StashAway is The First Robo-Advisor The SC Has Approved for The Malaysian Market

by Fintech News Malaysia November 1, 2018Singaporean company StashAway has arrived in Malaysia, bringing their artificial intelligence-enabled investing platform here.

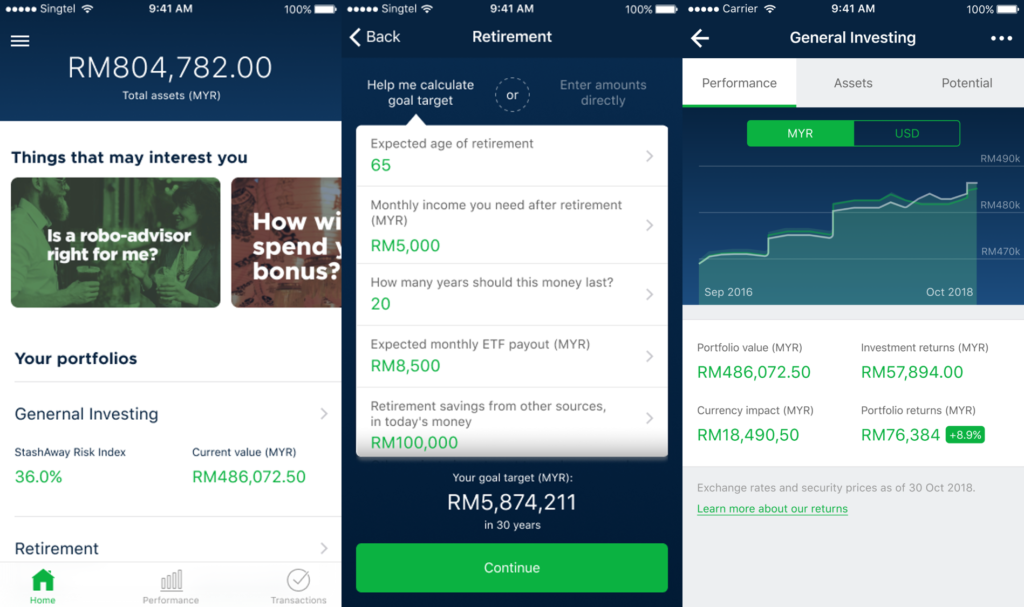

Basically, instead of having to pay high fees to get a human portfolio manager to plan your next investments, StashAway leaves the brunt of this work to data-driven AI, which allows them to offer these services for relatively lower costs to the general public.

Perhaps coincidentally, Ambank announced that they’ll be offering robo-advisors in 2019.

It is often said that robo-advisors could serve as a doorway for the average person to join the seemingly complicated investment world. The technology is able to reduce the costs of human labour while still offering personalised portfolios, and can usually be accessed as long as one has an internet connection and cash to spare.

StashAway claims that they can offer their platform with no minimum balance, no sales charge, flexible deposits and withdrawals, and annual management fees between 0.2%–0.8%.

Image Credit: StashAway

Currently, the platform is being rolled out to the approximately 5,000 people who signed up for the waitlist, with the company gearing up for public access by early November.

The platform will be available at their website, or on Google Play and the App Store.

StashAway’s brand of robo-advisor is named ERAA (Economic Regime-based Asset Allocation), and the company claims that ERAA combines a detailed risk management strategy with macroeconomic data-driven asset allocation strategy.

The company claims that the ERAA is desgined to navigate the ups and downs of economic cycles.

StashAway Malaysia Country Manager, Wong Wai Ken said:

“We’ve seen what’s been happening in the investment space in countries around the world, and by now, we expect these low-cost, convenient, transparent, and sophisticated investment options to be available to us.”

“Over-priced, inconvenient and one-size-fits-all Unit Trusts and Investment Linked Policies don’t cut it anymore. Malaysia’s population is growing and life expectancy is increasing; we need investment solutions that enable us to manage our growing wealth better.”

Co-founder and Group CEO, Michele Ferrario said:

“When you think about how 43% of gross financial assets in Malaysia are in bank deposits, it’s clear that current investment options aren’t doing their jobs of enabling Malaysians to build their long-term wealth through intelligent investing. This huge amount of wealth sitting in cash proves that the financial services industry has failed thus far to equip Malaysians with the right investment tools.”

StashAway’s entry into Malaysia is the fruition of Securities Commission’s regulatory framework for robo-advisors, the Digital Investment Framework Management. The introduction of this framework is one arm of the Securities Commission’s goal of democratizing access of investment products to the general public.

According to Tan Sri Ranjit Singh, the authority was looking into issuing licenses sometime mid-2018.

What this tells us is that StashAway won’t be the only players in the market offering artificial intelligence-enabled investing, and we may see this space heating up very soon.

Featured Image via StashAway