Digital transformation is something that should be happening across the organisation, not just the consumer facing fronts. However, when scanning the news, one might be tempted to think that much of the industry’s digitisation focus is limited to the latter.

In recent news, Hong Leong Bank introduced HALI, an artificial intelligence (A.I.) powered chatbot that is geared towards serving the internal employees. We figured it’d be a good idea to reach out to the Hong Leong team and get a sense of how a bank like Hong Leong would go about digitising their workforce.

Removing Redundant Workload

I’ll be the first to admit that the news cycle is often bombarded with news of companies and brands launching chatbots and it is difficult to not be sceptical and wonder if this is an effort purely targeted at appearing relevant rather than adding actual real value.

However, when we move past the headlines we can see some areas where chatbot can really add value to an organisation. One example is in Hong Leong Bank, its Human Resource Helpdesk team on an average month actually respond to a total of 1,950 emails on Human Resource policies and procedures related matters. These email enquiries alone represent 90% of the total enquiries that come in and mostly are repeated type of enquiries.

A use case like this is where chatbot can really shine. In just two weeks after Hong Leong Bank launched its virtual assistant named HALI, it has already assisted its human counterparts in responding to a staggering of 23,000 enquiries from its users within the Bank.

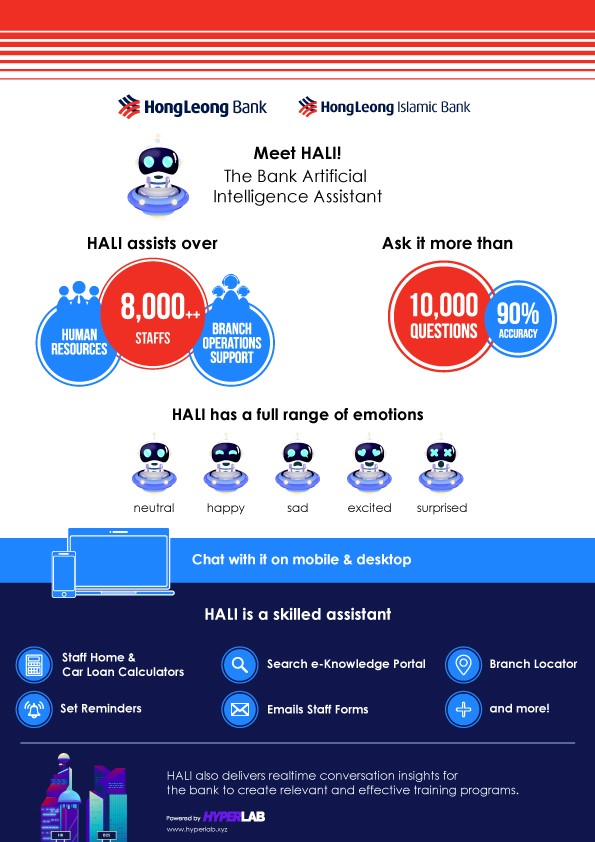

Infographic 1: HALI, the virtual assistant chatbot designed and developed for Hong Leong Bank.

The launch of HALI, a chatbot developed specifically for Hong Leong Bank is the first for Malaysia and is set to improve operations efficiency by 60% over the course of the year. Even though HALI is still in its infancy stage of maturity, the chatbot is already in an effective programme mode in assisting the HR Helpdesk team in the daily enquiries mundane tasks.

HALI is available 24/7 and the employees can easily access to HALI directly for enquiries on medical benefits, staff loans, leave policy, payroll, and scholarship to name a few.

The shift of the tasks to HALI further enables the bank to upskill their employees and place them in roles that can add more value to the organisation and provide better job satisfaction to the employees.

Fiona Fong, Head of Human Resource of Hong Leong Bank

According to Fiona Fong, Head of Human Resource of Hong Leong Bank, “The introduction of HALI is in-line with the Bank’s strategic direction of being digital at the core. Since the launch, we have been able to help our employees in upskilling their job competencies for better productivity. For instance, one of the team member has been moved up from her help desk functions to join the talent acquisition team.”

Receptive Reaction from Employees

Further to that, we managed to chat with few of the users on their experience with HALI:

Andrew Jong Ann Kee (HLB), Head of Mortgage & Strategy Planning

“Having rejoined the Bank a few months back, naturally I had a lot of HR queries. It is certainly a welcome change to have ever ready help with my HR onboarding queries.

With loads of information to digest for the new role, HALI has been uniquely invaluable in answering my ad-hoc questions without needing to navigate through the traditional information library. HALI on mobile makes it quick, easy and very convenient for me, and I move on to my next tasks seamlessly and efficiently.

I like how HALI is non-intrusive especially on repetitive queries that otherwise would have been funnelled to a HR colleague. For sure it has greatly extended HR’s reach and support level to fellow colleagues meaningfully, and I very much look forward to HALI v2.0 soon that builds on an even more superior staff engagement experience!”

Tan Eng Eng, Regional Operations Head for Negeri Sembilan and Malacca

“An innovative adorable AI, comes in handy in allowing quick access guide just by using simple key words. Fast & reliable in responding to query asked.”

Currently, HALI in its Phase 1 is able to answer 10,000 of enquiries with up to 90% accuracy. As more data and questions are being fed into HALI’s “Log”, the bank is already looking into its Phase 2 enhancement plan where the chatbot will be trained to answer a wider range of questions with even more accuracy in the future.

Upskilling and Digitising Learning through Bite-Sizes

While we’re on the note of upskilling employees, we have to acknowledge that the increasing ubiquity of mobile devices and time constraints has fundamentally shifted how learning is designed and consumed. Many of us no longer have the luxury (nor the patience) to sit down in the classroom for 1 or 2 days just to brush our knowledge up on one area.

This is especially true in the banking industry where there are constant regulatory changes, compliance policies to adhere to, and complex new financial products to familiarise oneself with. In recognising these issues, that is precisely the reason why Hong Leong introduced their mobile learning app, SmartUp – another industry first in Malaysia.

Infographics 2: SmartUp, the bite-sized e-learning app developed for Hong Leong Bank.

While this bite-size learning is not something that’s not completely new in the market, the key is whether it is correctly deployed to ensure its effectiveness in delivering learning to the employees 24/7. The SmartUp app offers their employees the bite-size learning materials that enables them the flexibility of picking up the knowledge while ‘on-the-go’. The modules made available through SmartUp is also categories by specific divisions to offer content that more relevant to the respective job function of their employees.

The app also enables training to be rolled out to their employees currently based at branches across the nation in a speedy manner. With an approximate 285 branches across the nation, one can only imagine the logistical challenges that may arise and how a traditional method of learning may delay the much needed information for employees based at branches, especially those in remote locations.

Future Plans for Hong Leong

Under the leadership of Mr. Domenic Fuda, Group Managing Director and Chief Executive Officer of Hong Leong Bank, the Bank continues to chart significant milestones in the digital landscape.

Being digital at the core, he emphasised that the Bank will constantly look at ways to leverage technology to increase efficiency and productivity towards improving the overall customer experience, as well as to upskill its employees’ competencies in the ever changing financial industry landscape.