OCBC Introduces its Mobile-First Banking Solution FRANK to Malaysia

by Fintech News Malaysia September 23, 2020OCBC Malaysia announced the launch of its digital banking solution FRANK by OCBC in Malaysia. This solution was first introduced in Singapore circa 2010.

In Malaysia, OCBC says that it seeks to provide the mobile generation with a “fresh new of banking” using mobile only banking options to make banking “less rigid whilst removing layered financial jargon and complex processes to make banking even more accessible”.

According to OCBC Bank’s Head of Consumer Financial Services Mr Lim Wyson, the initiative provides a vital piece of the jigsaw for making banking less restrictive in today’s digital world and will centre entirely on the customer’s mobile phone.

Lim Wyson

“Our consumer research on the banking needs of the mobile generation tells us that banking is way too cumbersome for them and we think it is time we give them more control and remove some of the restrictions associated with traditional ways of banking.

“As a leading bank in the region, our capabilities and resources have enabled us to develop something that engages the mobile generation in a manner that is more aligned with their lifestyle. FRANK by OCBC is dynamic and never static.

The first of the initiatives of FRANK by OCBC is a reinvention of the traditional features of Fixed Deposits. Our customers will now be able to enjoy the FD rates they normally see in traditional banking but without the usual penalties and restrictions,”

he said.

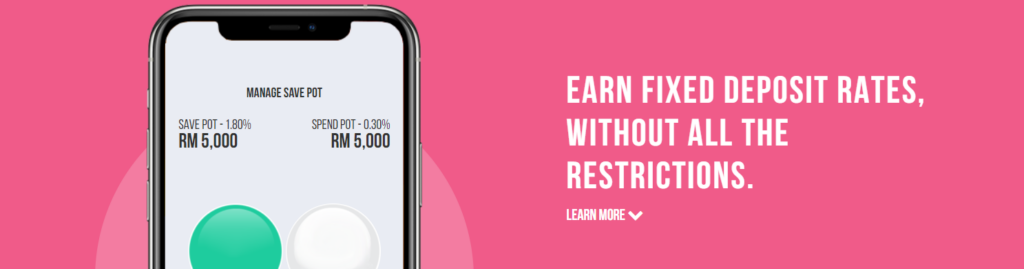

Frank by OCBC features a “Save and Spend Pots’ which enables users to earn interest while “maintaining control over when to spend their money” and does not require the “usual high minimum initial placecements of a Fixed Deposit”

Lim added that this provides users the flexibility to use their funds only when need arises without being penalised

Additionaly FRANK by OCBC features also include a function called “Money In$ights” which automatically categorises their spending and allows users to compare how they manage their money against others through a feature called “People Like You”.

It also comes with the FRANK debit card that they said has no foreign exchange mark-up when performing overseas transactions as well as for spending in foreign currency when making online purchases, unlike what is typical of most cards.

To sign up for this service, customers need to download mobile banking app, complete the online application form, and then head over to a nearby OCBC branch for biometric verification. A minimum deposit is needed and must be maintained in order to operate FRANK by OCBC