Maybank today launched mobile banking and e-wallet app called MAE by Maybank2u, an app they said is built to help Malaysians take charge of their everyday money matters, beyond their regular banking needs.

Maybank’s Group President and Chief Executive Officer, Datuk Abdul Farid Alias said,

Datuk Abdul Farid Alias

“MAE by Maybank2u was developed to be more than just a banking app; we want it to be an all-encompassing platform to help our customers manage their day-to-day money matters. Imagine it to be a pocketable digital bank but with many cool features to help you take control of your money.

The app contains the existing features within Maybank2u to help with your daily needs such as paying bills and fund transfers; but we have also introduced new tools to help customers track their spending while encouraging them to save too. We are expecting 3 million downloads of the app in the next 12 months.”

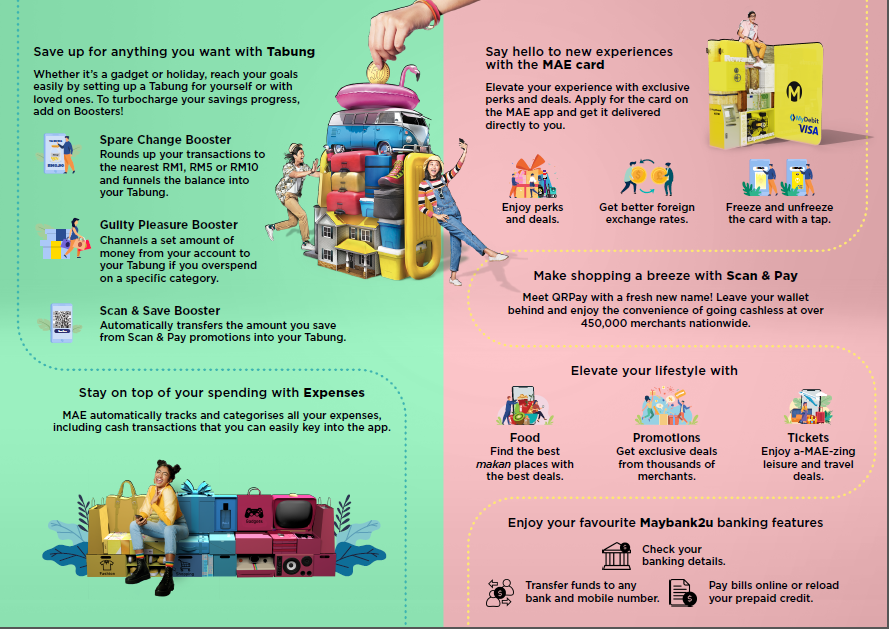

New features within MAE

MAE App Features

To help customers understand their spending habits better, Maybank has created a new tool called Expenses which provides a single, holistic view of everything spent across Maybank accounts, cards, and QR transactions.

These expenses are sorted into easy-to-understand categories such as Food, Utilities and Shopping to give more insights into where their money goes. Even cash transactions that are not normally captured by the app can be easily included with a few taps.

Tabung is another new feature, designed to help Maybank customers save consistently and regularly to achieve their goals.

There are two types of Tabung which can be created – Individual and Group. The group savings feature allows customers to jointly save with friends or loved ones towards a goal.

To help accelerate the saving process, Maybank has also introduced new complementary features called Boosters which transform micro-spending moments into saving moments.

Currently, there are 3 Boosters; Spare Change, which rounds up expenses and transfers the balance into Tabung; Scan & Save, which credits savings earned from promotions used during QR transactions and Guilty Pleasure, which allows you to set a daily spending limit in any category of your choice and an amount to be credited into your Tabung if the limit is exceeded.

For day-to-day spending, Maybank has introduced the MAE Visa Debit card which complements the MAE wallet.

It comes with a host of benefits including competitive foreign exchange rates and exclusive perks to enjoy locally and abroad. Customers can apply for the debit card via the MAE app and it will be delivered directly to their doorstep.

Besides the money tools, MAE by Maybank2u also has a fun new feature called the Makan Mana wheel which helps to recommend dining options while allowing Maybank customers to enjoy promotions from thousands of its partner merchants all across the country.

The MAE by Maybank2u app is available for download from Google Play Store and Apple AppStore. Existing Maybank customers are only required to undergo a simple security set-up, after which they can start using the app, with the data from all their Maybank accounts automatically made available in the new app.

Non Maybank customers are able to conveniently open a MAE wallet via the app and complete the application without having to visit a branch.

Once the application is successful, they may start using the app, and have access to all the banking features and money tools within.

Following the issuance of the new eKYC policy by Bank Negara Malaysia, other banks have rolled out their own digital onboarding processes. However, they still require their customers to show up in the branch physically to complete the process.