Posts From Rebecca Oi

Funding Societies Journey from Zero to Hero

In the world of business and entrepreneurship, the story of Funding Societies and its co-founders is noteworthy. Wong Kah Meng, a Co-founder and Group Chief Operating Officer at the platform, recently solidified his commitment by clinching the Founder of the

Read MoreCharting the Fintech Evolution with TNG Digital’s Journey

In a Fireside Chat held at the Fintech Frontiers Conference Malaysia 2023, Alan Ni, CEO of TNG Digital, shared insights into the remarkable journey of his company, which was recently awarded the title of Fintech of the Year. Moderated by

Read MoreHow Will BNM’s Digital Insurance License (DITO) Address Protection Gaps in Malaysia

In recent years, the insurance landscape in Malaysia has undergone a transformation driven by digital innovation, of which the introduction of Bank Negara Malaysia’s digital insurer and takaful operators (DITO) framework is expected to be a game changer. The emergence

Read MoreWill the Digital Future of Wealth Management in Malaysia Cater to All?

The wealth management landscape has significantly transformed in Malaysia and worldwide. The advent of digital technology and changing investor behaviours have opened up new opportunities for wealth managers. This panel discussion, titled “Reshaping the Future of Digital Wealth in Malaysia,”

Read More7 Key Budget 2024 Highlights Impacting Fintech in Malaysia

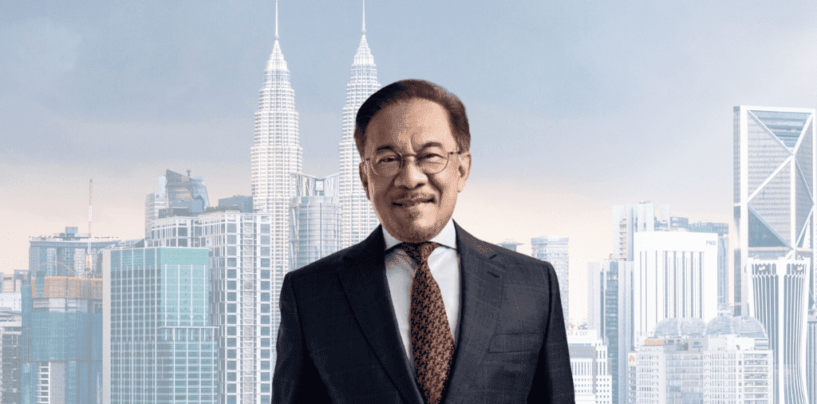

The Malaysia Budget 2024, tabled by Prime Minister Datuk Seri Anwar Ibrahim, outlines the country’s largest-ever financial blueprint, amounting to RM393.8 billion. Titled “Ekonomi MADANI: Memperkasa Rakyat,” this budget promises to prioritise and serve the ‘rakyat’ (people) with policies that

Read MoreBoost & CelcomDigi Team With Mastercard to Launch ‘Pay Later’-Capable Beyond Card

Boost, in a collaborative effort with CelcomDigi and Mastercard, has rolled out the Beyond Card in Malaysia. This card facilitates payments from the Boost wallet balance or through a pre-approved ‘Pay Later’ credit line, introducing an innovative payment concept to

Read MoreNavigating the Future of Wealth Management

In the realm of wealth management, the concept of personalisation has rapidly evolved from being a mere preference to becoming a necessity. This transformation has been expedited by the increasing demand for customised financial strategies, emphasising the significance of tailored

Read MoreFinancial Planning, Fintech Synergy Key to Malaysia Economic Resilience, Says SC

The world of finance, like many industries, is undergoing rapid transformation, spurred mainly by technological advancements even in emerging markets. One such country embracing this transformation is Malaysia, which was the backdrop for insights shared at the Financial Planning Association

Read MorePayNet’s MEEA Spotlights Collaboration, Innovation, Customer-Centricity

On August 16, 2023, Payments Network Malaysia Sdn Bhd (PayNet) hosted the annual Malaysia Excellence in E-Payments Awards (MEEA) to recognise and celebrate the efforts of PayNet’s ecosystem of banks, non-bank participants, businesses, and government agencies for their contributions to

Read MoreLuno Reflects on its Journey in Malaysia After a Decade in Crypto

In the ever-evolving landscape of fintech and digital assets, Malaysia has emerged as a promising hub for cryptocurrency and digital asset trading. Among the pioneers leading this transformation is Luno Malaysia, the first to obtain regulatory approval from the Securities

Read More