How Can Branch Banking to Evolve and Stay Relevant in a Digital World

by Fintech News Malaysia December 2, 2021If there is one clear mark that the pandemic has left on the banking industry, it is evident in the acceleration in the adoption of online and mobile banking solutions among customers, leaving a decreased footfall in physical bank branches.

In a report published by strategy consulting firm Roland Berger, it is estimated that by 2030, 567 bank branches will be closed down in Malaysia, and the number of physical branches will reduce from 2,467 in 2020 to about 1,900 in 2030.

From 2010 to 2015, data from Roland Berger also revealed that there were 252 new branches opened in Malaysia. However, from 2015 to 2020, this number was reduced to only 167.

Although branches are declining, Philippe Chassat, the co-author of the report, believes that bank branches will not disappear altogether by 2030. Instead, these branches will continue to co-exist with other digital channels.

This sentiment is also echoed in an article that we published in 2019 where we concluded that there will still be a sizeable number of branches at least in the near future, leaving us with the question: how should these bank branches evolve and change to stay relevant in the midst of digitalisation?

Identifying Opportunities for Automation

A key strategy would involve a constant review of the current processes in a branch to identify opportunities to simplify these processes through automation. This is a suitable time for banks to implement a strategic automation programme in their branches.

Banks should also take steps to identify opportunities to use video conferencing technology to assist their customers, even with service-based transactions. A self-service kiosk for transactions that would previously require a customer to have face-to-face time with an employee can be introduced within the self-service banking lobby of a branch, together with the ATM, cash, and cheque deposit machines.

Customers who need assistance in using this kiosk can then be connected to a representative through video conferencing. This can also help banks to utilize their self-service banking lobby in a greater capacity. More importantly, as branch banking evolves into this leaner structure, customers can save time as they perform their transactions.

Another interesting example is Citi’s success in using big data analytics to acquire new customers and retain existing ones. Using machine learning algorithms, data is analyzed to target promotional spending. From a branch banking perspective, effectively targeting new potential customers with products that are suitable for them and meeting their needs can save the time of the sales personnel in the branch. Additionally, this is also an excellent way to enhance the relationship with existing customers by proactively recommending products or services that they do not have before a competitor does.

The People Factor: Employees and Customers

It is important that the ‘people factor’ is not overlooked with more processes being automated in a branch. Banks must ensure that every employee who could lose their job as a result of automation should have an opportunity to be reskilled so that they can be redeployed into other areas of the bank.

Secondly, banks must ensure that they have an effective strategy when they migrate their customers to digital platforms or introduce new systems or processes that can impact customers. It is important that they do not compromise on the quality of service provided to their customers: both technology savvy and otherwise.

In doing this, each bank must be aware of the demographics of their customers in different branches throughout the country. A branch that is located in a more rural area could have a higher number of older citizens who may not be very technology savvy.

Instead of rolling out a standard migration across the entire network, more human resources can be allocated to these branches during the initial stages of the migration process to assist customers who need help with the new system or processes. This can also incorporate a human touch, an important ingredient in banking, which should not be overlooked in the process of digitalization.

The Hub and Spoke Model for Branch Banking

As bank branches evolve, one possible direction would be the use of branches on more advisory activities such as investment and bancassurance, where customers would prefer face-to-face interaction with their bankers.

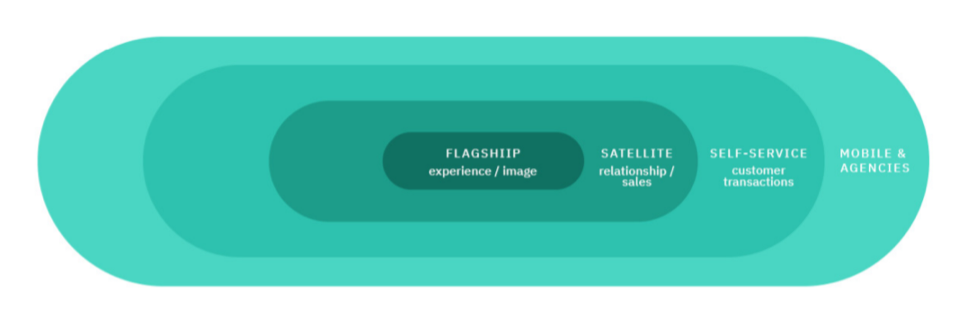

A report titled, ‘Branch Transformation in the Digital Era’ by IBM revealed that leading banks around the world are adopting the hub-and-spoke model that has 4 layers: hub, satellite, self-service centres, and mobile services. In each market, a single hub typically exists which offers a full set of products and services. The hub is surrounded by smaller satellite branches offering a minimum set of products and services that are relevant to the customers around them.

The third layer is the self-service centres (mainly offsite ATMs and kiosks), and the fourth layer comprises mobile employees. In certain areas, banks may even have a network of third-party agents. This could be an effective framework to direct the evolving nature of branch banking in the midst of digitalisation that can ensure a seamless transition and help customers to adjust to the changes.

New Distribution Model, Source: Branch Transformation in the Digital Era by IBM

Co-Banking Spaces?

In the UK, banks are experimenting with the idea of sharing a space in locations where footfall is low. In early 2021 they piloted the Bank Hub, an arrangement where five major banks effectively share a branch and provide banking services to their customers. Each bank will take turns to provide services on weekdays.

Image Credit: This Is Money

If proven successful this could be a potential model that banks can consider adopting as it enables banks to still provide services to underserved communities while still keep costs at a bare minimum.

Some banks have also been toying with the idea of converting their branch banking spaces into co-working spaces, which can be an effective way to get more entrepreneurs interacting with the banks brand. It could also be a value-added service provided to the bank’s SME customers as well.

Change Is Imminent

Without a doubt, change is imminent for branch banking. Many decades ago, the banking service delivery model involved a banker behind a desk or a teller behind a counter. The arrival of ATMs changed that. With digitalisation, this could be the appropriate juncture for traditional banks to decide how their branches should evolve, and the service delivery model that is best for their customers.

Muhammad Ghadaffi Tairobi, TM ONE’s Vertical Director for BFSI, believes that banks should optimize other channels such as contact centres and digital platforms, especially as the current pandemic might force banks to consolidate or close their branches. In this context, the cloud would be the main play, he said.

As the pandemic has accelerate the use of digital in banking environment and fintech, banks are now looking for cloud service providers that can fulfill their business needs and internal requirements.

Ghadaffi said that TM ONE’s Alpha (α) Edge has the key advantage from its localized implementation models as it provides flexibility with better cost efficiency, performance and security. In addition, he said as a Malaysian brand, they would have a better understanding of Bank Negara Malaysia’s requirements when embarking of digital transformation journey for banks.

Muhammad Ghadaffi Tairobi

“We believe that BFSI industry is still at a maturing stage in their journey to become a fully digitalized banks. Some challenges need to be addressed i.e. having talents with the right skills, educating the industry on the regulations and processes, not just on the technology. Even with cloud implementation, branches are still relevant as right now, the cloud implementation are focusing on decreasing the workload and internal efficiencies. Nevertheless, it is not impossible, but not in the near future” Ghaddafi said.

Featured image credit: Photo by Wengang Zhai on Unsplash