Reinventing How FIs Interact With Their Customers Using Digitalisation

by Fintech News Malaysia September 5, 2022Consumer digital adoption and expanding regulatory frameworks in APAC present significant prospects for digital banking.

COVID-19 has enhanced this potential by boosting digital adoption and highlighting the paths to digital banking growth.

Building and developing a digital bank successfully necessitates a focus on three success pillars that encourage client interaction and assure vital business agility; customer obsession, scalable and flexible technology as well as agile organisation and governance.

Successful digital banks are always focused on what their local customers want.

They offer a strong value proposition and enticing product characteristics, which they reinforce through market testing on a regular basis.

Many of the customer-focused strategies employed by successful digital banks are similar to those used by top consumer-oriented technology businesses.

Digital banks also use an end-to-end approach that encompasses the whole customer journey, including acquisition, engagement, relationship strengthening, and customer referral.

They focus on much more than product features – satisfying digital client expectations requires a user-friendly and intuitive user interface (UI) and a good user experience (UX).

Success Story – New Mobile Banking Implementation and Internet Banking Channel Modernisation

This success story describes how global technology services firm Aspire Systems delivered a cutting-edge digital banking solution with an intuitive user experience for a prominent bank while also modernising their legacy systems.

About the Customer

Aspire’s client is a renowned provider of financial products and services in Malaysia, catering to both retail and corporate consumers.

The target business categories are organised into core business divisions such as community banking, enterprise banking, corporate banking, and treasury.

Pain Points

The bank lacked a modern customer-centric multi-channel solution for onboarding, providing services, and engaging with their retail customers on a constant basis.

Instead of a ready-to-use product, the bank desired a market-proven platform (MXDP) and a solution for a solid base for an expedited roadmap.

In addition, the bank sought to assure system performance while onboarding 1.4 million customers.

Aspire’s Solution

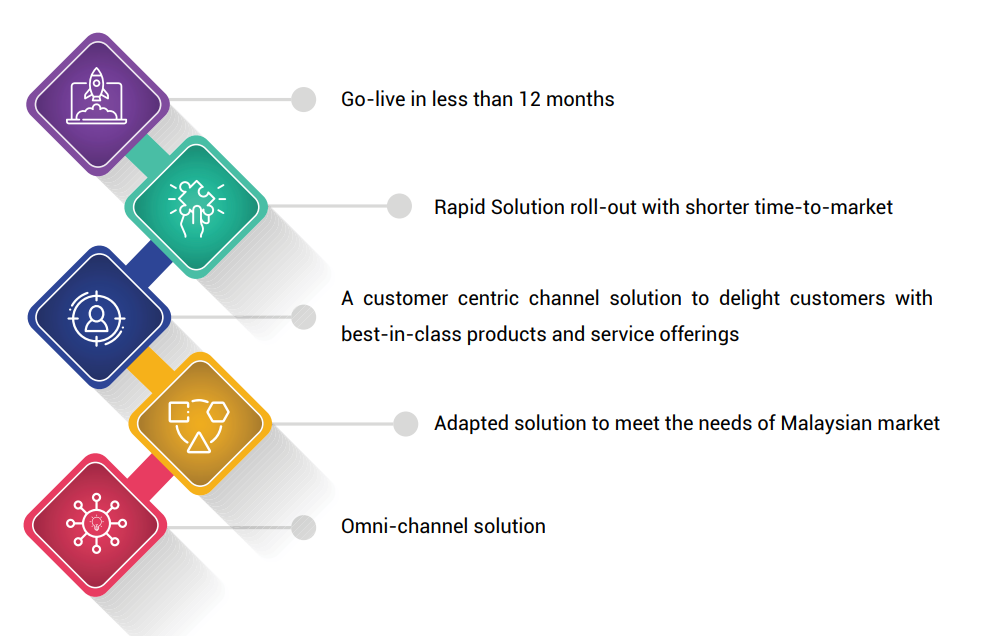

Aspire implemented Temenos Infinity Mobile and Internet Banking system with intuitive UX and back- office solution in this case.

The back office, service integration and orchestration, and a large portion of the UX solution were shared across channels. Infinity’s out-of-the-box mobile and internet banking system was adapted for the Malaysian market, including region-specific payment and other interfaces.

With a write once, deploy anywhere strategy, where a single code base can be deployed for both Android and iOS applications, the Infinity service orchestration system and MXDP enables the customer to swiftly develop and offer new services.

This provided an extra way to allow the legacy channel application to coexist until it is decommissioned.

In addition, Aspire supplied SIT test execution, performance testing, and security testing services. Due of pandemic limits, the solution was successfully implemented entirely remotely.

Results

Conclusion

Banking and financial institutions are always battling changing customer expectations. Adoption of digitally sound environments and offerings is merely the first step.

Aspire’s Digital Banking services will assist you in achieving end-to-end transformation for all your banking needs, while also creating superior customer experiences and enhancing operational efficiencies.

Increasing investment in technological integration, prioritising cyber security, constantly working towards digital upskilling of existing talent, and continuously innovating and building digital products for customers are all critical for banks looking to achieve full digital transformation in a shorter time frame.

Collaboration with digital-first financial services providers, such as fintechs and neobanks, may also help ensure quicker digital adoption among banks, facilitating the contribution to developing an interoperable, scalable, and future-proof digital ecosystem.

Download this case study to learn how Aspire delivered a cutting-edge digital banking solution for a prominent bank in Malaysia.