Banks Need to Avoid Risks of a Big Bang Transition When They Digitise

by Fintech News Malaysia May 11, 2022The latest research by the International Data Corporation (IDC) and Thought Machine, a cloud native core banking technology firm, revealed that 40% of banks in the Asia Pacific will make significant changes to their current core banking systems in the next three years.

The “A Clear Path Ahead: Migrating to Digital Core” report found that the transformation of core systems is now becoming a priority with 75% of banks saying that they have delayed full-blown replacements.

Banks are facing a reality check when it comes to legacy core banking systems which present several challenges.

Among them is the inability to quickly bring new products to market in an increasingly competitive and changing landscape, difficulty in automating processes and decisions as well as expensive third-party technologies required to supplement current core systems.

Reality of migrating systems towards digital core banking

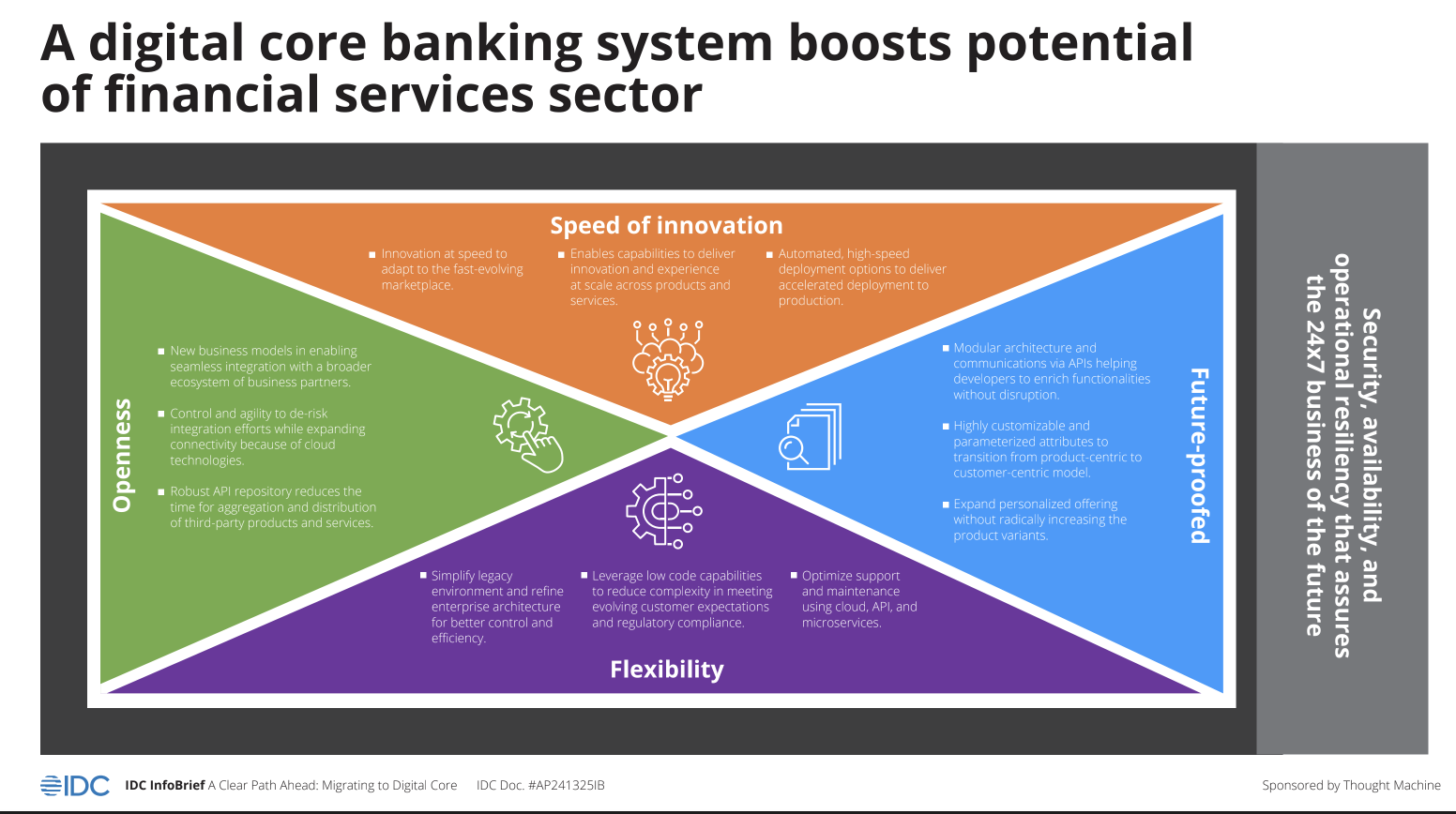

A digital core banking system boosts the potential of financial services sector in four key areas; speed of innovation, openness, flexibility, and future-proofing.

