Despite a challenging business environment associated with the global COVID-19 pandemic, there is still an appreciable appetite for Chinese technology-driven companies’intent on going public in the US. A total of 16 China-based companies held U.S. listings in the first half of 2020, one licensed affiliate of Tiger Brokers underwrites six of them. Tiger Brokers is the brokerage brand known to the market and belongs to a Nasdaq listed financial institution UP Fintech Holding Limited, act as one of the underwriters for their offerings. According to SEC and Bloomberg, Tiger Brokers once again led the rankings of underwriters for U.S. IPOs of Chinese ADRs among brokerages during H1 of 2020 based on the deal count.

Despite the uncertainty from the pandemic, many Chinese ADR issuers were enthusiastically received by investors. In the first half of 2020, 16 Chinese ADR issuers raised over $2.6 billion, a 74% increase from the same period last year, according to data compiled by Bloomberg. Kingsoft Cloud Holding Ltd (NASDAQ: KC) and Li Auto (NASDAQ: LI) were two of the largest IPOs, raising $510 million and 1.1 billion respectively.

The underwriting business is generally considered as the core but a manual business of most top-tiered investment banks such as Goldman Sachs, Morgan Stanley, JP Morgan, Citigroup, etc. With millions of users globally, Tiger Brokers has successfully developed a standardized procedure and process to largely automate its participation in the IPO business.

Leveraging its deep expertise in the TMT industry and strong institutional and retail investor base, Tiger Brokers served as a selling group member in numerous high-profile U.S. IPOs, including communication API platform Agora (NASDAQ: API), and clinical-stage biopharmaceutical company Legend Biotech (NASDAQ: LEGN). Tiger Brokers also served as an underwriter for multiple companies including NGS-based cancer therapy company Burning Rock (NASDAQ: BRN) and an underwriter in the listings of the online LGBTQ community, BlueCity (NASDAQ: BLCT) and workforce solutions provider, Quhuo (NASDAQ: QH).

Tiger Brokers has demonstrated unparalleled capability to assist China-based companies to raise financing in overseas markets. In the first half of 2020, the firm helped Burning Rock receive orders close to $360 million, while Agora and Legend Biotech received orders of $195 million and $120 million respectively. It recently assisted Li Auto to receive subscription orders of $1.887 billion, with more than $1 billion of orders from institutional investors and $800 million from retail investors.

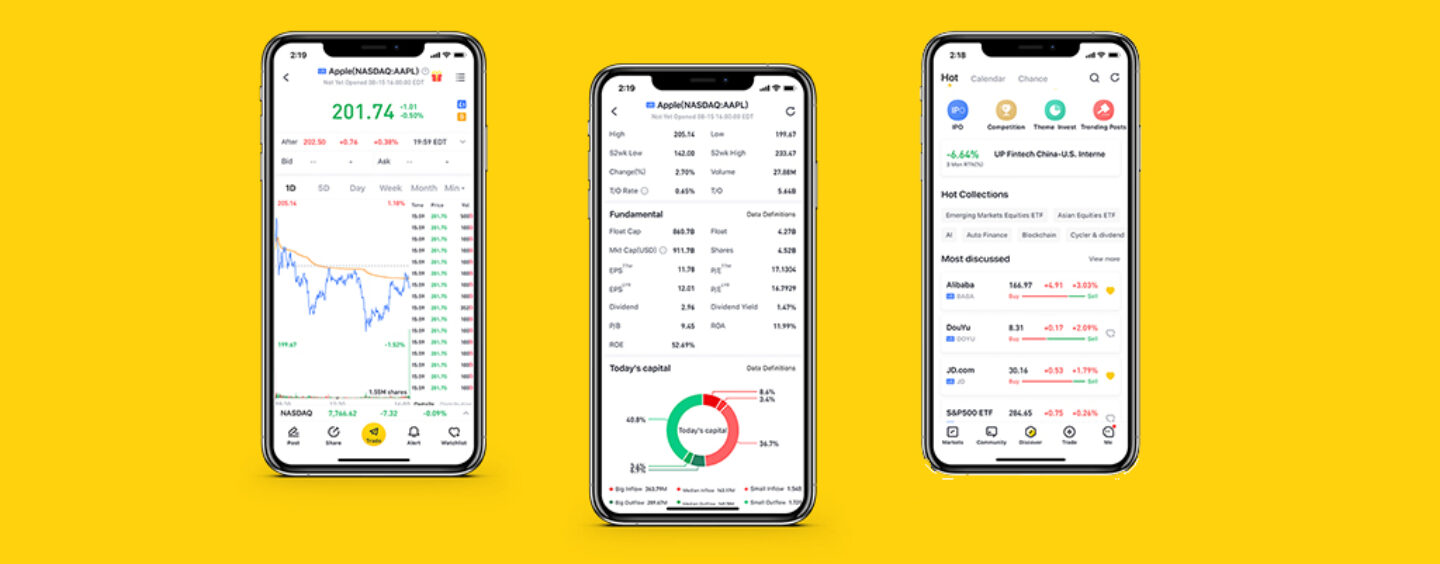

With a strong institutional investor network consisting of some of the world’s most sophisticated mutual funds and hedge funds, Tiger Brokers can help issuers meet a wide range of prospective investors across the globe, building strong demand for the new issuance. On the retail side, the flagship mobile trading APP “Tiger Trade” developed by Tiger Brokers continues to grow in popularity and currently has over 4 million users. Retails clients have the opportunities to invest in a newly public company’s stock through Tiger Brokers’s ‘one-click’ subscription service. By integrating brokerage services with institutional and corporate services, Tiger Brokers aims to better serve its wide range of clients while also diversifying its revenue streams.

Tiger Brokers’s growing strength in an IPO market long dominated by traditional Wall Street firms is due to its comprehensive knowledge of China’s evolving technology landscape. As a young group that listed on Nasdaq in 2019, Tiger Brokers is naturally more connected to emerging companies in China. By leveraging its detailed knowledge of the Chinese market, Tiger Brokers can clearly explain the issuer’s business model and financials to prospective investors, helping to foster a better understanding between buy-side and sell-side.

“Tiger Brokers has earned its reputation as a leader in the field of underwriting for Chinese-based companies in the U.S. We will continue to augment our institutional and corporate capabilities to offer a broader suite of corporate services that may include debt offering, equity research, and other corporate finance services,”

said Mr. DJ Guo, Head of Investment Banking at Tiger Brokers.

Tiger Brokers’ investment banking business has experienced significant growth since 2017. Tiger Brokers recently served as a joint book-runner for the international offering of NetEase’s secondary listing in Hong Kong and looks forward to further build its business with prospective issuers. The firm has participated in over 50 Chinese ADRs IPOs in total. In the future, the firm looks to expand its investment banking business in other key capital markets outside of U.S. Tiger Brokers, will soon launch on Australian shores – building on its existing presence in US, HK and CH markets, and signals Australia as the perfect move to go full circle.

Disclaimer: This press release is prepared by Up Fintech Holding Limited (NASDAQ: TIGR) which is an ultimate holding company of Tiger Brokers (NZ) Limited (ARBN 623 547 446; AFSL 505213; FSP 473106). Any information available in this press release is general in nature and for information purposes only. It is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. Whilst we believe the information in this press release is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Not all of the financial services mentioned in the press release, particularly participation in US IPOs, are available in Malaysia however they may be provided by the affiliates of Tiger Brokers (NZ) Limited in other jurisdictions.