the National Scam Response Centre (NSRC).

With more and more transactions now available online, payments have become more convenient but at the same time increases the risks of fraudulent activities due to security breaches.

Financial institutions play a critical role in cyber and financial security to provide a secure environment for financial transactions.

Given how serious matters have gotten, it is not surprising that a bank’s or financial institution’s approach to combat financial crimes influences users’ choices.

Malaysians are actively finding ways to improve their financial security in a bid to keep their data safe to avoid falling victim to these crimes.

Could this be Malaysia’s Safest Credit Card?

The all-new Alliance Bank Visa Virtual Credit Card is one that can mitigate various safety concerns that everyday users may have.

This card has evolved from the ways of traditional credit cards, empowering users with modern features that give greater control as well as convenience.

On top of that, there are additional layers of security that further reduces the risk of financial fraud.

Alliance Bank Visa Virtual Credit Card is Malaysia’s first credit card to offer a unique Dynamic Card Number (DCN) feature. Let’s dive deeper into what this means.

Security Feature That Significantly Lowers The Risk Of Financial Fraud

The traditional credit card (or debit card, for that matter) comes with a sequence of 16 to 19 digits embossed on it.

When making a purchase, the card number acts as an identifier that provides information, such as the bank provider and account holder, to the merchant.

When this number, paired with other details such as the security number, falls into the wrong hands, the account holder may become a victim of a financial crime.

Alliance Bank Visa Virtual Credit Card offers cardholders a much safer way of making payments through its Dynamic Card Number feature.

It can generate a random 16-digit number which changes every 30 minutes to provide an added layer of security that cancels automatically after it is used.

This can protect the user’s identity if they frequently make online payments to different merchants.

Generate One-Time Card Numbers or Card Numbers For Recurring Payments

By accessing the allianceonline mobile app, cardholders can generate a random card number for one-time payments, as mentioned above.

This will come in handy when customers make one-off purchases for groceries, petrol, meals, and others.

Each card number will last 30 minutes and the cardholder will not be charged for generating a new one each time.

However, the app will display a warning if the user continuously generates the card number without purpose or usage.

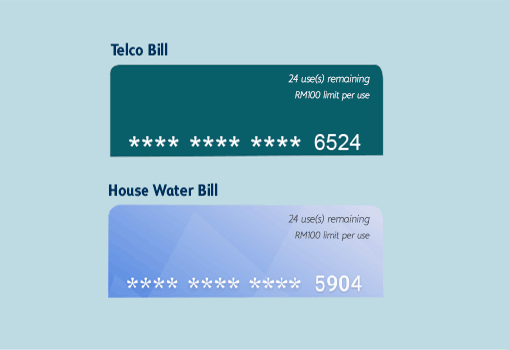

So how about recurring expenses? Plenty of customers have subscriptions and utility bills that they pay for on a monthly basis. This will work for those payments too.

When users create a card number on the app, they have the option to select ‘Subscription’ instead of ‘one-time’ and set a personalised limit and expiry date for each virtual card.

For example, customers could set up a virtual card for their streaming service that lasts for 6 months and has a monthly limit of RM50.

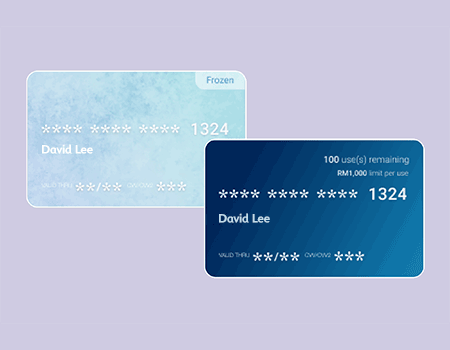

Freeze/ Unfreeze Your Card Or Delete It In Just A Few Taps

If, in any case, the user notices any suspicious activities with their Alliance Bank Visa Virtual Credit Card, they can temporarily block all transactions charged by freezing the card on the app.

Customers can also unfreeze the card without going through the hassle of calling customer service and waiting for the bank to take the necessary actions. Instead, they can have it done immediately on their own.

For cards that are no longer in use, customers have the option to delete it and it will be removed from their app. To use a new card number, they will simply need to generate a new one to make a transaction.

Alliance Customers to Receive Touch ‘n Go Rewards

When customers sign up for the Alliance Bank Visa Virtual Credit Card, they will have the opportunity to receive RM1000 Touch ‘n Go eWallet credit on top of a guaranteed gift of RM200 Touch ‘n Go eWallet credit.

They will need to apply using the code “RPVCC”, get approved, and activate their virtual credit card to be among the lucky winners where terms and conditions apply.

Click here to sign up for the all-new Alliance Bank Visa Virtual Credit Card.