If the benefits are clear, why have banks been dragging their feet when it comes to making the change?

The reality is that migrating systems toward digital core banking is filled with challenges, especially as the project comes face-to-face with the day-to-day realities of running the bank.

Any new digital core banking system has to quickly deliver business benefits, co-exist with current systems and processes and will require different resources to be successfully implemented.

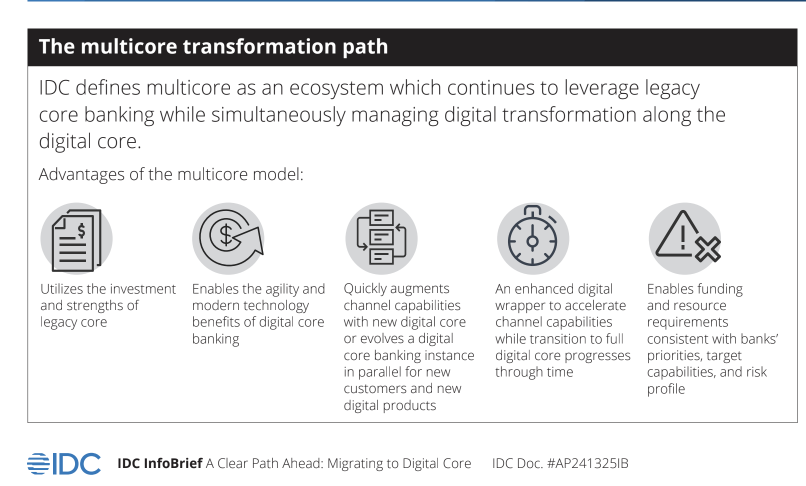

This research from IDC and Thought Machine indicates that banks are not yet ready to give up legacy core banking systems.

The research shows that they will continue utilising them even as they invest and build for the future with a digital core.

What is a multicore transformation path?

The digitalisation of banks’ core banking systems will be a gradual process, following a multicore transformation path – a path that provides customers choice over their vision, strategy, and risk profile for delivering digital core banking transformation.

Banks’ complex, connected environments lead to this preference for incremental transformation in line with dynamic business objectives.

Banks’ complex, connected environments lead to this preference for incremental transformation in line with dynamic business objectives.

It is crucial for banks to modernise the legacy core, but they must avoid the risks of a big bang transition with their current state.

This multi-core model enables banks to “run the bank while changing the bank”.

Previous approaches to core migration saw high failure rates with up to 40% of projects failing or being stopped completely and over 70% of large transition projects either exceeding budget or time provisions.

Multicore, on the other hand, offers the path of least friction or disruption.

The multicore route to modernisation requires a well-thought-out strategy of balancing the transition phases while managing the complexity of migration.

Some of the key considerations to deliver on the promise of multicore

Each bank will follow its own multicore journey. However, they need to follow a set of principles to succeed in addressing the unique complexities of maintaining legacy systems while overseeing change.

Key sources of success in a multicore implementation approach begin with clear vision and assessment of strategy, right architectural principles, business coverage, and target operating model built into the project plans.

IDC and Thought Machine’s research, A Clear Path Ahead: Migrating to Digital Core, delves deeper into this multi-core approach highlighting the challenges that banks may face and the key pointers that all banks should follow:

- Begin with the end-state in mind

- Seek independent advisors

- Plan in advance

- Review and synchronize the transition

- Early demonstration of effectiveness

- Partner with experts

- Understand trends and target model

- Leverage emerging technologies

The “A Clear Path Ahead: Migrating to Digital Core” report by IDC and Thought Machine can be accessed here.