Since the wave of fintech disruption arrived on the shores of Malaysia several years back, many 1st-tier banks have each responded with their own strategies.

Ambank was the only tier-1 bank that has not clearly spelled out their game plan, beyond their Group CEO, Datuk Sulaiman’s statement that they are ready to embrace fintech earlier this year.

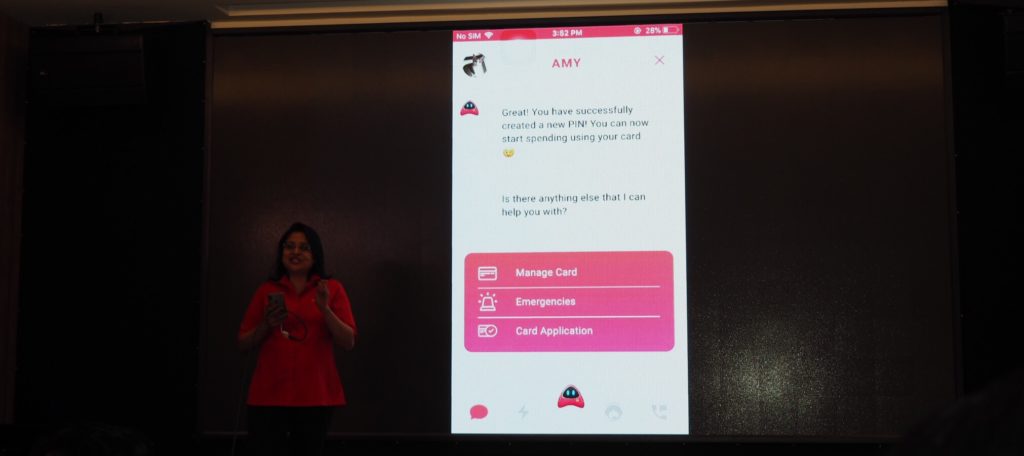

That has all changed today as Ambank unveiled their chatbot AMY and their intentions to launch a robo-advisory service by early 2019.

What is AMY and what purpose does it serve?

AMY essentially is an acronym for AmBank Malaysia, currently at its first iteration AMY will be primarily focused on assisting customers on credit card services.

According to Jade Lee Managing Director, Retail Banking, Ambank, AMY was designed based on the most frequent credit card related queries received on their call centre.

The chatbot’s current version will be able to assist customers to activate a new card, reset forgotten pin, arrange a temporary or permanent credit card limit increase, block a lost card and guide customers to apply a credit card that is most suited to their needs.

While Ambank is not the first bank to release a consumer facing chatbot, their COO, Iswaaran Suppiah stressed Ambank’s iteration is focused on services that are not already available via existing digital channels.

He shared that for example if a customer were to lose a credit card, he or she would have to go through the tedious process of calling the bank to cancel the card and schedule for a time to visit a bank branch to get the card replaced.

Echoing his view, Jade also expressed having the option of increasing transaction limits through the chatbot is also far more seamless than going through traditional channels.

During their press conference, Ambank also revealed that they have plans to incorporate NLP (Natural Language Processing) and machine learning into AMY in the near future and expand its functionalities beyond the credit card portfolio.

Ambank’s Upcoming Robo-Advisor and Other Future Plans

In recognising the inevitable arrival of robo-advisors in Malaysia Ambank’s Group CEO, Datuk Sulaiman has also hinted at rolling out robo-advisor in early 2019.

He expressed that the robo-advisory service will be leveraging existing data that they have to recommend investments based on their risk-profiling — which could provide them an upper hand over the other robo-advisors attempting to enter the Malaysian market, who will have to start from scratch.

Ambank also hinted at a service called “People Like Me” which will recommend investment portfolios to users based on the demographic that they are in.

Riding on the success of their new AmOnline launch with has seen their transactions multiply by 100 times, the bank also shared that they will be looking at rolling out new features and services every 3 months.